Staying Fit

Where there's money, there are scammers who want to take it, and tax scams are a favorite in all the nation's five-star boiler rooms. Here's a look at this year's “Dirty Dozen” tax scams, according to the just-released annual list from the Internal Revenue Service (IRS).

1. Phishing

One of the most popular scams is sending out fake emails or setting up fake websites whose purpose is to steal your personal information. Fraudsters always stay current with the news: Lately, many of those so-called phishing attempts use keywords such as “coronavirus,” “COVID-19” and “stimulus.”

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

The IRS will never initiate contact with you via email about a tax bill, refund or economic impact payments (aka stimulus payments). Don't click on links claiming to be from the IRS. If you have questions about taxes, go directly to the IRS website.

2. Fake charities

Scammers love to prey on kind hearts, and one way to do that is to set up fake charities. The COVID-19 pandemic is a perfect time for these scammers. Fake charity schemes start with unsolicited telephone calls, texts, e-mails or even in-person appeals. And bogus websites use names similar to those of legitimate charities to get people to send money or reveal financial information.

Legitimate charities will provide their employer identification number (EIN), if requested, which can be used to verify their legitimacy. You can find legitimate and qualified charities with this search tool on IRS.gov.

3. Threatening impersonator phone calls

Online impersonation scams are called phishing; voice impersonation is “vishing.” If you get a call from someone claiming to be from the IRS and threatening arrest, deportation or license revocation, you're probably getting vished. The IRS will never demand immediate payment, threaten, ask for financial information over the phone, or call about an unexpected refund or stimulus check. Taxpayers should contact the real IRS if they worry about having a tax problem.

4. Social media scams

That friend on Facebook offering ways to cut your taxes might not really be your friend. Scammers love to impersonate a potential victim's family members, friends or coworkers. A scammer may email a potential victim and include a link to something of interest to the recipient that contains malicious software, or malware. The malware, once unknowingly downloaded, will help the scammer browse your computer for personal information or use your computer to commit more crimes. Scammers also infiltrate cellphones to go after your contacts with text messages soliciting, for example, small donations to fake charities.

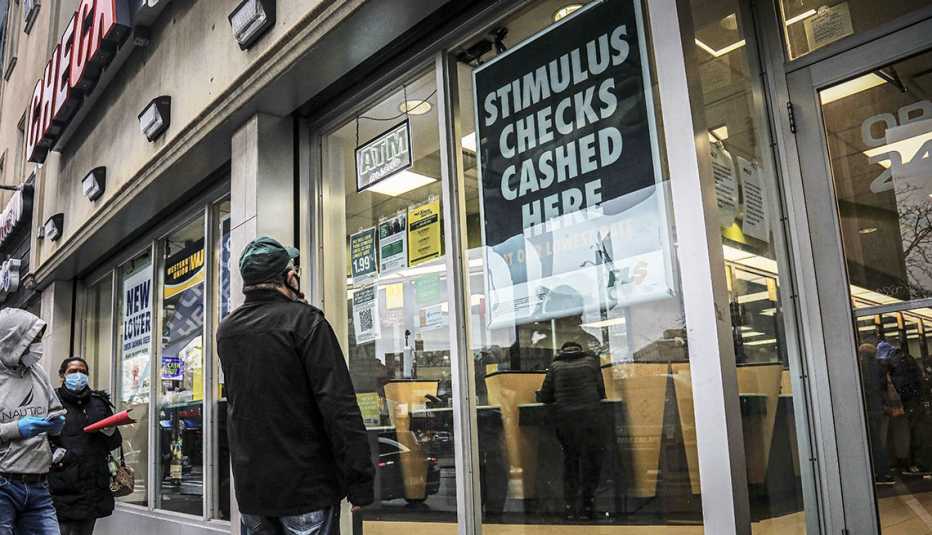

5. Stimulus payment/tax refund theft

When criminals steal your identity, they can file false tax returns and collect a nice little refund for themselves — making it harder for you to get yours. If you think you are the victim of identity theft, consult the Taxpayer Guide to Identity Theft on IRS.gov.