AARP Hearing Center

In this story

One? Or more? • When you’re hacked • Spread out the risk • Email’s here to stay • 8 pro tips

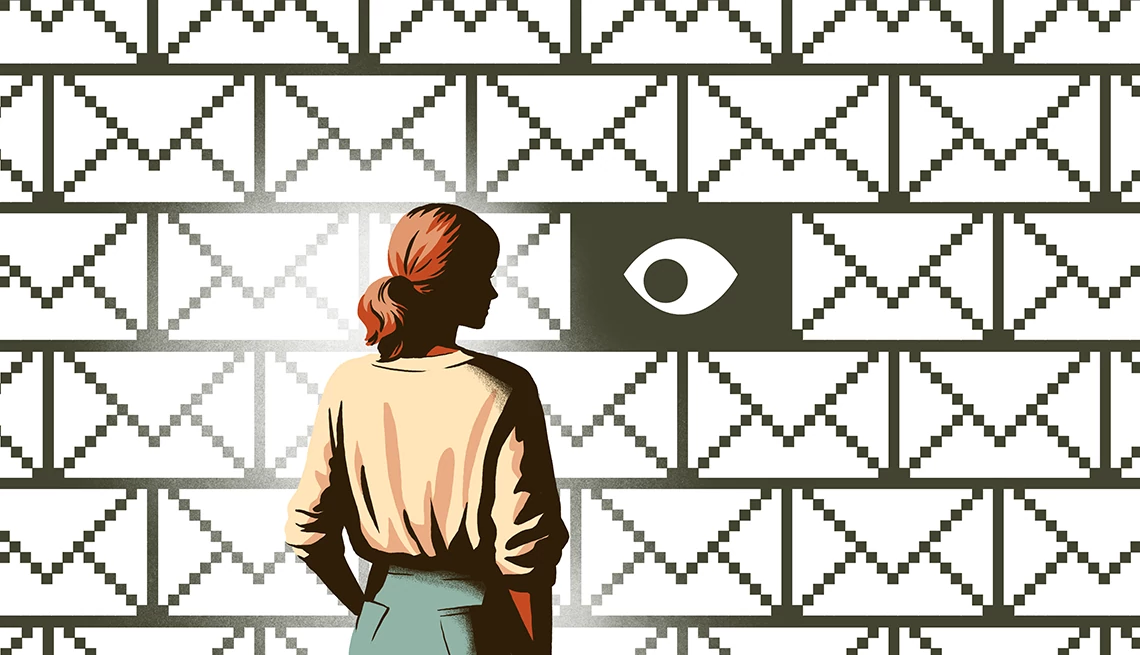

Do we really need more than one email account?

For security and privacy reasons, many people choose to have a spare email. But in an era when data breaches are a dime a dozen, maybe that’s no longer a good idea.

Some experts say one account is perfectly fine, provided you build up your digital defenses. That begins with using:

• A unique, complex password or passphrase that you don’t use for another digital account, whether it’s for online shopping, financial matters or medical confidentiality.

• Two-step verification — also called two-factor or multifactor authentication— to sign into your account. That provides an extra layer of security in case your password is stolen.

Reports of people having their email accounts hacked or spoofed are all too common, says President and CEO Eva Velasquez of the Identity Theft Resource Center, a San Diego-based nonprofit.

“It happens on a daily basis,” she says.

What happens when a crook cracks your password

Hacking means cyber crooks have taken control of your account.

“They can see everything in your inbox. They can send from your inbox,” Velasquez says. “They change the password. You no longer have access.”

Spoofing, on the other hand, is when someone disguises an email address, phone number or web address, often by changing a letter, symbol or number. The phony email is tied to a different account.

Criminals count on being able to manipulate people into thinking spoofed emails are real, and that can lead unsuspecting victims to download malicious software, send money or reveal personal or financial information. You’ll see this in “account update” emails from shady entities saying they’re Amazon but really are on a phishing expedition for your info.

Take Gmail, the world’s largest email service with billions of users worldwide. Its robust defenses block 99.9 percent of spam, phishing and malware from inboxes, says Ross Richendrfer, a Gmail spokesman for security matters. Even so, he cautions, “we know bad actors are constantly looking for ways to break in.”

More than one email account is effective, but don’t overdo it

Cybersecurity is not one-size-fits-all, Velasquez says.

More From AARP

Here’s the Lowdown on How to Store All Your Passwords

Overwhelmed by advice? Ed Baig sorts out the optionsA Spy Inside the Dark Web Watches Scammers at Work

David Maimon keeps an eye on criminals as they begin their schemes, and helps shut them down

8 Things to Know About Election Disinformation and AI

Artificial intelligence spreads, amplifies falsehoodsRecommended for You