AARP Hearing Center

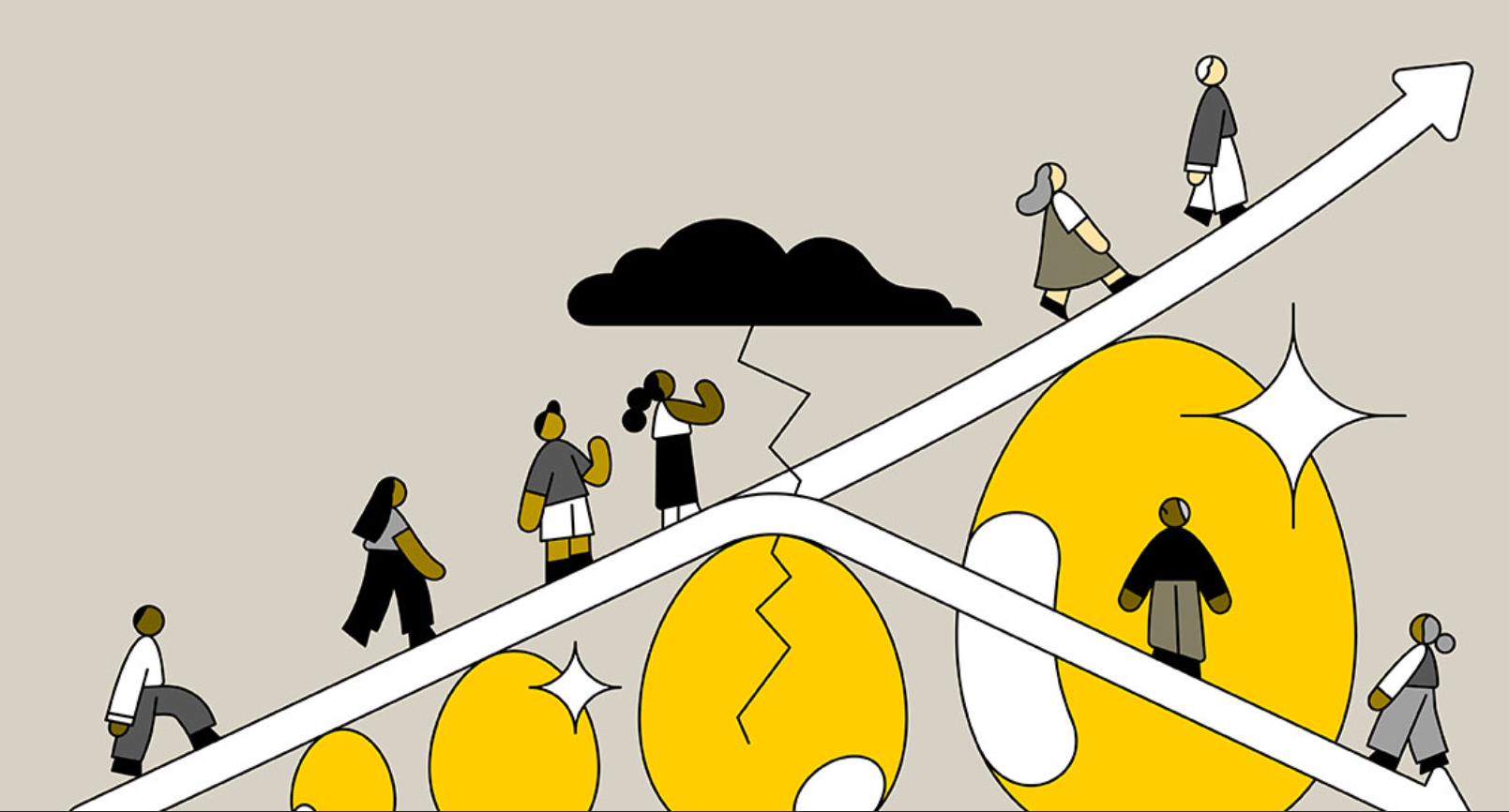

A growing number of American workers are turning to their 401(k) plans to cover unanticipated financial disruptions, like a medical emergency or unexpected layoff. In a June report, financial services company Vanguard found that the number of people enrolled in its 401(k) plans who are making withdrawals from their accounts has been steadily increasing since 2020.

For workers under age 59½, that usually comes with an immediate price: early withdrawal fees amounting to 10 percent of the amount taken out. But the financial consequences can linger for years. Each withdrawal from a retirement plan means less money in the account earning compounding returns and, over time, a significantly diminished nest egg.

Perhaps more alarming, early withdrawals don't affect all communities equally. Black and Hispanic workers “are taking out money more frequently from their retirement savings than others,” says Kara Woolley, senior program manager for the Inclusive Saving and Investing Initiative at the Aspen Institute Financial Security Program.

Major purchases, emergencies drive withdrawals

Taha Choukhmane and Lawrence Schmidt, assistant professors of finance at the MIT Sloan School of Management, published a working paper in August on racial gaps in retirement savings. They found that among workers who made at least $1,000 in recent contributions to a retirement plan, 12 percent of white savers were likely to make an early withdrawal in a given year, compared to 15 percent of Hispanic savers and 23 percent of Black savers.

“The rate of early withdrawals among Black Americans is almost twice as high as among white workers,” Choukhmane says. “These gaps remain really large even when we compare workers who work at the same firm, make the same amount of earnings and have the same level of education.”

A March 2024 report from the Collaborative for Equitable Retirement Savings, a joint initiative of the Defined Contribution Institutional Investment Association, the Aspen Institute Financial Security Program and Morningstar Retirement, echoes those findings.

Not only are Black and Hispanic workers more likely than white peers to make early withdrawals, but Black workers tend to withdraw larger percentages of their retirement savings than other groups, and Black and Hispanic workers are more likely to have outstanding loans from their 401(k) accounts, the study found.

More From AARP

How to Protect Your Retirement Savings

Poor investment returns early can hurt you more than losses later

7 Ideas to Reduce the Racial Retirement Gap

Steps to move the needle on equity

7 Great Tips to Build an Emergency Fund

Make sure you have money when you need it

Recommended for You