AARP Hearing Center

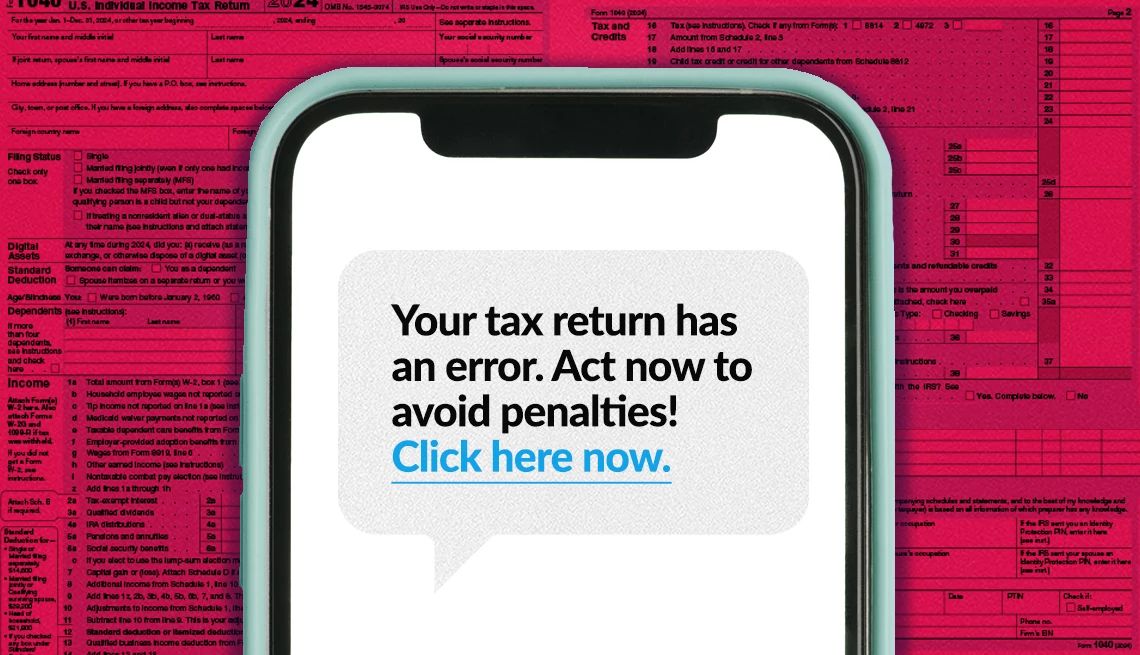

IRS impostor scams surge during tax season, and a new rule about how refunds are issued may cause confusion and stress. As of this year, the IRS will only distribute tax refunds electronically as the federal government moves away from paper checks. It’s this kind of change that provides additional opportunities for scammers to impersonate the agency.

Here’s what to know and how to help protect yourself and your loved ones.

How It Works

- You receive an unexpected communication that claims to be from the IRS.

- They may say you owe back taxes and face legal action if you don’t act fast and pay immediately, or they may ask for banking details to “update refund information” because of the new rule.

- They may seek payment via wire transfer, cryptocurrency, or by purchasing gift cards and sharing the numbers off the back.

- They might have good news: you have a refund coming or even a tax rebate, which you can claim by clicking a link or calling a phone number.

What You Should Know

- Generally, the IRS will first send a letter through the mail before the agency otherwise contacts taxpayers; it only uses email and text with your permission.

- Federal agencies never request payment via wire transfer, cryptocurrency, or gift card. In 100 percent of these scenarios, it is a scam.

- If a tax filer does not include direct deposit information on their 2025 return, the IRS will send a letter to the last known address to request bank information or to find out why the taxpayer cannot provide it.

What You Should Do

- If you get a call claiming to be from the IRS, hang up – or better yet, don't pick up the call to begin with.

- If you want to confirm your tax payment status, call the IRS directly using a trusted number from an official letter, at IRS.gov or log into your IRS Online Account if you have one.

- Beyond IRS impostors, tax ID fraud is also a concern. Consider obtaining an IRS identity protection PIN. The PIN is known only to you and the IRS, and your return cannot be processed without it.