Staying Fit

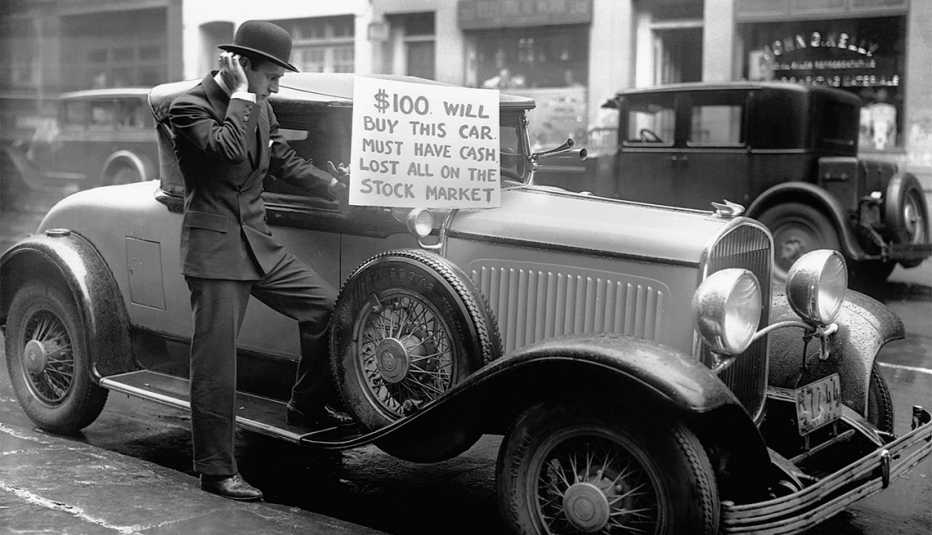

The wild investing ride of the first two decades of the 21st century is over. As we enter the next decade, it's important to look back over the past 20 years for lessons we can take into the future. Let me walk you through the emotional highs and lows many of us experienced and try to draw a few lessons from them.

Highs and lows

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

The century began near the height of the dot-com bubble when internet companies with little revenue and huge losses had valuations in the tens of billions of dollars. People who questioned those valuations were told they were stuck in the old economy. The Standard & Poor's 500 stock index peaked on March 24, 2000, and quickly plunged by nearly 50 percent.

During the tech wreck, some clients came to me in shock, wondering how their many stock funds could have lost 70 to 80 percent. Those stock funds, of course, all owned the same dot-com companies. A total stock index fund was far more diversified.

As stocks soared to new heights, the dot-com bubble was soon forgotten. This time the bull was real — as in real estate. You can't print more real estate, right? Between October 2002 and March 2007, U.S. stocks gained 133 percent and international stocks gained 240 percent. Bonds steadily gained 22 percent.

I advised clients that a third of their equities should be in international stocks and the typical response was, “Why only a third – isn't all the growth coming from overseas? We want whatever is hot.”

Of course, this bubble burst as well. Getting mortgages was all too easy. The defaults that soon followed caused the collapse of many Wall Street titans like Lehman Brothers and Bear Stearns.

For ways to save and more, get AARP’s monthly Money newsletter.

This plunge was slightly more than the dot-com bubble, with U.S. stocks losing 55 percent and international stocks dropping 60 percent by the market bottom on March 9, 2009. But it was the fact that the plunge happened so quickly that magnified the pain so much. Only high-quality investment grade bonds and bond funds did well. Morningstar reported that the average bond fund lost about 8 percent in 2008. Many bond funds behaved more like stocks, as investors reached for income but lost much of their principal.

And advisers, who were supposed to keep investors disciplined with a relatively stable asset allocation between risky assets (stocks) and low-risk assets (bonds and cash), timed the market poorly.