AARP Hearing Center

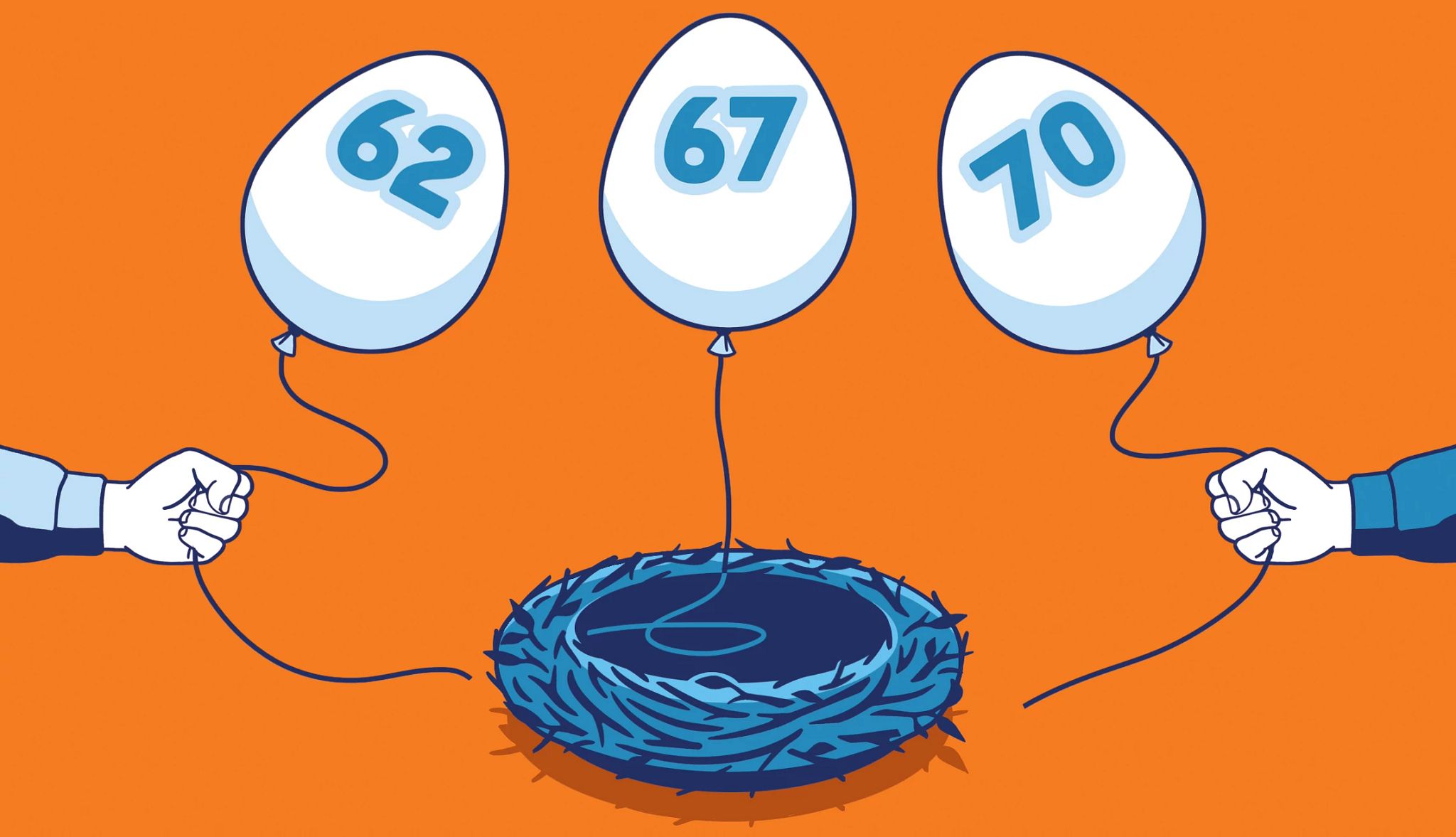

Age is often described as just a number, but that number matters when it comes to filing for Social Security retirement benefits. Here is a look at the pivotal role age plays.

What’s the earliest you can start Social Security?

The earliest you can start retirement benefits is age 62. Your payments would begin in your first full month as a 62-year-old — that is, the calendar month after your birthday.

You can apply up to four months before you want your Social Security payments to start. For example, if you turn 62 in June, your benefits can begin in July, and you can apply as early as March.

There is an exception: If you were born on the first or second day of a month, you can begin collecting your benefits in that month.

For example, if you were born on Nov. 1 or 2, 1963, Social Security considers you to be 62 as of Oct. 31 or Nov. 1, 2025. You can apply for benefits in July and they would begin in November. But if you were born between Nov. 3 and Nov. 30, your first full month at 62 is December.

What is full retirement age?

Full retirement age, or FRA, is when you become entitled to claim 100 percent of the Social Security benefit calculated from your lifetime earnings. For most of the program’s history, that age was 65, but since the early 2000s, it has been gradually increasing to 67 because of changes to Social Security’s financial structure that Congress enacted in 1983.

What happens if you start Social Security at 62?

If you begin benefits before your full retirement age, Social Security reduces your monthly payment by a fraction of a percent for each month you filed early. The dollars add up.

If you were born in 1963 and start benefits in 2025 at age 62, you will get as little as 70 percent of the amount you would have received if you had waited until 67, your full retirement age. That reduction is permanent.

More From AARP

Social Security Worries Loom Large for Gen X

Program’s uncertain financial future fuels concern for a generation nearing retirement

My Biggest Retirement Mistake: Skipping a 401(k)

A long-term care aide had a pension from a past job and thought that was all she could get

Why People Are Filing for Social Security Sooner

New AARP survey sheds light on 16 percent spike in retirement benefit claims