AARP Hearing Center

Your Social Security statement is a one-stop shop for key information about your benefits and earnings history. With an online My Social Security account, you can view, save and print an up-to-date version of your statement at any time.

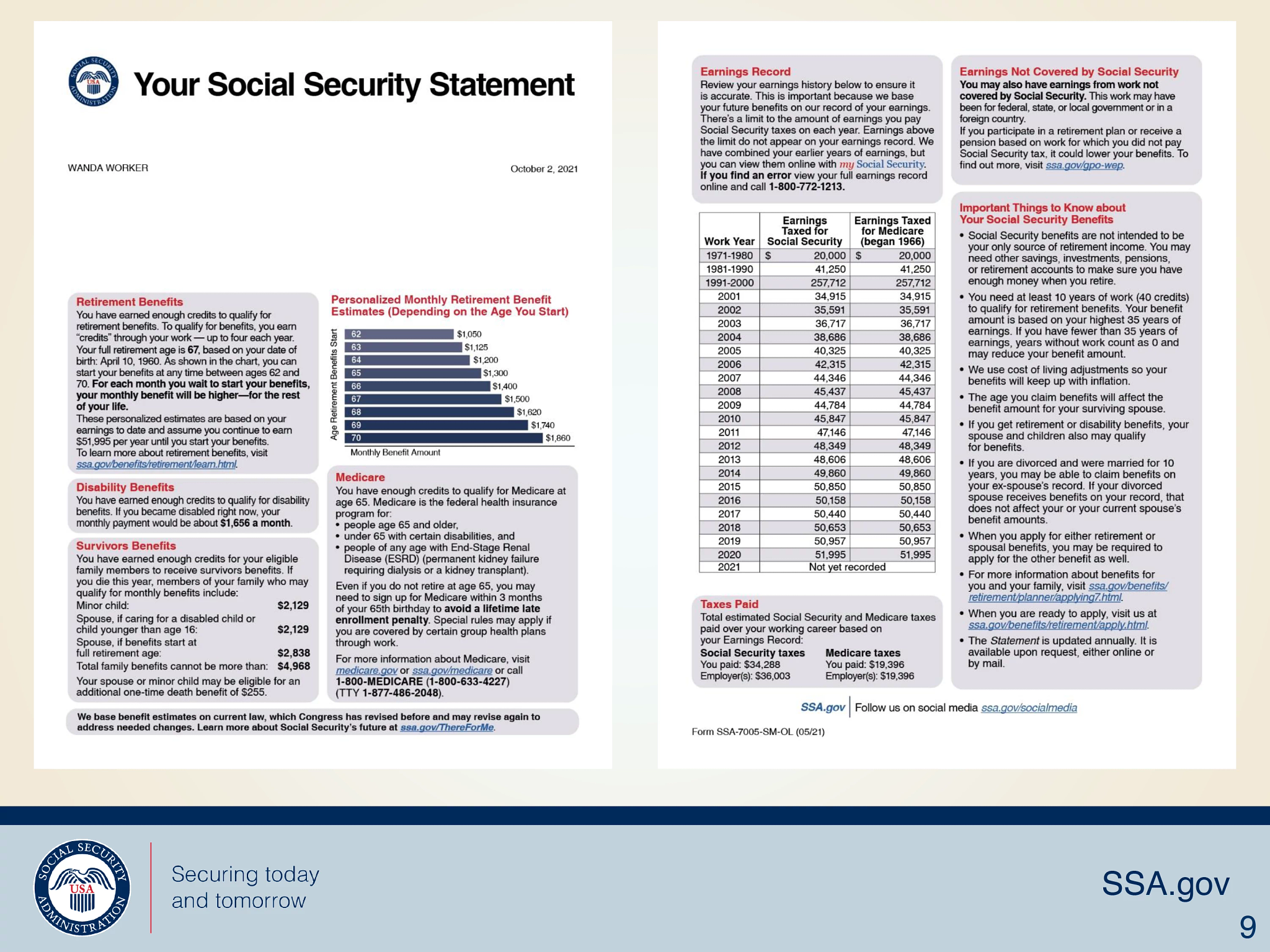

This two-page personalized report gives you an illustrated, segmented breakdown of projected future benefits (or, if you’re already getting a monthly Social Security payment, how it was calculated), along with a year-by-year record of your work income and how much you have paid in Social Security taxes.

How do I get my Social Security statement?

Formerly mailed annually to tens of millions of U.S. workers, Social Security statements are now available primarily online. According to the Social Security Administration (SSA), about 97 million people have My Social Security accounts and can access their statements (and some Social Security services) 24/7.

The SSA mails paper statements only in limited circumstances. If you are not yet receiving benefits and don’t have a My Social Security account, you will automatically be sent a copy three months before your 60th birthday and each year after that, until you either file for benefits or create an online account.

You can request a paper copy of your Social Security statement at any age by printing and completing an SSA-7004 form and mailing it to the address on the form. You should receive your statement in the mail in four to six weeks.

What’s included in my statement?

If you haven’t yet claimed Social Security, the first page of your statement prominently features a bar chart showing your projected monthly retirement benefit, based on past, current and potential future income, if you file at any age from 62 to 70.

If you have worked in the two years prior to the statement date, the benefit projections assume that you will continue to earn similar wages until you claim benefits.

You’ll also find estimates of your Social Security Disability Insurance (SSDI) benefit if you become unable to work for an extended period due to a serious illness or injury, and estimates of the survivor benefits your spouse and children could receive based on your work record.

More From AARP

Having a Job and Social Security May Cost You

Before full retirement age, you’ll face an earnings test

What if Social Security Starts at 62, 67 or 70?

How to get the highest benefit, and when to collect early

Estimate Your Social Security Benefits

When to claim and how to maximize your payments