AARP Hearing Center

If you’d invested just $1,000 in Berkshire Hathaway when Warren Buffett became chairman and CEO of the company in 1970, you would be a millionaire today.

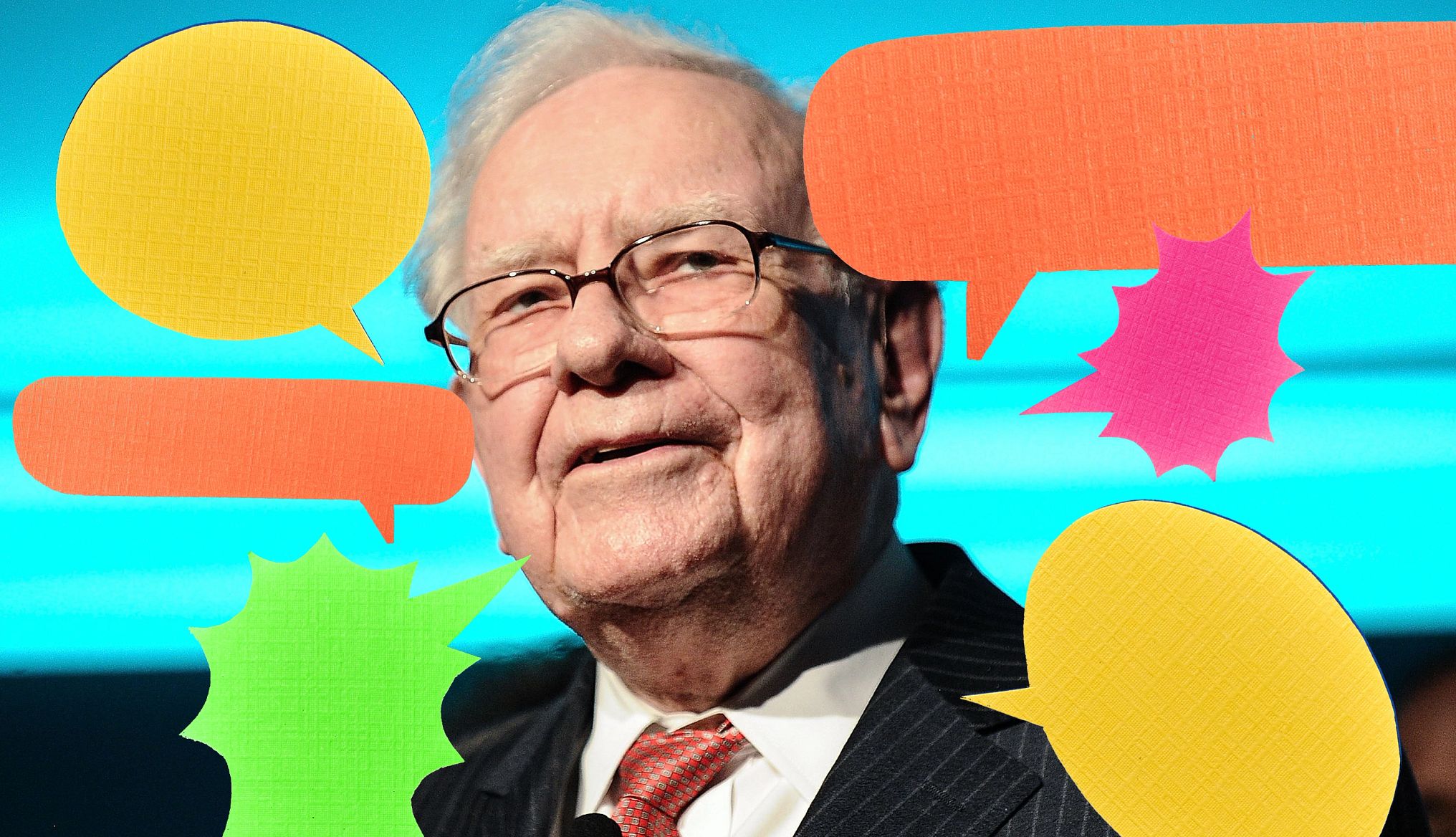

Buffett, hailed by many as the best investor of all time, is stepping down as chief executive at the end of this year, he announced at an annual shareholder's meeting on May 3. The 94-year-old, recently worth an estimated $154 billion, is turning over the role to vice chairman Greg Abel. Buffett said he will stay on as chairman of the company's board of directors.

In honor of his retirement announcement, let’s take a look at some of the legendary investor and philanthropist’s most notable quotes. (Consider it free investing advice from the fifth richest man in the world.)

1. “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

—Statement in January 1991, as quoted in Of Permanent Value: The Story of Warren Buffett (2007) by Andrew Kilpatrick

2. “Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.’ Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down.”

—In a 2008 Chairman's Letter to shareholders

.jpg?crop=true&anchor=24,0&q=80&color=ffffffff&u=k2e9ec&w=1952&h=1464)

3. “Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.”

— As quoted in Rules That Warren Buffett Lives By by Stephanie Loiacono at Yahoo! Finance (Feb. 23, 2010)

4. “Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

— As quoted in Homespun Wisdom from the ‘Oracle of Omaha' by Amy Stone in BusinessWeek (June 5, 1999)

5. “It takes 20 years to build a reputation and five minutes to ruin it.”

— As quoted in Corporate Survival: The Critical Importance of Sustainability Risk Management (2005) by Dan Robert Anderson

6. “You want to be greedy when others are fearful. You want to be fearful when others are greedy.”

— Interview with Charlie Rose on PBS (Oct. 1, 2008)

7. “I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

— In a panel discussion after the premiere of the 2008 documentary I.O.U.S.A.

8. “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

— In a 1988 Chairman's Letter to shareholders

9. “You only find out who is swimming naked when the tide goes out.”

— In a 2001 Chairman's Letter to shareholders

10. “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

— As quoted in In Class Warfare, Guess Which Class Is Winning by Ben Stein in the New York Times (Nov. 26, 2006)

More From AARP

Retirement Mistake: Delaying Move to Retirement

After an interstate move, this couple struggled to find a community to call home

5 Simple Steps for Older Adults to Set a Budget

Keeping your spending under control doesn't have to be difficult

9 Big-Ticket Purchases Retirees Often Regret

Think twice before pulling the trigger on that boat or RV