AARP Hearing Center

After you enroll in Medicare, your first order of business is to decide whether you want to get coverage from original Medicare — the government-run program that includes Part A hospitalization coverage and Part B doctor and outpatient services — or a Medicare Advantage plan, which bundles Parts A and B and usually Part D prescription drug coverage. Private insurers sell Medicare Advantage plans, also known as Part C.

Most Medicare Advantage plans pay for services that original Medicare doesn’t cover, such as dental, hearing, vision care and prescription drugs. But they typically have provider networks, and you have to pay more or may not have coverage for a provider who is out of the plan’s network. You can enroll in a Medicare Advantage plan during the seven-month initial enrollment period surrounding your 65th birthday after you’ve enrolled in Parts A and B.

You can also sign up or switch plans during the annual open enrollment period, which runs from Oct. 15 to Dec. 7 each year. Your coverage will start Jan. 1. Because Medicare Advantage plan premiums, medical and drug coverage, out-of-pocket costs and provider networks can change from year to year, it’s a good idea to review your options during open enrollment each year. You may be able to sign up at other times if you qualify for a special enrollment period. And if you already have a Medicare Advantage plan, you can switch plans or go back to original Medicare during the Medicare Advantage open enrollment period from Jan. 1 to March 31.

Keep in mind that if you decide to return to original Medicare and you have a preexisting condition, you may have a difficult time getting a Medigap policy.

8 steps to choose and sign up for Medicare Advantage

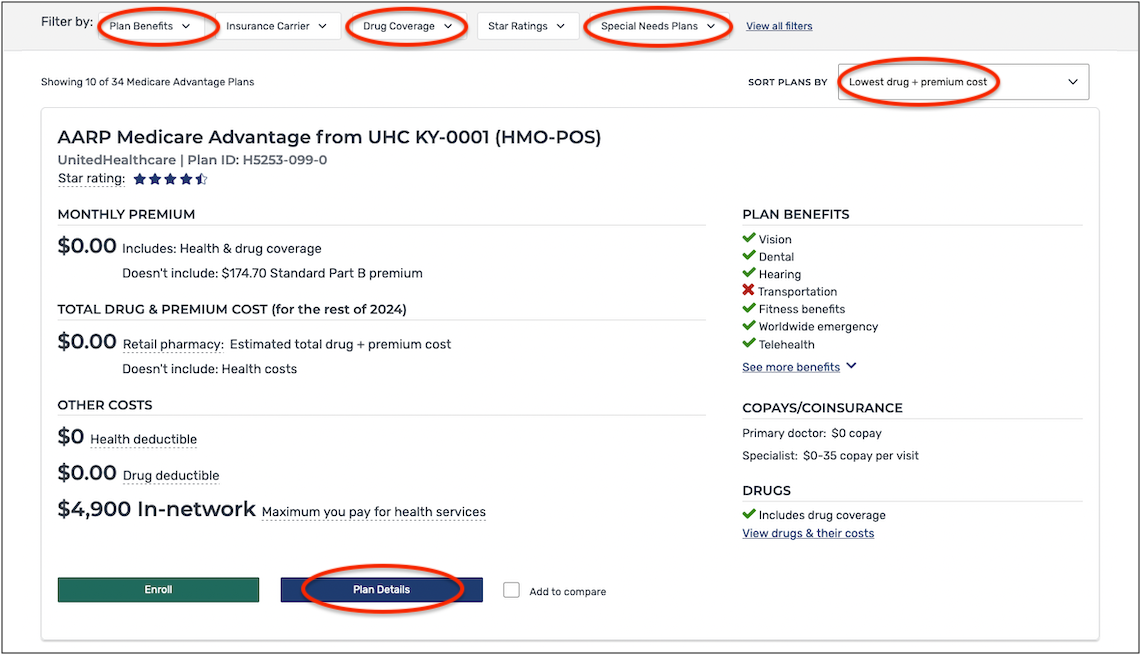

The best way to compare Medicare Advantage plans available in your area is by using Medicare’s Plan Finder tool. Here’s a step-by-step guide:

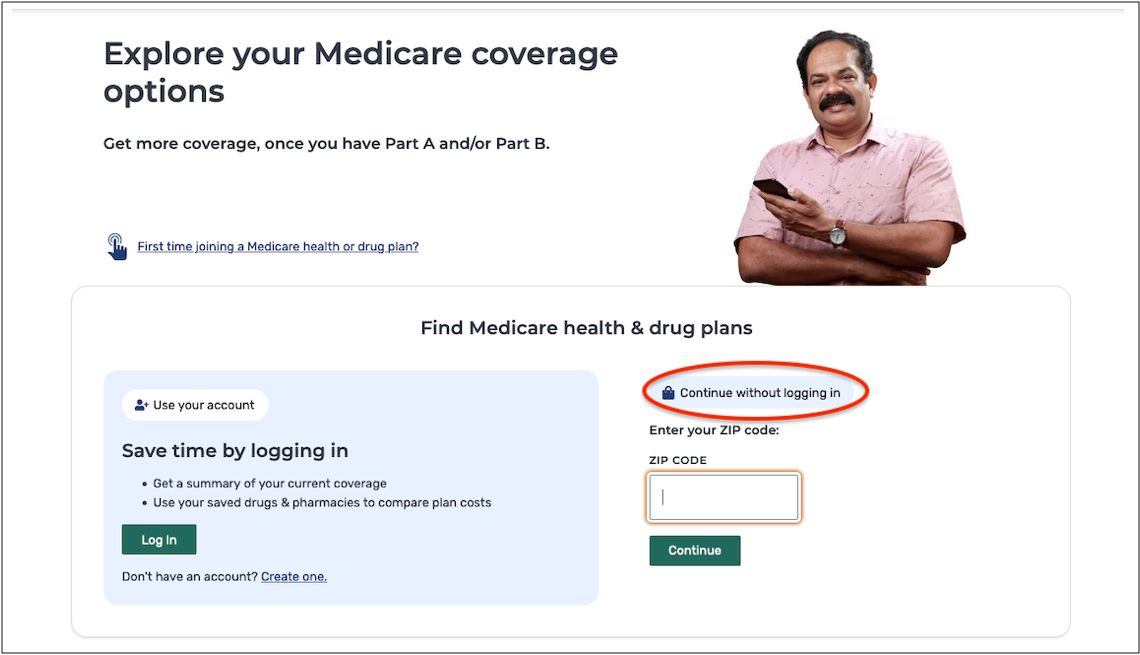

1. You’ll see two options: Log in to your online Medicare account, or go to the second section, where you’ll enter your ZIP code and may need to select your county.

Choose Medicare Advantage Plan from the Select a plan type drop-down menu. Click the blue Apply button and then the green Start button.

2. Indicate if you get help with your medical expenses. If you’re not sure, you can find out by logging in to your Medicare account.

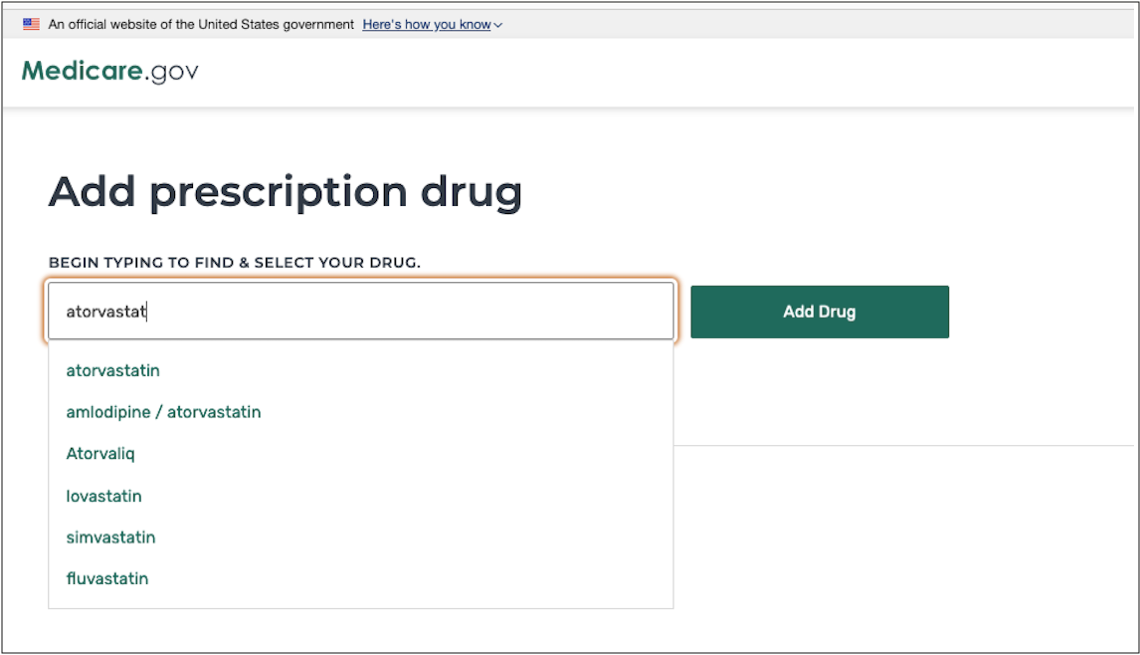

3. If you don’t receive help, you’ll be asked if you want to see your drug costs when you compare plans. Click Yes, so you can get the best sense of how much you might spend with each plan.

Next in Series

Use Medicare Plan Finder to Pick a Part D Plan

How to sign up for a prescription drug plan online