AARP Hearing Center

Katherine Skiba,

Crooks posing as Social Security employees triggered a record-shattering number of complaints in 2020 and led to nearly $45 million in victim losses, proving pandemic shutdowns did not stanch what the Social Security commissioner called a “terrible” problem.

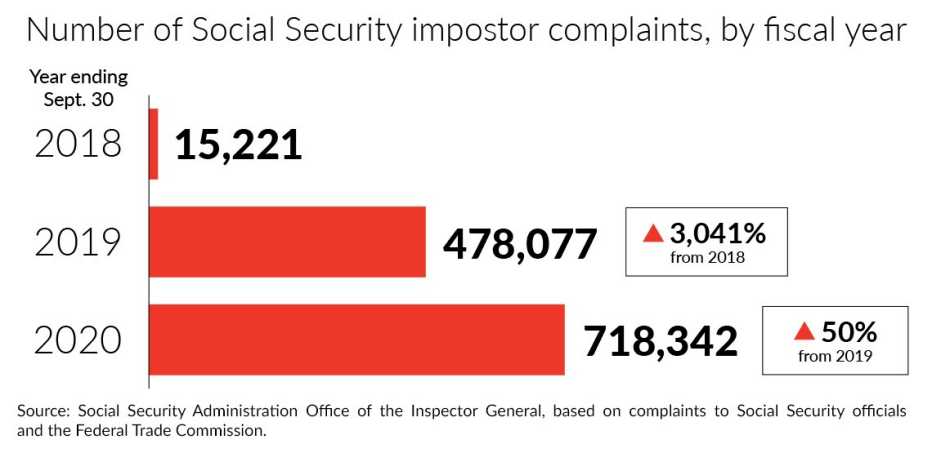

In what has emerged as the No. 1 impostor scam afflicting a U.S. agency, there were more than 718,000 complaints about Social Security impostors during the 12 months ended Sept. 30, 2020, a significant jump from the roughly 478,000 reported during the same period the previous year.

The average victim lost $6,100 in calendar year 2020, though historically losses for some individuals have been much higher. A 27-year-old Chicago-area man is awaiting sentencing after admitting he and his accomplices ripped off an older woman in Massachusetts for more than $900,000.

The bad actors posed as Social Security Administration (SSA) and U.S. Department of Justice officials, and told victims that their identities had been stolen and they needed to transfer money to various bank accounts.

Older people have more to lose

Federal officials said that while the Social Security impostor scam is not necessarily targeted at older Americans, losses for older victims may be steeper, since they generally have more money than younger people.

Andrew Saul, SSA commissioner, and Gail Ennis, the agency’s inspector general, discussed the rise in impostor scams on the eve of National Slam the Scam Day, which falls on March 4. As part of the effort, the agencies and their private-sector partners — one is AARP — promote scam awareness and prevention.