AARP Hearing Center

AARP Priorities

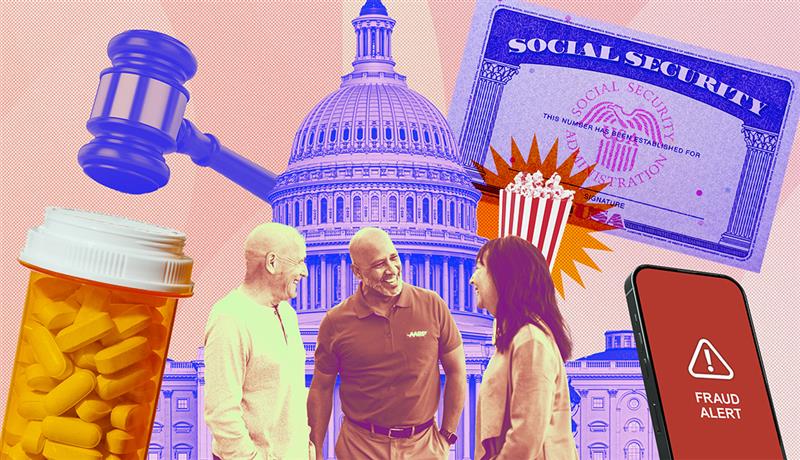

AARP Stands for All Older Americans

Since 1958, we have fought for the priorities of older Americans, no matter what. We always have, and we always will.

AARP has members in every congressional district, representing all people 50-plus.

Over the years, AARP has worked with every president, Congress, governor and statehouse.

• We are 100 percent committed to our priorities.

• We are 100 percent nonpartisan — we do not engage in partisan politics.

• We do not support or contribute to political candidates, parties or campaigns.

Spotlight

Safeguarding Social Security

AARP works tirelessly to protect Social Security, one of the most important issues for older Americans. Americans work hard throughout their lives and contribute to Social Security so it will be there for them when they retire. AARP advocates on behalf of all older Americans to urge Congress and the president to safeguard the financial security of older Americans now and in the future.

Improving Health Care and Medicare

AARP is dedicated to protecting Medicare and ensuring quality, accessible health care for older Americans. We advocate for policies that strengthen Medicare's financial stability — and to expand coverage and reduce out-of-pocket costs. AARP strives to guarantee that older Americans receive the affordable, high-quality health care they need to live healthy, fulfilling lives.

Reducing Prescription Drug Costs

AARP leads the fight to make prescription drugs affordable. We recently helped pass a law allowing Medicare to negotiate to lower drug prices and cap out-of-pocket costs. Despite this progress, drug prices remain too high. AARP continues to challenge big drug companies, advocating in Congress and statehouses nationwide to ensure fair drug prices.

Empowering Family Caregivers

If you’re one of America’s 48 million family caregivers, AARP has your back. Our advocacy has led to the first-ever national strategy on caregiving and over 300 state laws supporting caregivers. From tax credits to family leave policies, AARP is making a difference for these unsung heroes.

Fighting Age Discrimination and Bias

AARP is committed to protecting older workers' rights through advocacy, education and legal support. We work to change perceptions across industries by improving the representation of older Americans in media and advertising, challenging stereotypes and promoting a more accurate and positive image of aging.

Stopping Fraud

AARP helps arm you with the information you need to avoid scams and is fighting to change laws to hold criminals accountable. With fraud reaching crisis levels and costing older Americans billions annually, AARP's efforts are more crucial than ever in the face of rapidly evolving technological threats.

AARP IN YOUR STATE

AARP has offices in every state and territory working to advance priorities for those 50-plus.

More About Our Work