AARP Hearing Center

Having a good credit score is an enviable position to be in, especially in today’s environment marked by rising interest rates. With a high credit score you’ll get favorable rates on loans, superior terms and lots of offers.

According to Experian, the credit scoring agency, a credit score between 800 and 850 is deemed exceptional, while 740-799 is considered very good and 670-739 is good. Anything below that and it may be more costly to borrow money. It could mean you need to provide collateral or pay a higher interest rate.

Obtaining a high credit score may seem tough, especially if you’re saddled with a low score and costly debt. But these high credit scorers share several habits you can emulate, and it all starts with knowing what goes into your credit score. “They understand what factors matter,” says Courtney Alev, consumer financial advocate at Credit Karma. “They are cognizant of that and it’s reflected in how they handle their finances.”

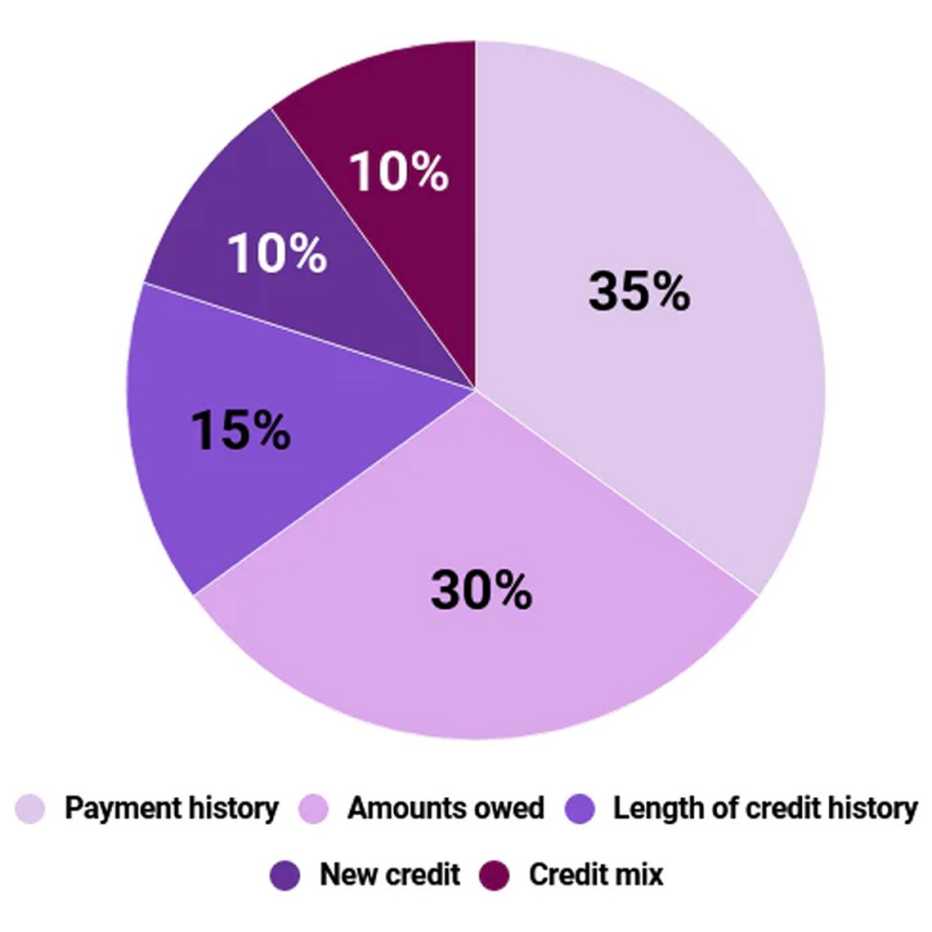

Credit Score Factors

From paying on time to keeping balances low, here’s a look at four habits of people with good credit, and tips to get yourself inducted into this group.

1. They pay on time

Your credit score consists of several factors, and a big one, accounting for about one-third, is payment history. Lenders want to know you pay your bills on time and reward those consumers who do it consistently. “Folks with good credit always pay on time, ideally in full, but if not, at least the minimum payment ahead of time,” says Alev. “This guarantees they won’t have a late payment.”