Staying Fit

Every cent counts for retirees, and for that reason, state taxes are about as welcome as a bear in a beehive. Although you shouldn’t base where you retire on taxes alone, they are an important consideration, especially if you’re going to live in a new state when you retire.

States get tax revenue from a number of sources. Some states, such as Alaska, South Dakota and Wyoming, sit on enough natural resources that their mineral rights sales enable them to keep most taxes extraordinarily low and skip income taxes altogether. Oil-rich Alaska, for example, has no taxes on income, estates or retirement benefits. In fact, residents get an annual payment from the state for their share of those oil riches. In 2023 that was $1,312 per citizen.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

No income tax

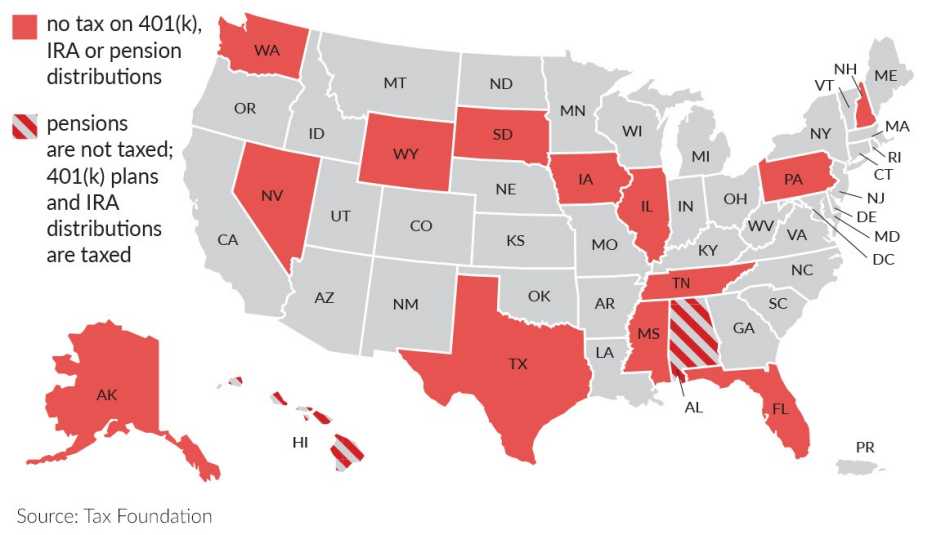

The federal government considers distributions from pensions, 401(k)s and traditional individual retirement accounts (IRAs) as income — the same as it does the income you get from work. Eight states have no income tax whatsoever, which means that retirement benefits — including Social Security retirement benefits — remain untouched by the state taxman. Let’s start with the eight states that have no income tax whatsoever: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

A ninth state, New Hampshire, also has no income tax, so it doesn’t tax retirement distributions. It does, however, tax interest and dividends, although the tax will be phased out by 2025.

Four other states have income taxes but give retirees a break on pensions and retirement plan distributions.

- ·Illinois, which has a 4.95 percent flat income tax won’t tax distributions from most pensions and 401(k) plans, as well as IRAs and Social Security payouts. Earnings from investments are taxable, however.

- Mississippi has a maximum state tax of 5 percent. It doesn’t tax retirement distributions or Social Security benefits..

- Pennsylvania has a 3.07 percent flat tax and doesn’t tax retirement plans or Social Security benefits.

- Iowa, which has a maximum 5.7 percent income tax, doesn’t tax retirement plans or Social Security payouts for people 55 and older.

What about everyone else? Most states carve out some exemptions for retirement income. For example, in addition to the nine states with no income tax, 29 states don’t tax military retirement pay: Alabama, Arizona, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Utah, West Virginia and Wisconsin. In Virginia, you won’t pay taxes on any of your military retirement pay — provided you’ve won the Congressional Medal of Honor.

More From AARP

401(K) Plan Contribution Limits for 2023 and 2024

Thanks to inflation, you get to sock away moreAARP's Retirement Calculator

Map out your future with AARP’s Retirement Calculator

5 Tips to Make Your Money Last

Adjust your financial plan for successRecommended for You