AARP Hearing Center

Figuring out how much money you need to retire comfortably can feel like one of those word problems from high school that still haunts you. “If X equals your spending in retirement, Y equals your rate of return and Z equals the number of years you will live, how much will you need to save, given that X, Y and Z are all unknowable?”

The retirement equation isn’t unsolvable, but it’s not a precise calculation either. Also, recommendations for how much money you need to save for retirement can vary widely, depending on the data that’s being crunched.

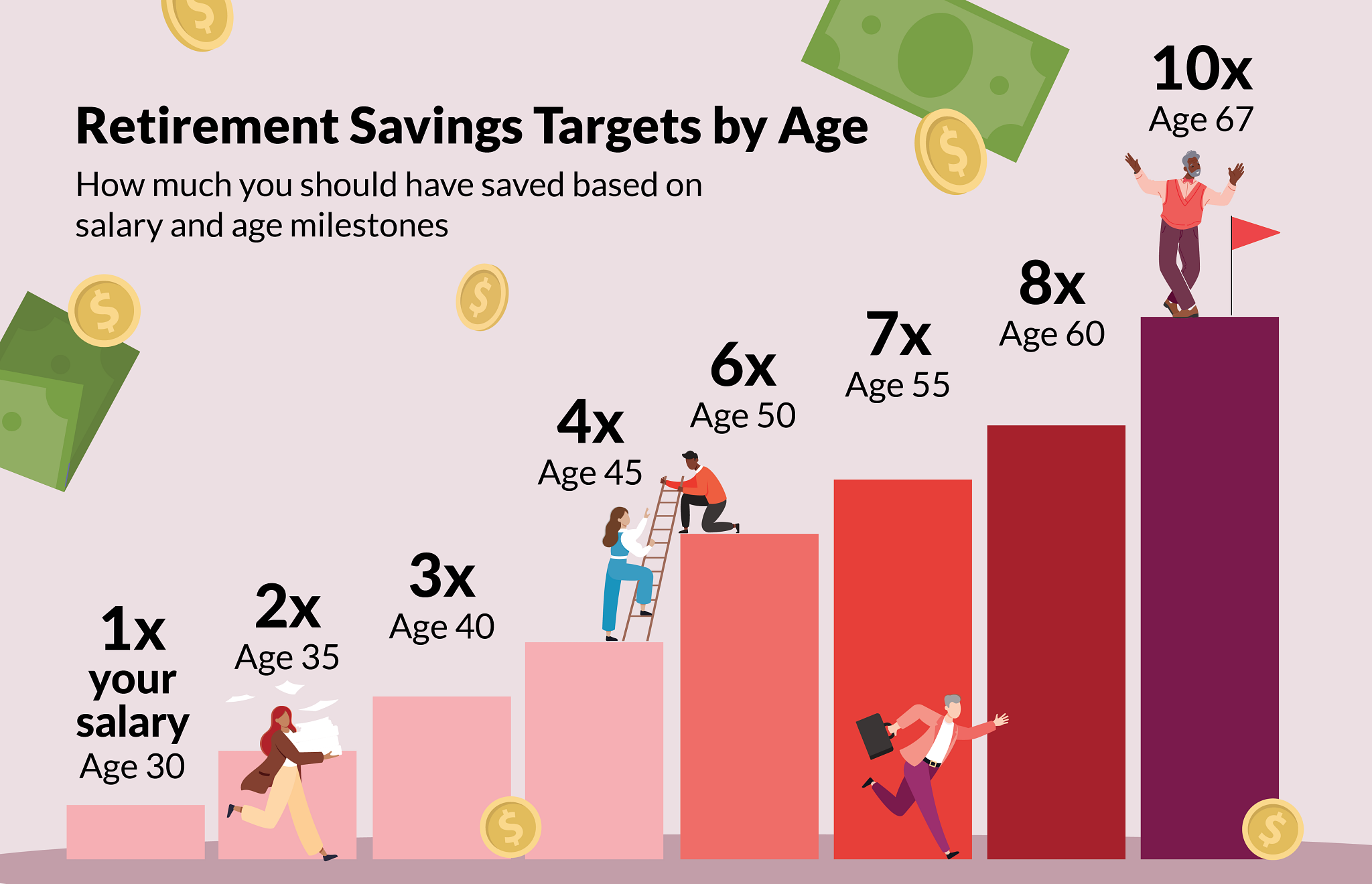

For example, according to Northwestern Mutual’s 2025 Planning and Progress study, Americans believe they will need $1.26 million to retire comfortably. Meanwhile, Fidelity Investments says Americans need to save 10 times their preretirement income by age 67.

In other words, the so-called magic number for how much retirement savings you need is up for debate.

What’s not up for debate is that you should revisit your retirement formula once or twice a year to make sure it’s on track and be prepared to make adjustments if it isn’t. Weigh the following five factors to get a better handle on how much money you will need to retire.

Factor No. 1: Lifestyle and expenses

The rule of thumb is that you’ll need about 80 percent of your preretirement income to maintain your lifestyle, although that rule requires a pretty flexible thumb.

Why not 100 percent? For one thing, you will no longer be paying payroll taxes toward Social Security (although you may have to pay some taxes on your Social Security benefits), and you won’t be shoveling money into your 401(k) or other savings plan. In addition, you’ll save on the usual costs of going to work, such as new clothes, commuting, lunches and the like.

Are You on Track for Retirement?

Try AARP’s retirement calculator to find out if you’re saving enough.

In determining how to cover that 80 percent, you need to factor in retirement account withdrawals and any other income you expect to receive, such as Social Security, a pension or an annuity. If your annual preretirement income is $50,000, for example, you’ll want those income streams to add up to at least $40,000.

Say you and your spouse have checked your Social Security statements and can expect to receive a combined $2,000 a month in benefits, or $24,000 a year. You’ll need about $16,000 a year from other sources. Bear in mind that any withdrawals from a tax-deferred savings account, such as a traditional IRA or a 401(k) plan, would be reduced by the amount of taxes you pay.

Next, consider the things you might want to spend money on. “In the first three years of retirement, the biggest expense is often travel,” says Mark Bass, a financial planner in Lubbock, Texas. New retirees “want to take a four-week trip somewhere, maybe pay business class to get there, and it can cost $20,000 or so.”

That’s not a problem, Bass says, as long as you build the trip into your budget and it doesn’t end in the poorhouse. So you’ll want to develop a retirement spending plan alongside your income projection.

Medical care is another expense to factor in. For 2025, the standard monthly premium for Medicare Part B, which covers most doctors’ services, is $185 or higher, depending on your income. You also have to pay 20 percent of the Medicare-approved amount for most medical services after reaching the $257 annual deductible.

More From AARP

Traveling With Friends When Budgets Clash

When vacationing together, financial compatibility is key

My Friends Didn’t Donate for My 5K

Should a reader follow up to ask for contributions? Here’s what our etiquette expert says

My Husband Is Spoiling Our Grandkids

Couples don’t always align when it comes to their grandparenting styles