Staying Fit

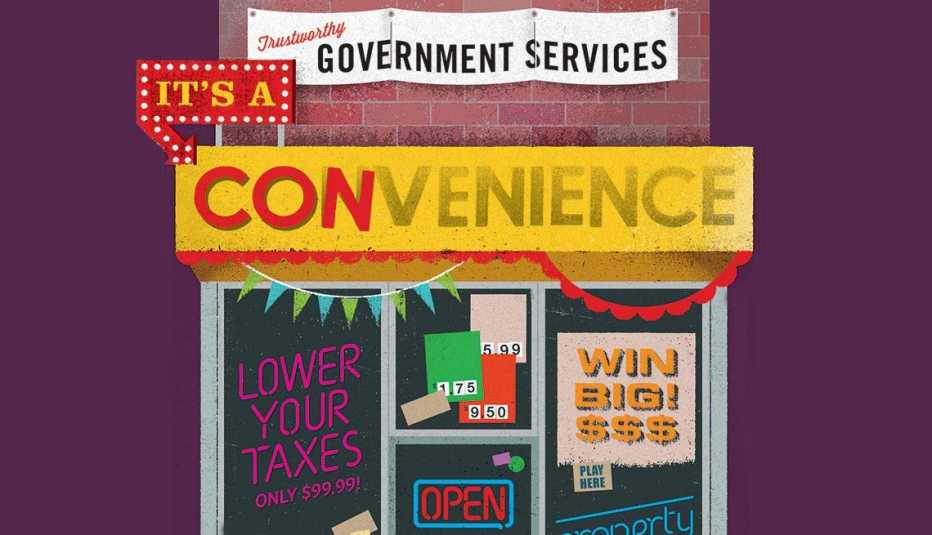

Why pay for what costs nothing? It's always a good question, especially with private companies out there trying to charge you hefty fees for government or financial services that are usually free.

At best, what the companies do is legal but unnecessary. Sometimes they provide little more than you-do-the-legwork instructions to get documents at government offices and websites. At worst, their letters, phone calls and emails trick you by pretending to have official government affiliation—and for their fees, they do nothing but collect personal information for identity theft.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Property deeds

Your home's title is on record at the local courthouse or city hall. If you want a certified paper copy, just head to the county clerk or recorder's office. The cost is typically less than $2 per page or $10 total. Don't fall for a letter that appears to be an official bill to order a copy of your property deed, usually for $80 or more, and perhaps bears an "act before" date. Despite buzzwords such as "national," "U.S. government" or "official," these letters are from private companies. They glean property parcel numbers, assessed values and other details from public records to make their letters seem authentic. It's only in the small print, if anywhere, that you learn that it's not a required bill and the sender is not affiliated with any government agency.

Lower taxes

Another home-front hoax: letters and phone calls saying you can lower your property-tax bill. In this ruse, private companies charge up to $200 for another DIY freebie: filing a dispute of your property's current assessment. Many of these letters can look like invoices with implied government affiliation and contain phrases such as "tax readjustment" and "tax review."

This scheme tends to uptick when property tax bills are issued, which is during summer months for many homeowners. For no charge, you can request a property reassessment with your city or county assessor's office. You'll need to show evidence that market conditions mean you deserve a lower assessment. But before filing, consider the possible fallout: If property values in your area have been increasing, your plea could actually result in a higher tax bill.

More From AARP

Phone Scams

How to identify and avoid common phone scamsDebt Collection Scams

How to spot debt collection scamsIRS Impostor Scam

Protect yourself from irs scam calls