Staying Fit

Ever since President Lyndon Baines Johnson made Medicare the law of the land in 1965, hundreds of millions of Americans have relied on this program to help them get affordable, quality health care.

About 66 million individuals are currently enrolled in Medicare. Of those, more than 57 million are people 65 and older and more than 8 million are younger people with disabilities.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Medicare has evolved over the years. In 1997, Congress officially created Part C, what is now known as Medicare Advantage, the private insurance alternative to original Medicare. And in 2003, lawmakers added Part D, which covers prescription drugs.

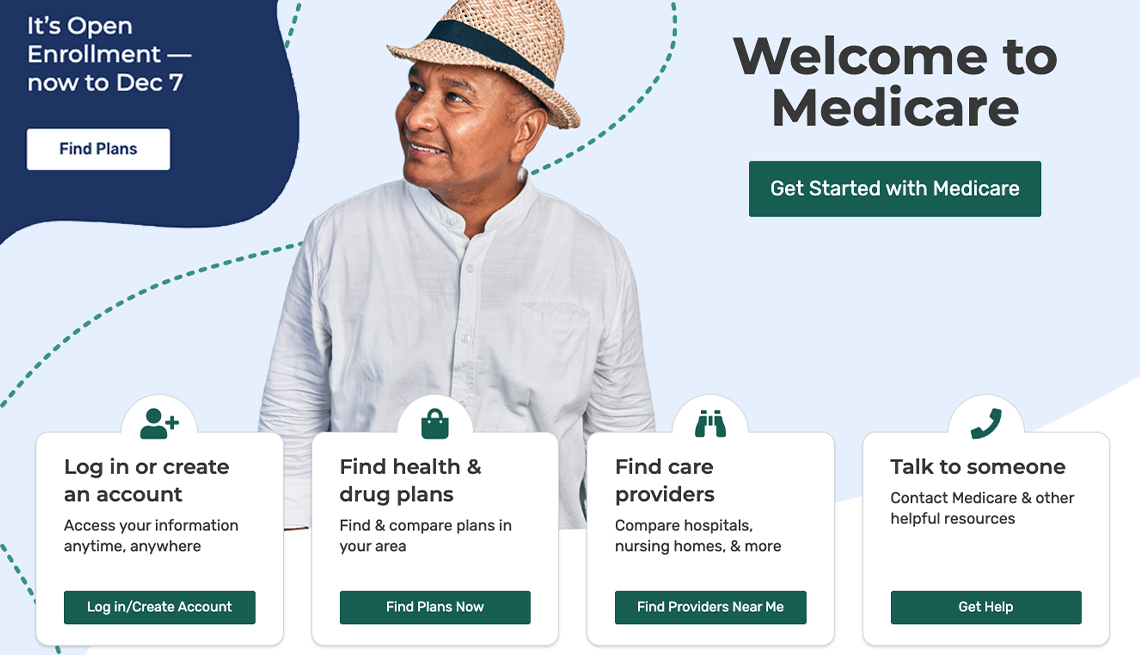

Here are the answers to some of most frequently asked questions about Medicare. Detailed information on the various parts of Medicare, as well as how and when you can enroll or change your coverage, can be found in AARP’s Medicare Made Easy series.

1. You have options

Medicare has four basic parts: Part A covers hospital, hospice and some home care. Part B covers doctor visits, diagnostic tests and other outpatient services. Part C, also known as Medicare Advantage, is the private insurance alternative to original (or traditional) Medicare. Part D covers prescription drugs.

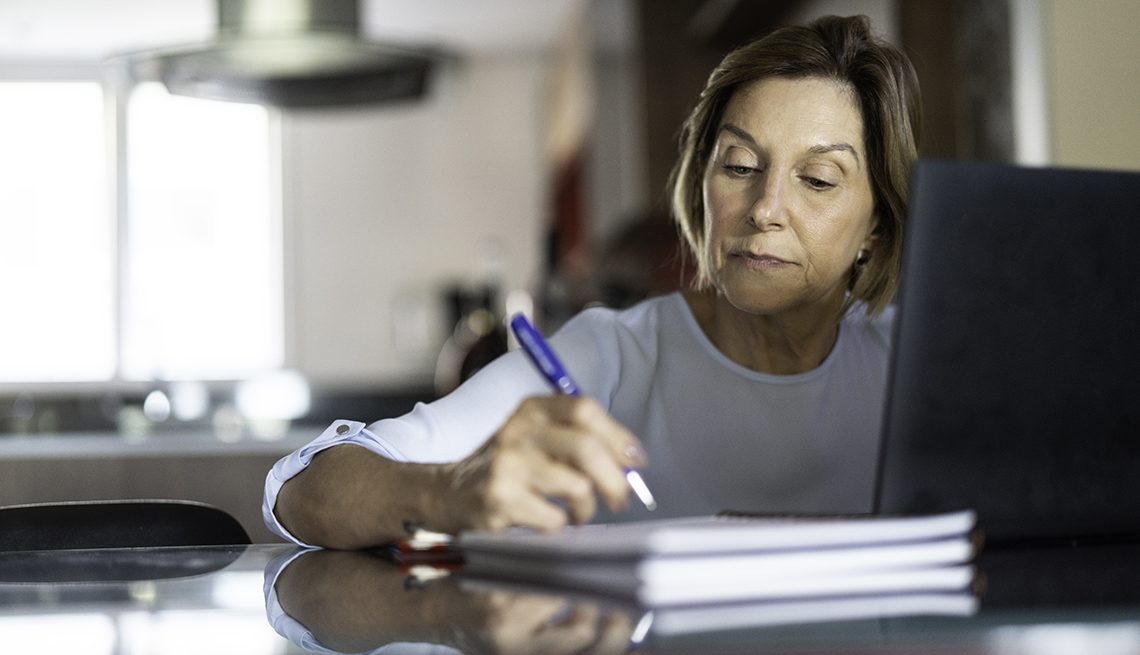

When you sign up for Medicare, you’ll have to decide whether to go with original Medicare or a Medicare Advantage plan. If you pick original, you’ll need to enroll in a Part D prescription drug plan to get your medications covered and you may want to buy a supplemental (Medigap) policy, which will pick up some or all of your out-of-pocket costs. (See more below about what Medicare will cost you.) If you choose Medicare Advantage (MA), or Part C, you’ll then have to pick which insurance company’s plan you want to enroll in. You likely won’t need to get a Part D plan because most MA plans include coverage for prescription drugs.

2. You could pay more if you enroll late

Medicare has what it calls an initial enrollment period (IEP) for people turning 65. It runs for three months before your 65th birthday month and three months after. You’ll need to sign up for Medicare Part B during that enrollment window or you’ll be subject to a late enrollment penalty, which means you’ll have to pay a higher monthly premium for as long as you are on Medicare. The same goes for Part D coverage.

Because most people don’t have to pay a premium for Part A, it likely won’t cost you anything to sign up for that part of Medicare, and doing so will put you into the system and make it easier when it’s time to enroll in Part B.

More on Medicare

Medicare Part B Premium to Increase in 2024

Deductibles also going upWill Original Medicare Survive the Medicare Advantage Boom?

New enrollees increasingly opting for the private insurance alternative to the federally-run programAARP Exclusive: Interview with CMS Administrator

Original Medicare should be here to stay