AARP Hearing Center

This summer, AARP spoke with members from around the country about what Social Security means to them. These older Americans told AARP about paying into the retirement program for decades and relying on it now.

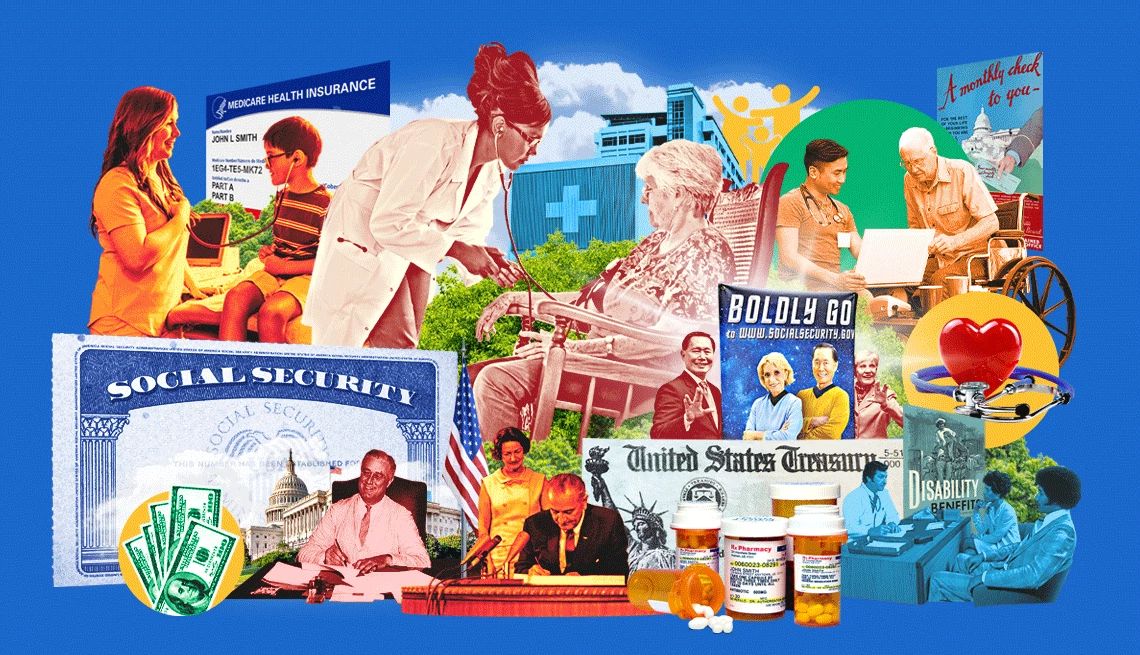

These stories are part of AARP’s campaign to commemorate the program’s 90th anniversary and ensure the program remains on solid financial footing for generations to come.

Here are their stories:

Part-Time Teacher Depends on Social Security

Leeza Burton, 67, of South Carolina, works part time as a substitute teacher. But she says she can’t work forever and depends on her Social Security. “I’ve paid into this all my life.”

This Recipient Never Forgot Her First Paycheck

Verel Johnson, 70, of Florida, says she remembers getting her first paycheck and learning about the FICA tax, the federal withholding taken out to fund her future Social Security benefit. “It’s supposed to be there as an investment for me,” she says.

Retiree Relies on Social Security to Cover Expenses

Steve Porter, 74, of Arizona, says he started paying into Social Security 58 years ago, when he got his first job a McDonald’s. “Social Security is mine. I’ve earned it,” he says.

Cancer Survivor Took Early Benefit

Lelia Gibson-Green, 63, of Colorado, claimed her Social Security benefit early after being diagnosed with cancer. “I want to live a little longer to see my grandkids grow up,” she says, and Social Security is key to that wish.

This CPA Counts on Social Security in Retirement

Tom Mueller, 66, of Kentucky, says Social Security is central to his retirement plan, and he thought carefully about when to claim his benefit. “If it is cut in any which way ... that would be detrimental,” he says. “I would have to make some serious choices.”

Caregiver Lost Her Retirement Savings and Lives on Social Security

Debbie Haupt, 71, of Missouri, quit her job early to care for her husband and then lost half her 401(k) during the 2008 financial crisis. She now lives entirely on Social Security. “That’s all I have right now.”

Social Security Helped Cover Her Cancer Treatment

Janice Ferebee, 69, of Washington, D.C., used her Social Security benefits to help pay for her chemotherapy, among other expenses. “I am extremely grateful for Social Security.”

His Family Sacrificed and Saved

Doug Craig, 67, of Minnesota, says his family lived modestly and saved with the understanding “that if we coupled that with Social Security, things were going to be OK.”

Join Our Fight to Protect Social Security

You’ve worked hard and paid into Social Security with every paycheck. Here’s what you can do to help keep Social Security strong:

- Add your name and pledge to protect Social Security.

- Find out how AARP is fighting to keep Social Security strong.

- Get expert advice on Social Security benefits and answers to common questions.

- AARP is your fierce defender on the issues that matter to people 50-plus. Become a member or renew your membership today.