Staying Fit

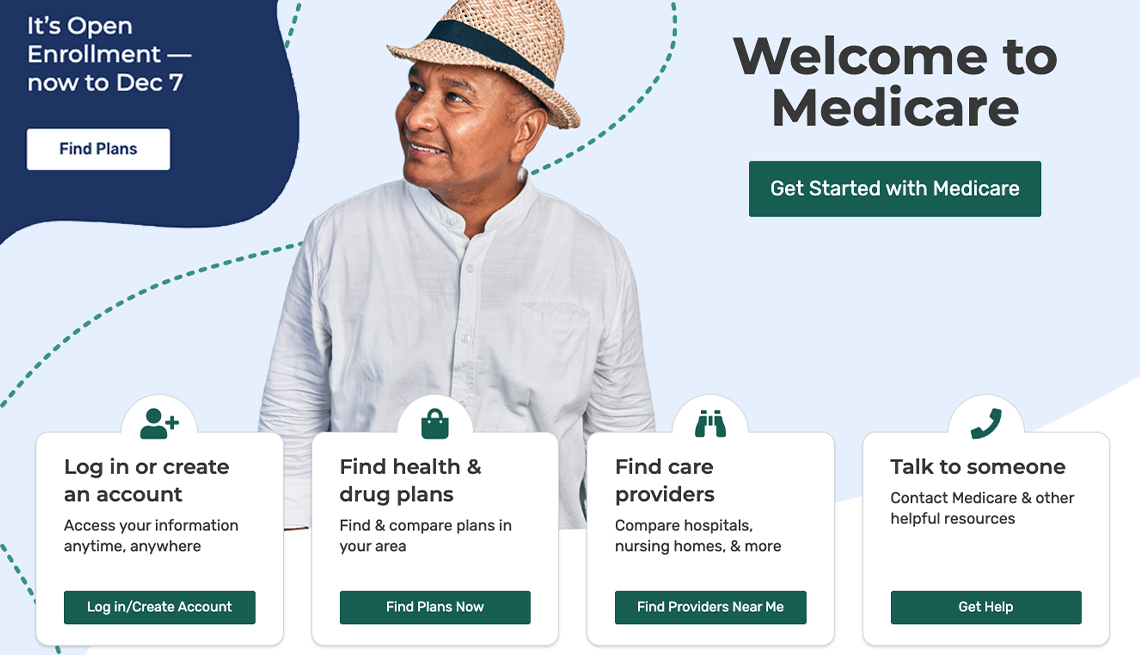

As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal (Medicare Advantage) at a restaurant, where the courses are already selected for you, or going to the buffet (original Medicare), where you must decide for yourself what you want.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

If you elect to go with original Medicare, your buffet will include Part A (hospital care), Part B (doctor visits, lab tests and other outpatient services) and Part D (prescription drugs). If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you'll also be able to get coverage for prescription drugs.

But there are significant differences in the way you'll use Medicare depending on whether you pick original or Advantage. Here's a comparison of how each works.

Going to the doctor

Under original Medicare, you can choose any providers — primary care doctors and specialists — who accept Medicare. You don't need referrals to see any medical provider and you don't have to worry about your doctor leaving a plan's network. According to the Kaiser Family Foundation, only 1 percent of doctors don't participate in Medicare and, for example, 83 percent of primary care physicians accept new Medicare patients. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

Under Medicare Advantage, you will essentially be joining a private insurance plan like you probably had through your employer. The most common ones are health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs. Medicare Advantage plans have become increasingly popular. Nearly 32 million, almost half of all Medicare beneficiaries, are enrolled in one of these plans and the average enrollee has more than 43 plans to choose from.

More on health

10 Common Medicare Mistakes to Avoid

Errors can prove costly to new enrolleesMedicare Open Enrollment: Everything You Need to Know

When it starts, when it ends, and how it works for original Medicare and Medicare Advantage10 Steps to Take After You Sign Up for Medicare

Just enrolled? You can put your new Medicare coverage to good use