AARP Hearing Center

A 73-year-old Chicago man awarded a Purple Heart for combat injuries in Vietnam says he fell victim to two con artists, who walked away with his cash and enough personal information to put him in jeopardy of future financial crimes.

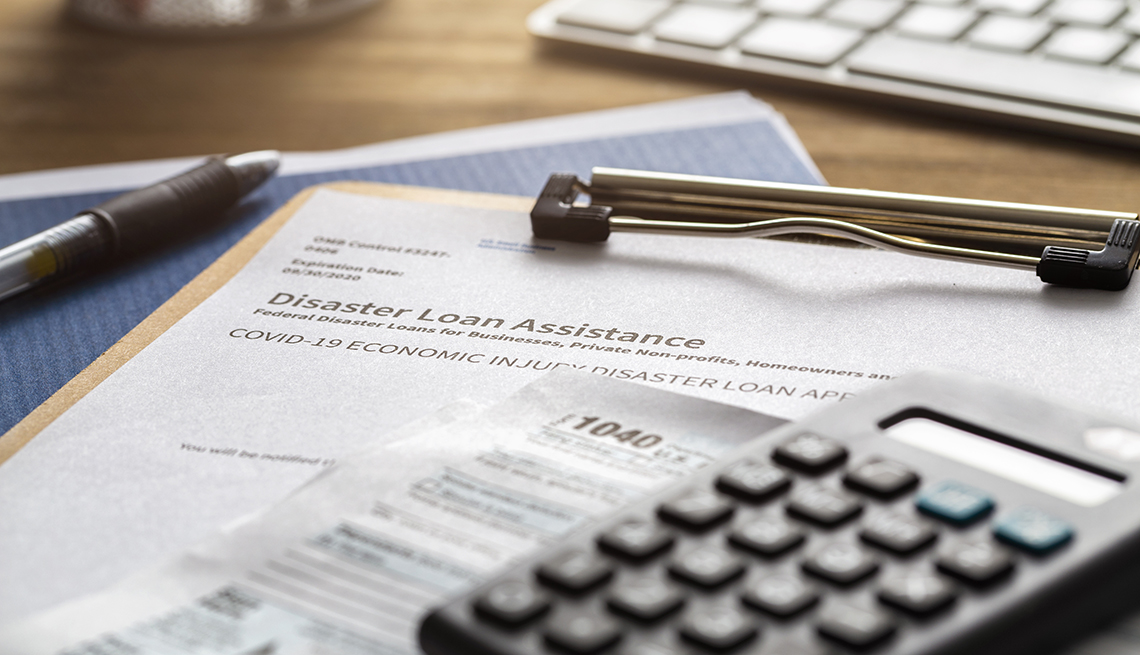

Kenneth tells AARP that two women approached him last month boasting they could get him a $10,000 grant — money purportedly available because of the COVID-19 pandemic. (His full name is not being published to protect his privacy.)

He says one of the women, who is in her 60s, resides in Kenneth's 18-unit apartment building on the South Side. The sidekick was her friend, a woman in her 30s whom he'd never met before July 11, when the grant application supposedly was made.

Kenneth, who is divorced, is a retired painter for the City of Chicago. His finances are secure thanks to a pension, Social Security and Veterans Affairs benefits.

Perilous duty in Vietnam

He says that he served with the Army's 7th Cavalry Regiment. A sergeant, he was a radioman and spent 13 months in country from 1967 to 1968. At times, he says, he rappelled from a helicopter into tall elephant grass to face the Vietcong.

One day a 122-millimeter rocket hit a communications bunker, instantly killing the soldier next to him. Kenneth survived but his ear drums were perforated, leading to permanent hearing loss. He recuperated on a Navy hospital ship and soon was back in the fight despite the injuries, which led to his Purple Heart. “I still have combat flashbacks,” he says.

Friend was a ‘moocher'

According to Kenneth, the older woman who he says scammed him had been a friend. Sometimes he lent her $20 for gas; once he gave her $70. Eventually, she'd pay him back. “She was never able to keep a job very long,” he says. “She has a moocher mentality."

He says he once spent $100 to buy groceries for her at Walmart. When he cooked, he'd occasionally give her a plate of food; one Thanksgiving he gave her enough turkey and sides to last a week.

As for the $10,000 grant, his friend said her younger associate could get him the money in two days.