Staying Fit

Looking for something delivered free to your house? You'll probably use Amazon. Want a computer, mobile phone or tablet? Apple or Microsoft will probably make the device, run it, or both. Want to find out who Pepin the Short was? You'll need to Google that. (He was Charlemagne's father.)

The seemingly entrenched position of most valuable publicly held companies in America makes it easy to assume that these blue chips would be good investments. After all, what could possibly happen to behemoths like Apple, Microsoft, Amazon, Alphabet and other top companies in a world dominated by technology? The answer is plenty, and that's why you need to own a broad portfolio of stocks, preferably in an index fund. There's only one way to go when you're number one, and you never know who will be the next on top.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

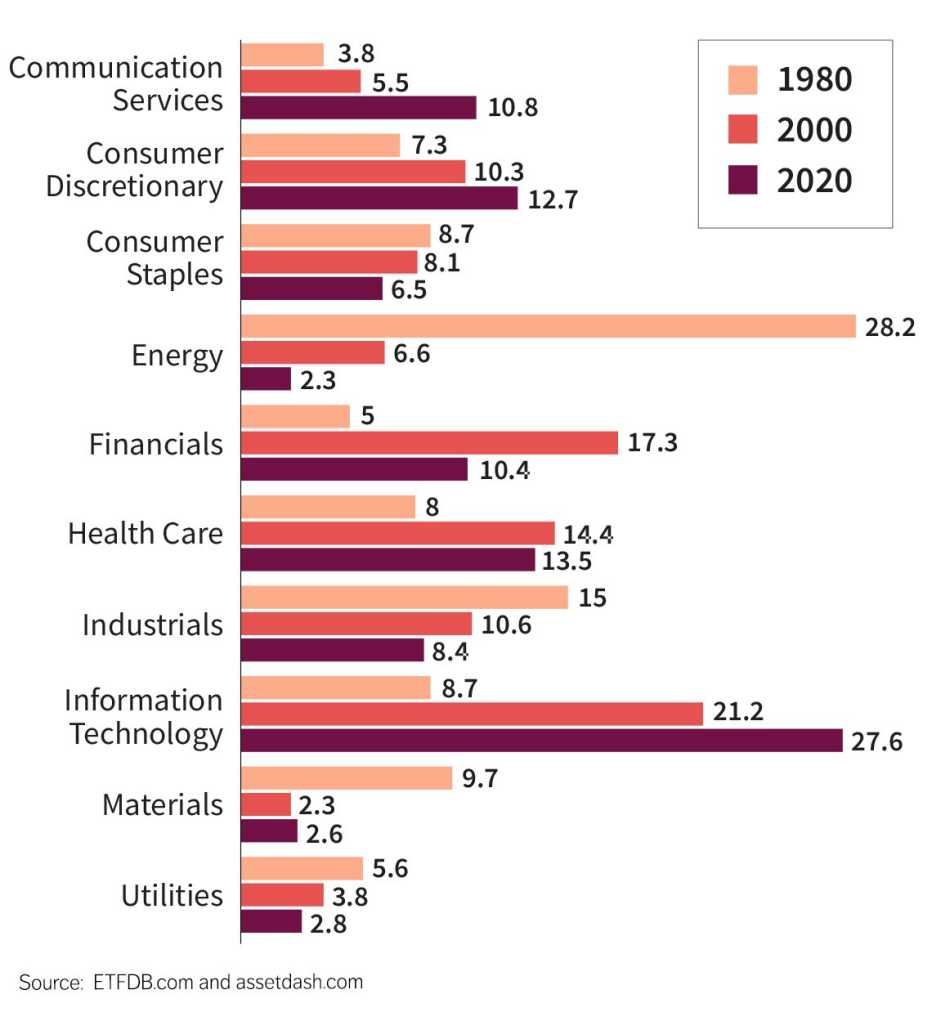

Consider the 10 most valuable companies back in 1980 as well as in 2020. In 1980, I had recently graduated from college and started investing. Big Blue (IBM), Ma Bell (AT&T) and oil companies dominated the landscape. (In fact, AT&T was the only telephone company in the country.) I would soon enter graduate school, where my business school case studies celebrated the great management and the dominance of these companies. They had built barriers to entry in essential industries of the day, so much so it seemed unlikely that they would have any competition. The companies were so valuable that they were called blue chips, after the most valuable poker chips. It seemed like a safe bet to own them. Many expected to simply collect the dividends and watch the stock share prices rise.

Largest companies in the S&P 500

Ranked by market capitalization, which is share price multiplied by current price per share.

Fast-forward four decades and not a single one of these companies makes the top 10 list. Two of them merged (Exxon and Mobil) and, combined, don't make the top 30 most valuable U.S. companies. Standard Oil of Indiana became Amoco, which is now a part of British Petroleum (BP). Standard Oil of California changed its name to Chevron, merged with Texaco to become ChevronTexaco, but now is plain old Chevron. AT&T, broken up in 1984, now ranks as 30th-largest company in the U.S. General Electric, whose dividends and earnings once rose as reliably as the sun in the east, is the 75th-largest U.S. stock after slashing its dividend to a penny in 2018.

More on money

Still Missing a Stimulus Check?

You can claim it as a credit on your income tax form

5 Financial Resolutions for 2021

Lessons learned from the pandemic

Should You Buy Individual Stocks?

Some rules if you're feeling lucky