Staying Fit

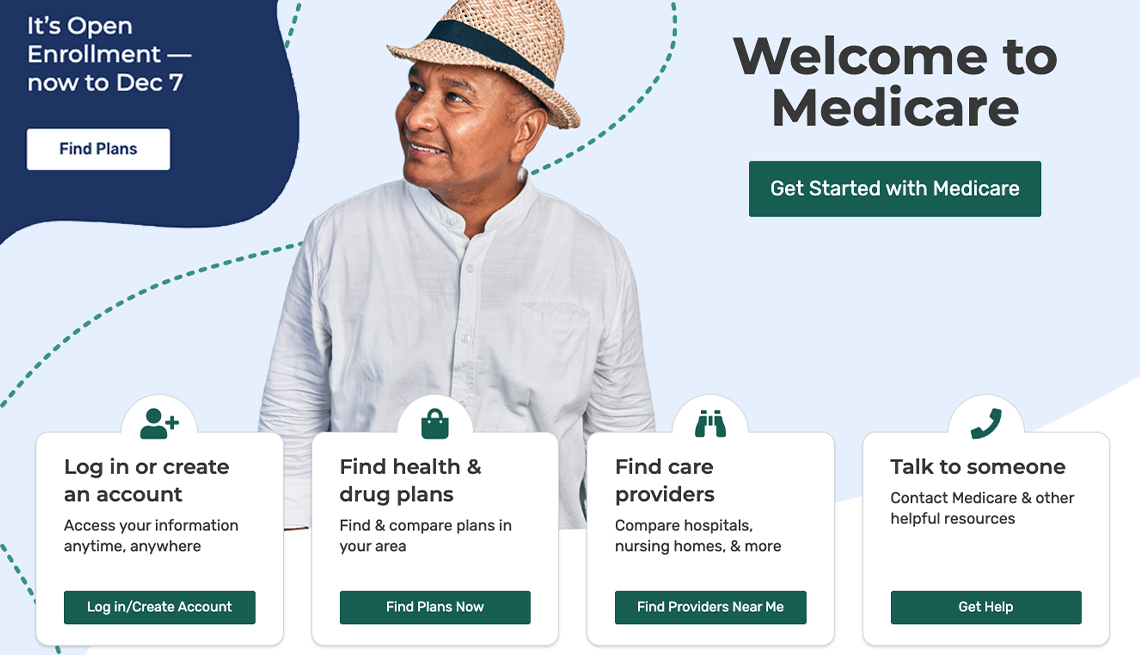

What is Medicare? For more than 58 years, it’s been the program that older Americans and people with disabilities turn to for their health care coverage. In 2023, it is helping more than 65 million people pay for everything from hospital stays to doctor visits to prescription drugs.

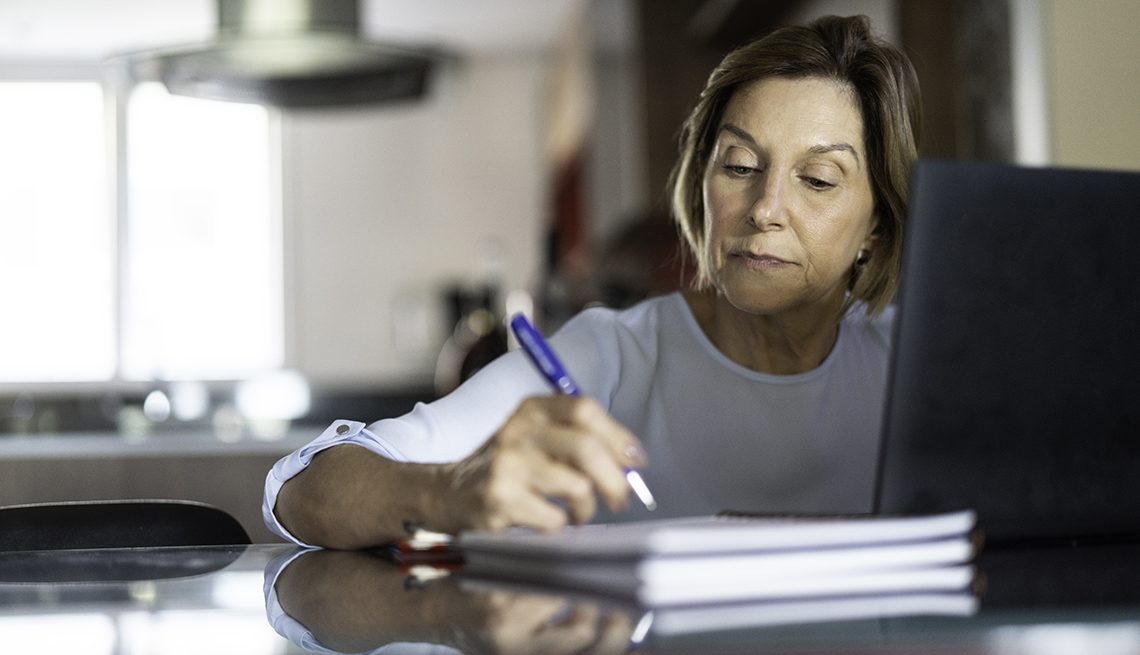

At 65, you become eligible for the program. You’ll need to set aside time around that milestone birthday to sift through many options so you can sign up for the coverage that meets your health needs and budget.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

It’s up to you to get ready. Unless you are already receiving Social Security benefits and therefore will be automatically enrolled in the program, you won’t get a letter in the mail reminding you that it’s time to start making these decisions. What’s more, the timetable is specific — and important. You can start signing up three months before you turn 65, and you’ll have until three months after your birthday month to enroll. If you miss that deadline, you may end up paying higher premiums. If you are still working and have employer-sponsored health coverage, you can probably wait to sign up — but more about that later.

Taking control of your health care

You’ll need to do some homework before you start assessing options and picking plans. Make a list of your doctors and decide how important it is to you that you can continue seeing them once you are on Medicare. Also, make a list of medications you take so that you can make sure the prescription drug plan you select will meet your needs.

Think about your lifestyle. Are you a homebody who never travels outside the U.S.? Are you an adventurer who goes abroad frequently? Do you split your time between residences and need medical care in different states? All these factors are likely to figure into the decisions you make.

Your financial situation also is important. You’ll learn through this guide that Medicare helps pay for medical care for older Americans and people with disabilities. But it’s not free. You’ll want to choose an option you can afford and build the out-of-pocket costs into your budget. And take time to review the ways the federal government can help you pay Medicare’s costs if you can’t afford them.

You need to pay attention to all of Medicare’s parts. Part A covers hospital and hospice care and some skilled nursing services after you’ve been in the hospital. Part B includes doctor visits and other outpatient services. Part C is Medicare Advantage, which is a combination of parts A and B — and usually Part D, which helps pay for prescription drugs.

Your biggest decision will be whether you want to get original Medicare or enroll in a Medicare Advantage plan, the private insurance alternative to the original program.

More on health

Health Spending to Outpace U.S. Economic Growth

Medicare projects the nation's health expenditures will rise 5.4 percent annually over next decade

Financial Health of Medicare Trust Fund Improves

Trustees project solvency until 2031, but Congress still must act for the long term

The Big Choice: Original Medicare vs. Medicare Advantage

Which path you take will determine how you get your medical care — and how much it costs