AARP Hearing Center

Key takeaways

- What you can do with My Social Security

- How to create your account

- Update an outdated log-in

- Protect against fraud and identity theft

Whether you're already receiving benefits or are years away from retirement, it's important to keep an eye on your account with the Social Security Administration (SSA) to ensure you will collect what you have earned. Tracking and managing your benefits is easy when you set up an online My Social Security account.

Taking a few minutes to create this account will give you more control over your benefits and save you the time and trouble of having to call the SSA (which can involve hours-long waits to speak to a live representative) or go to a local Social Security office to conduct routine business.

All you need for on-demand access to Social Security information and services is a computer, smartphone or tablet. If you don’t have one, ask a trusted friend or relative with secure internet access to help you get started. Your public library or a local senior center may also have computers you can use — just make sure to log out of your account after using a public computer.

What you can do with an account

Now that Social Security has mostly stopped sending out paper benefit statements, an online account is the primary way people can keep track of their retirement benefits. About 86 million people have established My Social Security accounts, according to the SSA. You can use your account to:

- Get estimates of how much your monthly retirement benefit would be if you claim it at any age between 62 and 70.

- Set up direct deposit of your benefit payments.

- Request a replacement Medicare or Social Security card.

- Change your address or phone number on file with the SSA.

- Verify your earnings over your career.

- Request a benefit verification letter, which you can use as proof of income when applying for a loan or mortgage or for government assistance, such as Supplemental Nutrition Assistance Program (SNAP) benefits or housing vouchers.

- Request a replacement SSA-1099 or SSA-1042S, the forms the agency mails to you every January for tax purposes that summarize your benefits for the previous year.

- Check the status of a pending claim or an appeal of a disability benefits decision.

- Receive notices about your benefits online (instead of by mail) and get email or text alerts when you have a notice available.

When you are ready to apply for benefits, you can click through to the claim form from your My Social Security account or go directly to the application section of the SSA website.

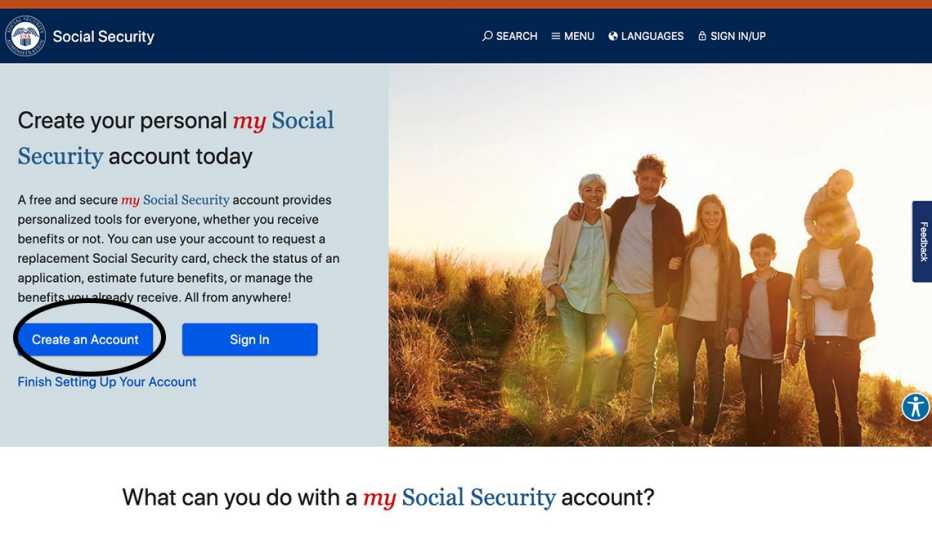

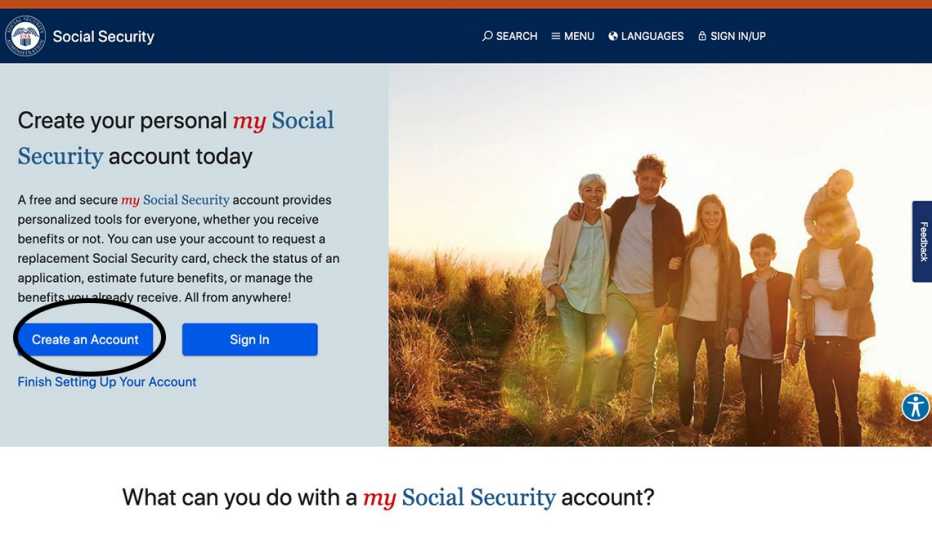

How to get started

To create a My Social Security account, you must be at least 18 years old and have a Social Security number and a valid email address.

More on Social Security

Social Security Calculator

Get an estimate of your benefits

10 Social Security Myths That Refuse to Die

The program is going broke, the retirement age is 65, and other common misconceptions

When Should You Claim Social Security Early?

Waiting boosts monthly payment but isn't always feasible