AARP Hearing Center

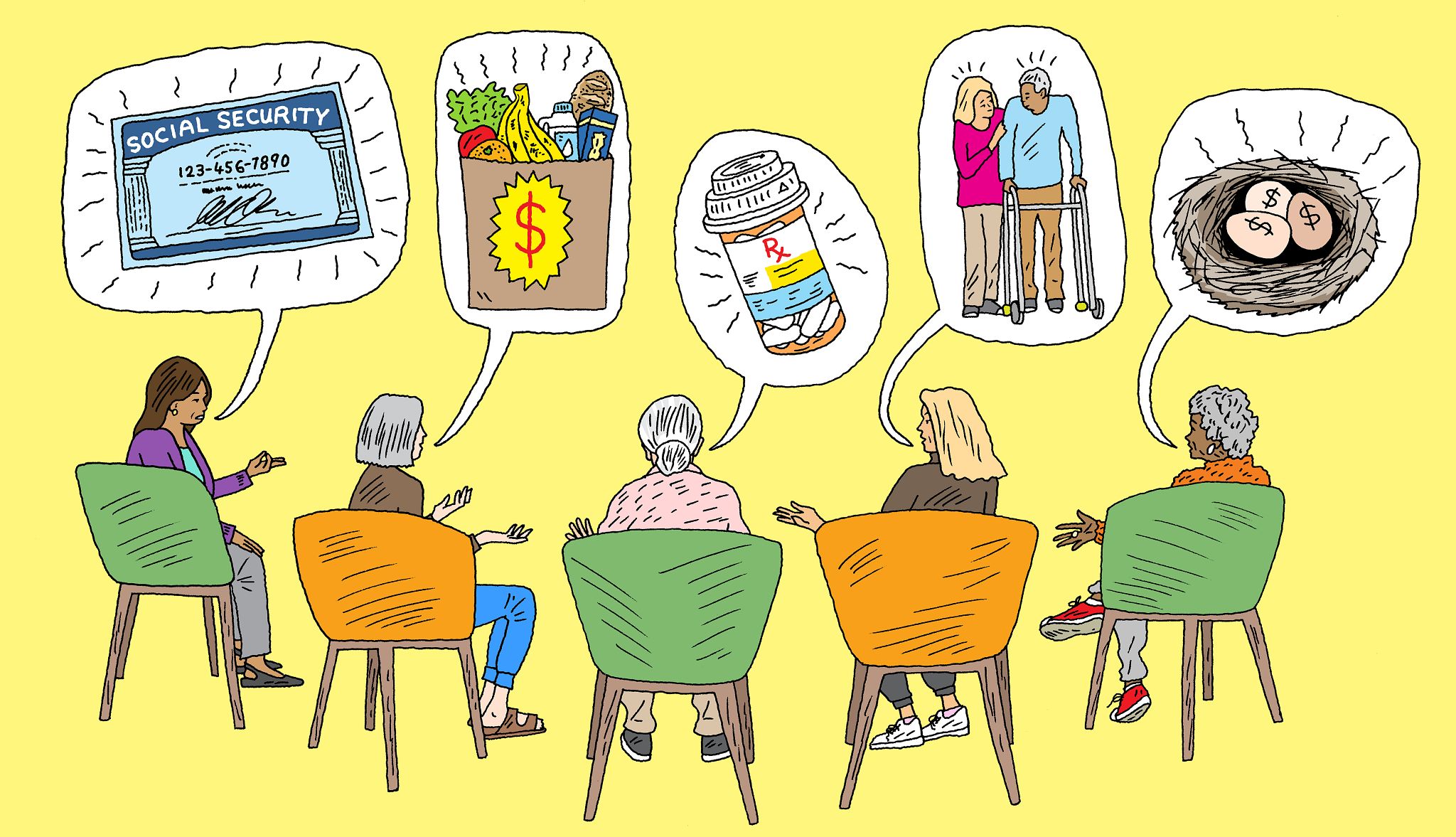

Women in their 50s, 60s and 70s are strategizing on how to stretch their savings into retirement, are caring for family members of different generations and are dealing with medical costs that health insurance does not always cover.

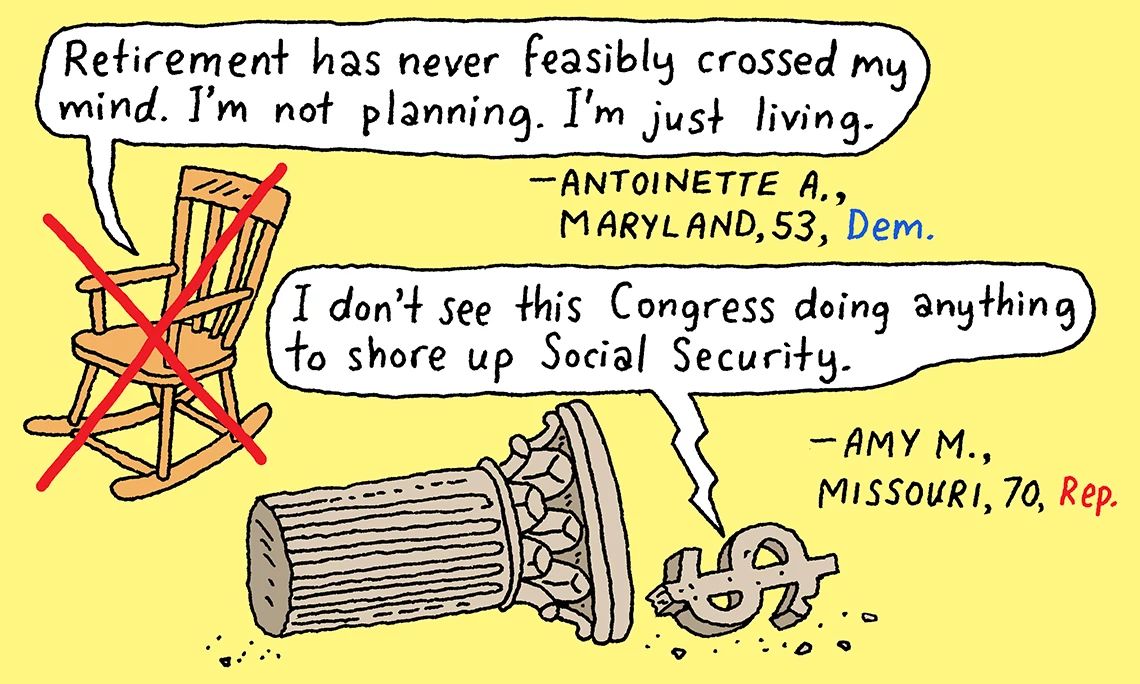

They’re also considering the possibility that Social Security won’t pay out as promised.

A series of focus groups organized by AARP asked women 50 and older about their concerns, their priorities and the state of the country. The discussions took place in October as part of “She’s the Difference,” AARP’s research series gauging older women’s perspectives. Women 50-plus make up a large share of registered voters, turn out to the polls at a high rate and are often a key swing voting bloc in elections.

About 30 participants were divided into four focus groups based on their age and political leanings. The focus groups were led by a bipartisan team of pollsters: GBAO Strategies, a Democratic research firm, and Republican research firm Echelon Insights. Many of the women noted that life rarely pans out the way you expect. One participant is still living paycheck to paycheck after 40 years in the workforce. Another is helping raise her late daughter’s five children. Others thought they would travel more, retire earlier or plan a future with a partner rather than alone.

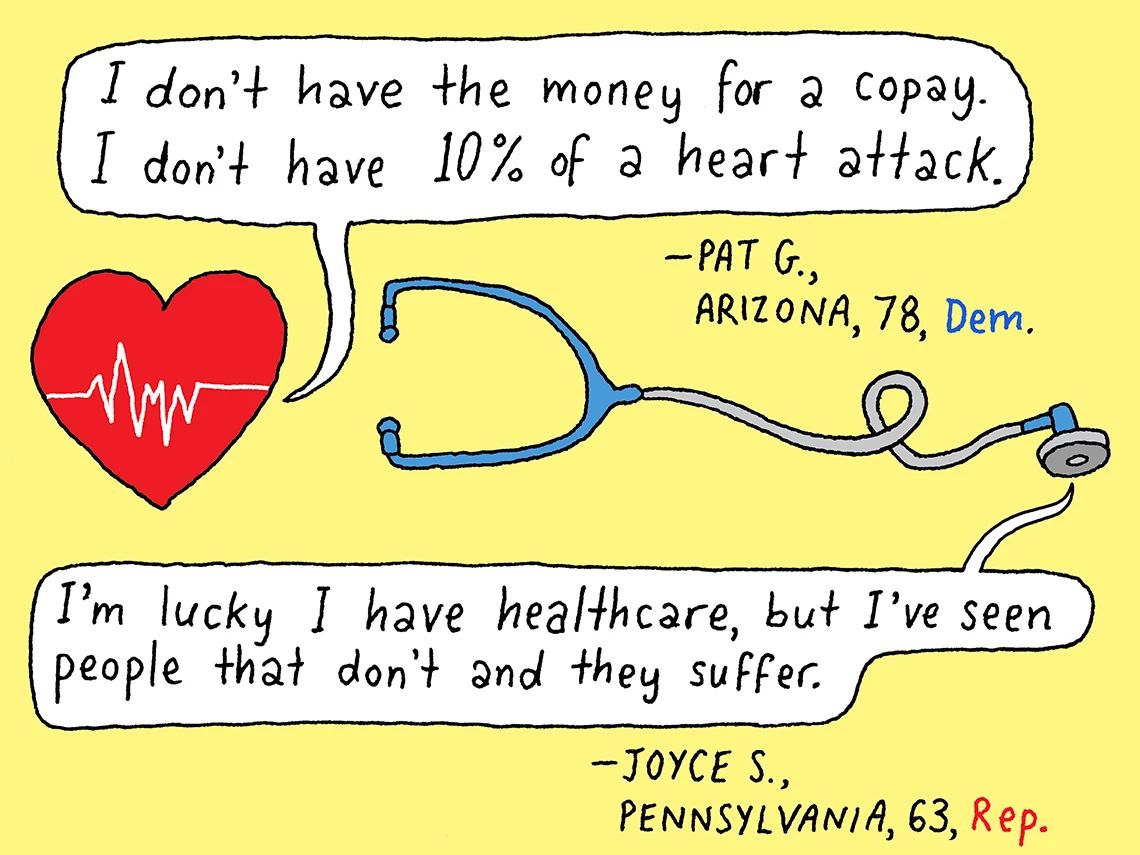

Although Republican and GOP-leaning women were generally more hopeful about the state of the country and more positive about their personal lives than Democratic or Democratic-leaning women, qualms about the cost of living, retirement and health care spanned both sides of the aisle. And participants in three of the four focus groups fear the country’s best days are behind them; only older Republican women saw better times ahead.

No matter their political affiliation, women noted that working hard did not always yield results. Although several Republican women felt hopeful about the state of the country under Republican leadership (in contrast with Democratic women, who struggled to find a bright spot), participants at large worried about political divisions. Both Republicans and Democrats wonder why the government is not doing more to lower health care costs, support long-term care or shore up Social Security. Few could name a politician who excites them or seems sensitive to their needs.

“We’re on Earth, and they’re on Mars,” Sharron C., a 61-year-old Republican woman from Louisiana, said about politicians in general.

Here’s how women age 50 and older feel about their finances, health care, caregiving and retirement in 2025:

Feeling the pinch of higher prices

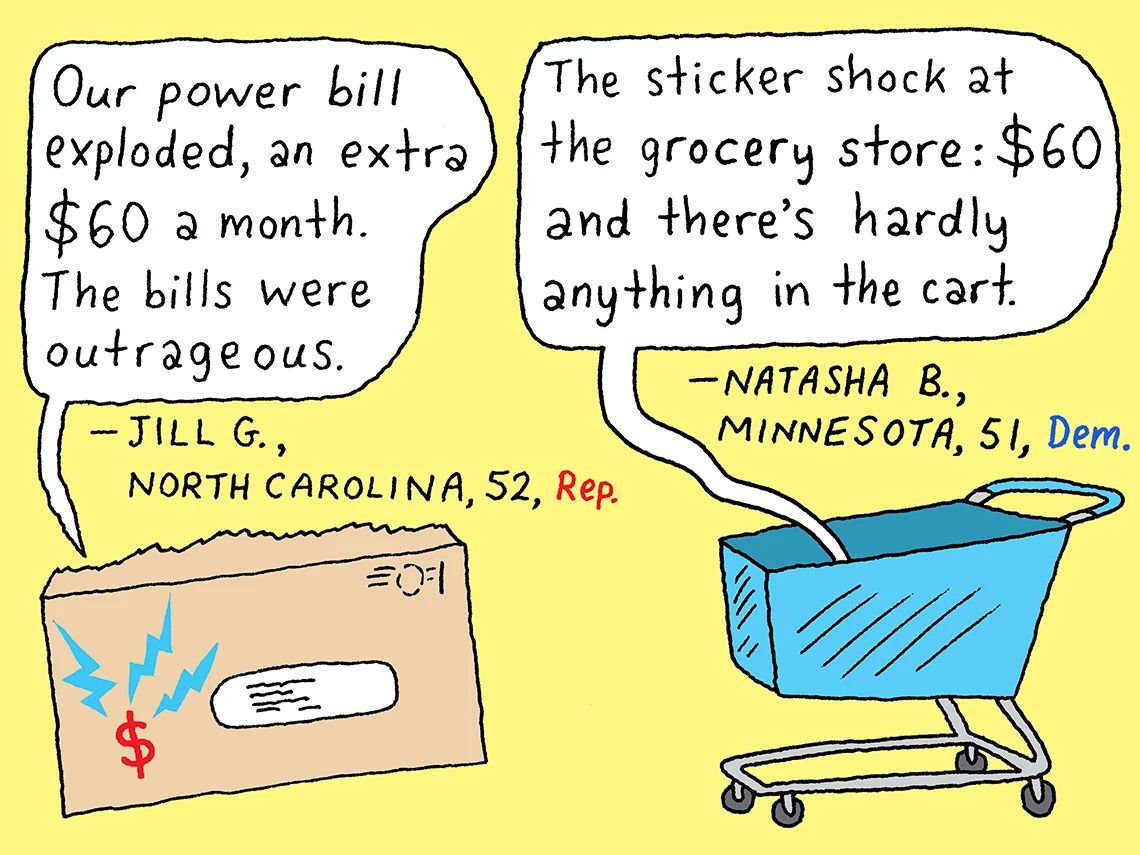

Girl Scout cookies. Lay’s potato chips. A meager cart of groceries that rings up $60 at the register. Women across all ages and political groups are dismayed at rising food prices and shrinking package sizes. Several of them are turning to discount grocers like Aldi, learning the art of meal prep or sacrificing name-brand items — with some exceptions.

“I have to have Heinz ketchup,” said Antoinette A., a 53-year-old Democratic woman in Maryland.

Sticker shock doesn’t stop at food. Participants winced at the cost of cable, utilities and housing. Jill G., a 52-year-old Republican woman from North Carolina, lamented an extra $60 a month tacked on to her electric bill, making the total “outrageous” in the summer when air conditioning was on as well.

More From AARP

US Government Shutdown Impacts Older Adults

Travel plans, SNAP food aid, Medicare telehealth and retirements all face uncertainty

5 Ways AARP Is Fighting Age Discrimination

We’re protecting older workers and helping people find jobs

Congress Mulls a Major Fix to Housing Crisis

Housing shortages and high costs make aging in place difficult for older adults