Staying Fit

Disputing a problem on a medical bill can be time-consuming and frustrating. “It takes our professional case managers on average 22 calls to resolve a case,” says Caitlin Donovan, spokesperson for the nonprofit Patient Advocate Foundation.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

While most disputes aren’t as complicated as the ones Donovan’s organization takes on, you should be prepared for a lengthy battle. The medical billing system is extremely complicated, with thousands of codes representing the universe of treatments and procedures. The range of possible problems is vast, from coding mistakes and duplicate charges to surprise out-of-network fees and wrongly denied insurance claims.

No matter what kind of billing problem you face, follow these recommendations to boost your chances of getting an overcharge removed or an insurance denial reversed.

More advice on avoiding, fighting and paying surprise medical bills

Get the itemized bill

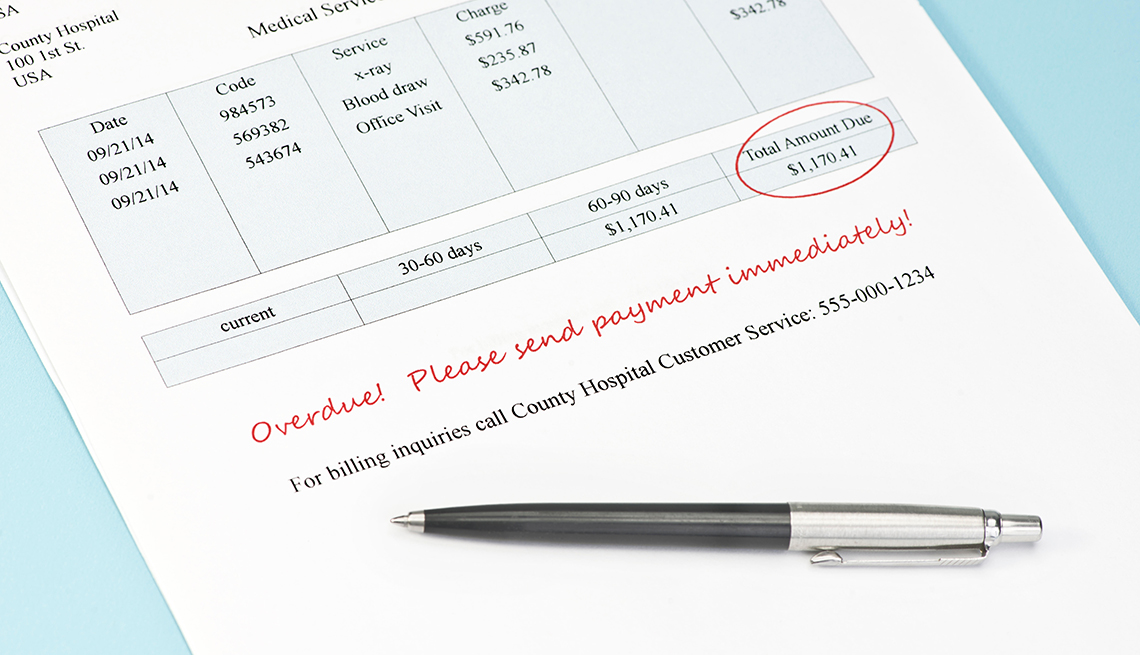

Hospitals and medical offices often send a bill that summarizes the services you received and lists one lump sum due. To spot problems, ask for an itemized statement.

“You want to see every single charge that they charged you,” says Teresa Brown, senior director of hospital accounts at Medliminal, a company that works with insurers, medical offices and consumers to review bills and lower health care costs. “That is your first line of defense.”

Check to see if you are being charged for services you didn't receive, medications you didn't take or facilities you didn’t use. Compare the bill with the explanation of benefits (EOB) sent by your insurance company or, if you’re a Medicare recipient, your Medicare Summary Notice.

Talk to your medical provider

Ask your doctor’s office about any charges you don’t understand, point out any obvious errors and request that they review your bill.