AARP Hearing Center

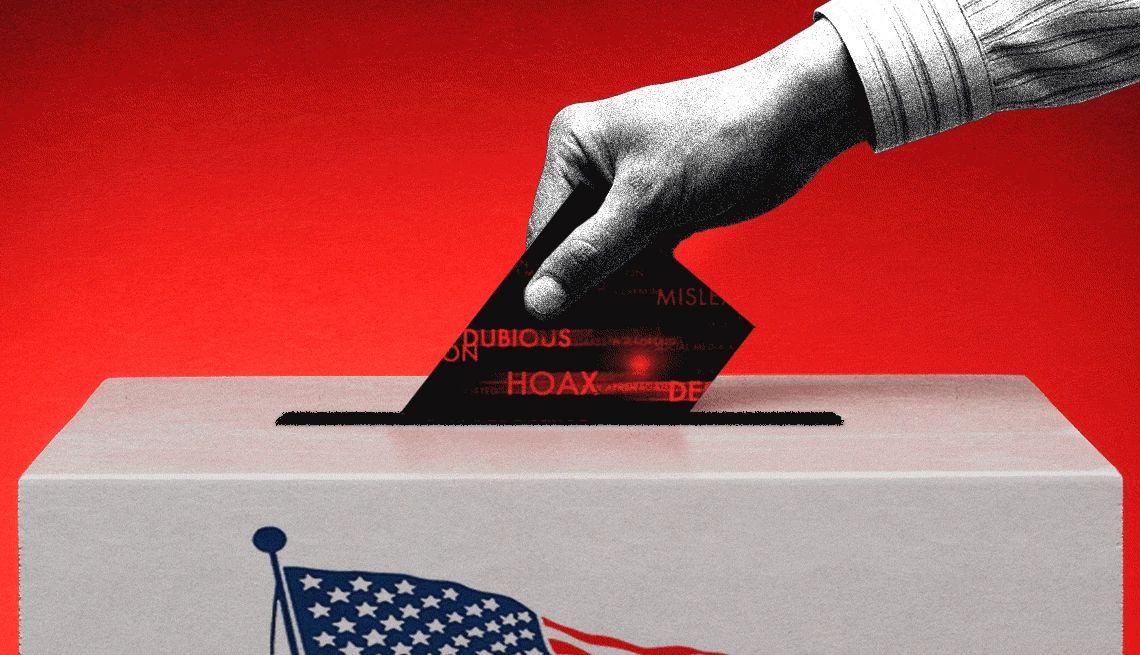

Government & Elections

Read news and features on government, politics, voting and vital issues 50-plus Americans care about — from Medicare to Social Security to the economy

AARP IN YOUR STATE

Find AARP offices in your State and News, Events and Programs affecting retirement, health care and more.