AARP Hearing Center

For most taxpayers, 2022 returns are officially due by midnight on Tuesday, April 18. If your 1040 isn’t electronically transmitted or postmarked by then, you may face hefty penalties. We all know that missing the tax deadline is a bad thing. But why does the deadline fall when it falls, typically on April 15, but on April 18 in 2023? And what's so special about April 15, anyway?

It’s complicated. Let’s start at the beginning.

When was the first Tax Day?

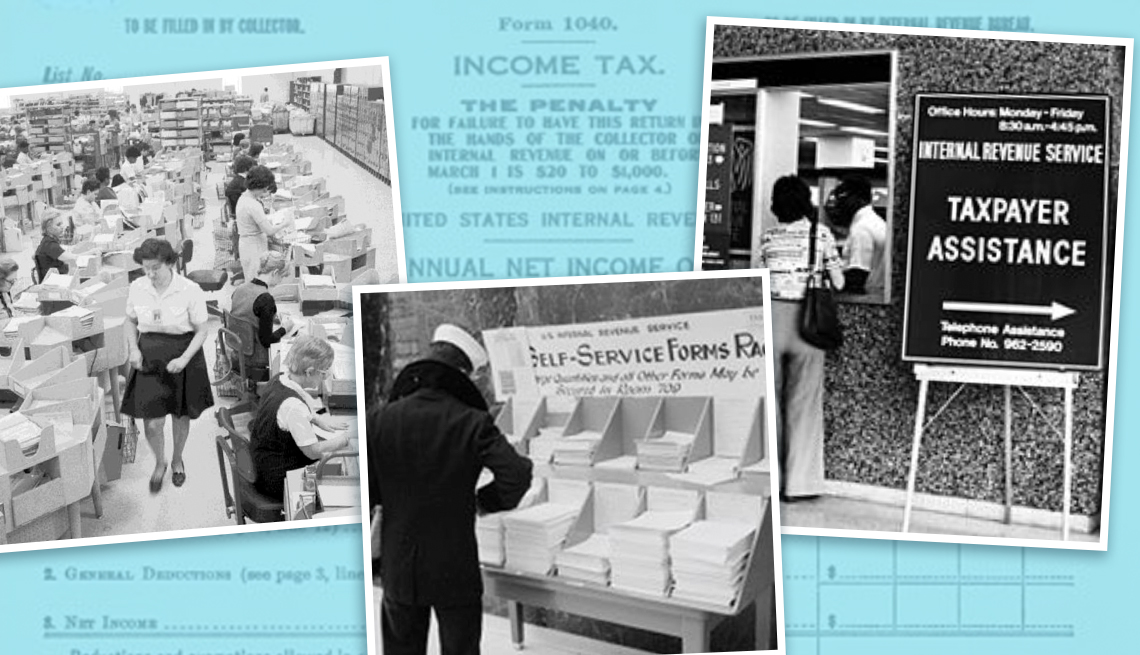

The inaugural Tax Day fell on March 1, 1914, and not on April 15. The income tax was allowed by the 16th Amendment, but the tax itself was created by the Revenue Act of 1913. The new law placed a 1 percent tax on income of more than $3,000 – the equivalent of $92,389 today – and a top surtax of 6 percent on incomes above $500,000. (That’s a bit over $15 million in today’s money). The 1040 federal tax form was created in 1914.

Congress pushed back Tax Day to March 15 in 1919, mainly to help with the increasing complexity of the tax code. (The new Tax Day was thanks to the Revenue Tax of 1918, which was passed in 1919. Time moves slowly for tax legislation.) Tax Day wasn’t shifted to April 15 until 1955, after Congress passed the Internal Revenue Code of 1954.

So why is Tax Day on April 18 this year?

Two reasons. First, Tax Day can’t be on a weekend, and April 15, 2023, falls on a Saturday. When this occurs, Tax Day gets bumped to the following Monday – except when it doesn't. This brings us to the second reason: April 17 is when Emancipation Day in the District of Columbia is celebrated this year. The holiday marks the date in 1862 when enslaved people in D.C. were freed. The actual date of emancipation was April 16, but because April 16 is a Sunday, it’s celebrated on April 17. Got it? While not a federal holiday, the IRS recognizes Emancipation Day, which explains why we all get yet another extra day to file in 2023.