Staying Fit

This year, the nation faces 1970s-style price hikes on everything from garbage bags to gasoline. Want to whip inflation now? Try these 99 tips to stretch your dollar when inflation is squeezing it.

Read the 2023 version of AARP's 99 Great Ways to Save

1-29

Groceries | Vegetable gardens | Cars | Travel | Entertainment

30-65

DIY | Energy | Phones | Shopping | Help from AARP

66-99

TV watching | Make it last | Get it free | Get it used | Save while saving

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Groceries

Fact: Grocery prices have gone up 10 percent in the past year, the largest annual rise in 40 years, according to the USDA.

1. Use ground chicken in your chili. Beef and veal prices rose the most of main food groups this year, at 16 percent. Fresh poultry increased less — and it was much cheaper to begin with.

2. Plan this Friday for next Tuesday. A proven way to contain grocery costs is to plan out the week’s meals and to buy food from a shopping list based solely on that plan. Friday is a great day for planning, as many stores post their week’s discounts and deals that day or the day before.

3. Search before you shop. Flipp is a free phone app that consolidates retail circulars. This makes it a snap to compare your shopping list to circulars from your local supermarkets to determine which store’s virtual coupons will save you the most money. You can also use the app to generate your shopping list.

4. Make Thursday a “pantry cooking” night. Americans throw away 30 to 40 percent of our food supply, often because it goes uneaten until it’s no longer edible. The antidote: Cook at least one meal a week based entirely on foods lingering in your refrigerator or pantry.

5. Have an “eat me first” spot in your fridge. Designate a shelf or bin in your fridge for all of the leftover food bits (think nubs of cheese, a half serving of pasta,a lemon wedge) or overly ripe foodstuffs that should be eaten before fresher items.

6. Yes, order online. What you might lose in delivery costs often is more than made up by avoiding impulse purchases when browsing a store. The trick: Lower your delivery costs. Look for coupons at sites like CouponFollow.com to find deals, such as $20 off your first order at Vons, 15 percent off Kroger grocery shipments, and $10 off your first delivery of $20 at Instacart.

7. Pay with the right card. Many credit cards offer cash back today, but the amounts often vary by category. Search the Internet for cards that offer the most cash back for groceries; you might find a card that will give you 5 percent back on food purchases. Websites like CardRates and NerdWallet let you compare your card with others.

8. Double up with cash-back apps. With services like FetchRewards, Coupons.com or Ibotta, your grocery purchases earn points toward gift cards for various shopping options such as Amazon, Target and Walmart. Fetch Rewards, for example, has a section where you can see which brands will get you the most points.

9. Go all-in on store brands. Many major grocery chains have greatly expanded their store-brand lines, and their reputation for quality has improved. Chains are highly secretive about who makes their products. But simply compare the ingredients list with name-brand versions to see how close they are. Store brands can run as much as 25 percent less than the name-brand version.

How I saved on groceries

With my always-hungry son coming home from college last Saturday, I needed to stock up on food. I pulled every money-saving trick in the book: digital coupons, in-store flyer coupons (cherries for $1.99 a pound!), opting for store brands, scouring the shelves for member-only and manager’s special markdowns (ground turkey for $2.28 a pound? Meatballs tonight!). I then went to the Asian market, which charges substantially less for produce. In all, I went to four nearby stores to get the best prices. Bottom line: What could have been a $350 food spree came in around $200.

—Neil Wertheimer, deputy editor

10. Use self-checkout. A study conducted by IHL Consulting Group reveals that people who used self-checkout spent less on impulse purchases. This is likely because shoppers are paying attention to what they’re buying, as well as the prices, when they're scanning goods themselves — rather than getting distracted by their phone or the magazine rack while a cashier does it for them.

For food gardeners

11. Focus on high-cost foods. Many of the most common garden vegetables — green peppers, zucchini, cucumbers — cost very little at the store come harvest time. Focus on edibles that routinely cost more at the store. That could include most fresh herbs; heirloom tomatoes; organic lettuces; and vegetables for ethnic or regional cuisines like Chinese choy, okra, tomatillos or Jerusalem artichokes.

12. Grow veggies that are easy to preserve or store. It’s a shame to find yourself with so many peppers or greens that you can’t even give them away before they rot or wilt. Tomatoes can be canned; beans can be canned, pickled or frozen. Plant some pickling cukes. Butternut and other winter squashes will last until spring in a cool, dry place.

13. Plant edible perennials. Many herbs and spices — among them garlic, rosemary, thyme and oregano — will grow back year after year, making them a great value. Plus, they are often easy to grow because deer and other critters won’t eat them. Several of these also do great in pots outside the kitchen door, so you don’t even need a garden.

14. Hold a seed swap. Unless you have a truly large garden, it is rare to use up a full packet of seeds. And it's always best to plant seeds the same year you purchased them, rather than storing them for future seasons. The solution: Connect with neighbors or friends who garden, and coordinate your seed-buying — with the goal of sharing packets and cutting costs.

Car Costs

Fact: A gallon of gas in the U.S. averaged just over $3 in May 2021. One year later, it had increased to over $4.50.

15. Brake less, coast more. Think of driving this way: Everytime you brake, you waste the gas you just used to get to your current speed. The more you can coast or avoid the surging and slowing of crowded traffic, the higher your gas mileage will be. Get in the habit of accelerating gently, coasting toward red lights and stop signs, and trying to use the brake a little less. A secondary benefit: You’ll be driving more safely, which could save insurance dollars and perhaps collision repairs.

16. Choose a different tire. New tires can actually lower gas mileage because more rubber literally meets the road. If getting better gas mileage is important to you, consider shopping for what the industry calls low rolling resistance tires, which are manufactured to lessen the friction of the tire against the road; some estimates suggest they can improve fuel economy by 4 to 11 percent. Be sure to check their safety ratings for snow and rain, but their reputations are generally good.

17. Sell your car privately. Due to current demand for used cars — especially older, high mileage vehicles — a private sale is likely to fetch more for your car than a dealer might pay in a trade-in deal. If you are buying a new car, negotiate that price independent of the trade-in; only after the deal is done should you let them bid on your old car. That way you’ll know what the dealer is really offering.

18. Yes, really, consider an EV. Most major carmakers offer electric vehicles now, meaning prices are coming down while gas prices are going up. Increasingly, buying an electric vehicle is likely to make economic sense. Currently, if you drive 12,000 miles a year, you can probably expect to break even in about two to three years, versus a similar gas model. Public charging stations charge about twice what it costs to charge at home, so you’ll save more if you drive mostly within the car’s charge range. Apps are available to tell you where to find free public charging stations.

19. Check gas prices by phone. Several phone apps are available to give you the current cost of gas in the area where you’re driving. For example, search “gas” on the Waze app, type “Geico gas” into your browser for the same result, or check the GasBuddy app.

20. Ignore that oil-change sticker. Most oil-change shops slap a sticker on your windshield summoning you back in 3,000 miles. Check your owner’s manual. Many newer cars use a synthetic oil that needs changing far less frequently than older cars.

How I saved by selling my car

A dealer offered me $100 in trade for my 2008 Subaru Outback. Without spending a penny, I sold it myself for $2,200. I washed, vacuumed and cleaned the car’s interior and washed the inside of the windows. I located the title and put it in the glove box along with all service receipts. I researched the trade-in and private sale value of the vehicle. I disclosed the leak in the power steering reservoir. It gave buyers confidence in my honesty.

—David Schiff, writer

21. Skip oil additives, unless …The oil in your engine already contains additives designed to prolong the engine’s life. So if your car is running well, aftermarket additives won’t make it last longer. An older car with high mileage may be the exception: Ask your mechanic whether additives could squeeze more miles out of the car.

Travel

Fact: Airline ticket prices jumped 18.6 percent just in the month of April, according to the consumer price index.

22. Rule No. 1: Go off-season. Long walks on a deserted beach. Great restaurants without a reservation. No traffic jams. Off-season travel is not only cheaper, but it can be more relaxing than fighting in-season crowds. For Example, a two-bedroom oceanfront condo on the Outer Banks of North Carolina is $200 per night in April, but the cost shoots up to $300 per night in June.

23. Have your weekends on Wednesdays and Thursdays. Most resorts and inns offer lower rates on weekdays than weekends, so you can save more by going midweek. Some resorts offer better prices on Sunday-through-Thursday packages.

24. Choose no-car-needed vacations. Car-rental companies depleted their fleets during the COVID-19 pandemic, and now they are struggling to replenish due to a shortage of semiconductor chips. As a result, rental fees have soared beyond the inflation rate. Fly into cities that have good public transportation, such as San Francisco, New York, Chicago or Boston. If you are looking for a more secluded getaway, go to a mostly car-free island such as Mackinac Island, Michigan, or Catalina Island, California.

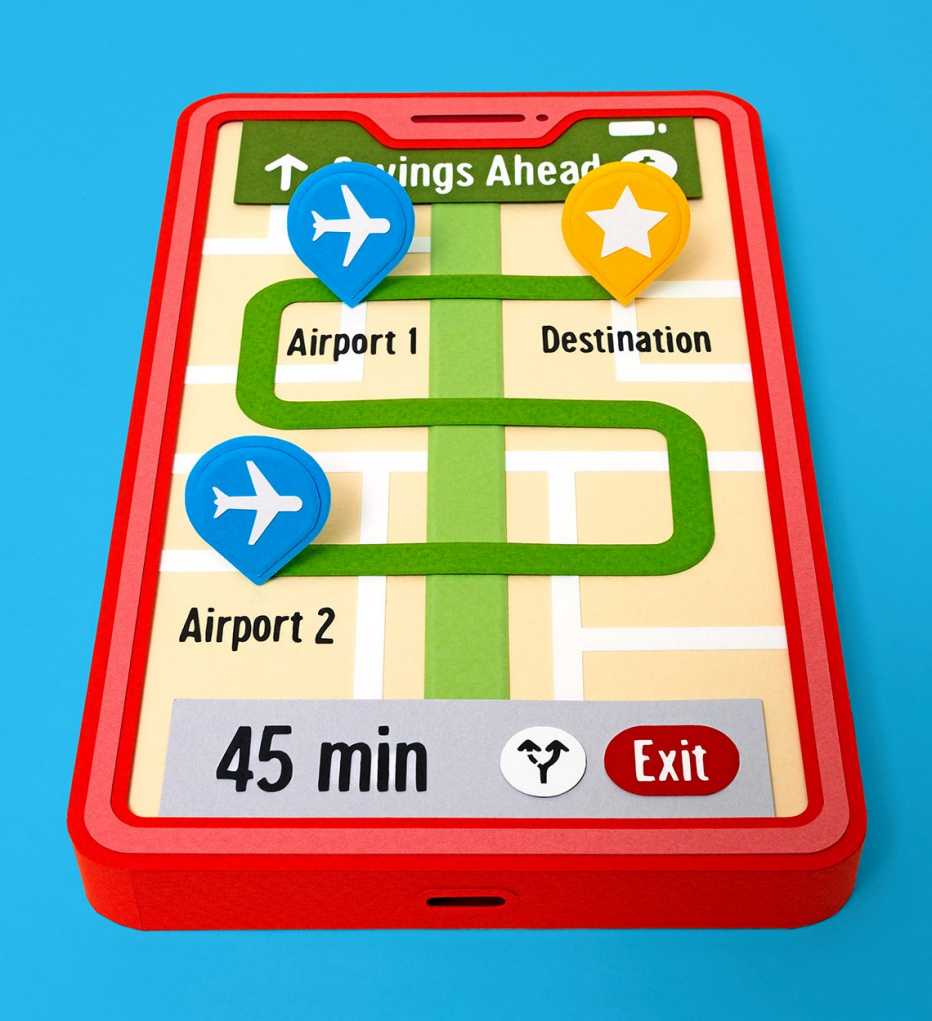

25. Save on airfare and hotels. Check out fares to airports that are an hour or two from the ones closest to your destination. If you can save, say, $100 per person and will be renting a car anyway, it might be worth the extra time and gas. Book hotels last minute, if you can. For example, if you’re planning a road trip and you’re flexible about where to stay, you’ll save an average of 13 percent by booking two weeks in advance rather than four months out, a NerdWallet study reveals.

How I saved on vacation

"When my wife and I decided to go to Cabo San Lucas earlier this year, I researched different deals I saw online—some all-inclusive, some not; some with airfare included, some not. Of all the options I found, by far the best was to fly Southwest Airlines direct from Colorado, where I live, and book lodging through Costco Travel. That was $800 cheaper than the next-best deal, plus it came with a $353 Costco gift card. After we got back, I used the card toward an Apple Watch, which cost me $37 out-of-pocket. Now my watch reminds me of my wonderful vacation."

—Allan Roth, financial planner

How I saved with promo codes

"If you buy online, always try entering a promo code at checkout. Companies offer these to new customers (WELCOME10 or WELCOME20) or to reward returning customers (SAVE10, SAVE20 or THANKS). I recently bought outdoor furniture covers and got 20 percent off by using WELCOME20. You can get promo codes by signing up for marketing emails, using a search engine to look up common codes or looking up social media influencers who share promo codes."

—Sara Schwartz, senior editor, AARP Members Only Access

26. Don’t pay resort fees. About 40 percent of luxury hotels now charge these fees for facilities like pools or concierge services, which average about $25 per night. Look for lodging without the extra charge at ResortFeeChecker.com. Another tactic to avoid these fees: Book with hotel loyalty points. HiltonHonors and World of Hyatt are among the loyalty programs that often waive resort fees.

Entertainment

Fact: A leading movie theater chain announced surge pricing of an extra $1 to $1.50 for tickets to its spring blockbuster.

27. Party early. You could save around 35 percent on food and 20 percent on drinks by dining during happy hour rather than peak dinner hours or later. Check your neighborhood establishments to find out when they host happy hour, or use a site like Happable.com to get details on happy hour deals at local chain restaurants.

More From AARP

How to Stretch Your Retirement Money as Prices Rise

Inflation erodes older adults' buying powerSubscribe and Save?

Pros and cons of signing up for auto-deliveries