AARP Hearing Center

Investors don't earn market returns, according to a recently updated study from Morningstar, a Chicago-based investment research company. The research, titled “Mind the Gap 2019” and conducted each year by Russel Kinnel, director of manager research, builds on the work demonstrating that higher expenses lead to lower returns. It also measures the impact of poor timing.

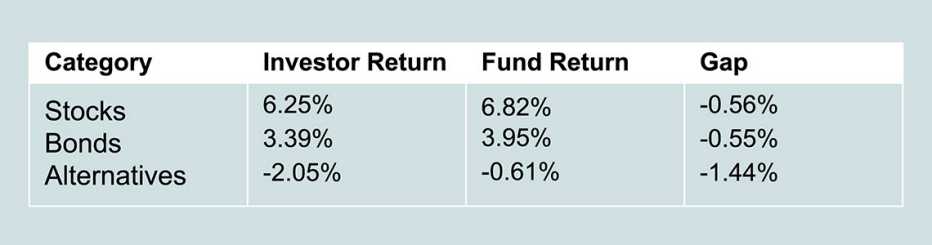

According to Morningstar, over multiple 10-year periods, the average investor underperformed the funds they invested in, for all three major asset classes. This chart shows the annualized returns and gaps:

Key findings

Alternative funds are complex funds that are supposed to zig when the market zags. However, they are prone to low returns and investors also time their purchases particularly poorly, such as buying after strong performance.

Another key finding was that investors in asset allocation funds, like target date retirement funds, actually did an average of 0.22 percent better annually than the funds themselves. That's because these funds must stick to an asset allocation, meaning they have to buy when stocks go down and sell after stocks perform well. It's just the opposite of human nature.

These gaps are strictly from poor timing and do not include the fees of the underlying funds. Morningstar has long shown that lower fees are correlated with higher returns for each asset class.

But the research indicates that investors do more performance chasing with expensive and volatile funds, making a bad situation even worse.