AARP Hearing Center

Kansans receiving Social Security benefits will no longer pay state taxes on that income under legislation signed by Gov. Laura Kelly June 21, three days after it was passed by state lawmakers in a special session.

The Social Security provision is part of a broader tax cut package that Kelly, a second-term Democrat, negotiated with Republican legislative leaders after vetoing three prior tax bills over differences in changing the state’s overall income tax structure.

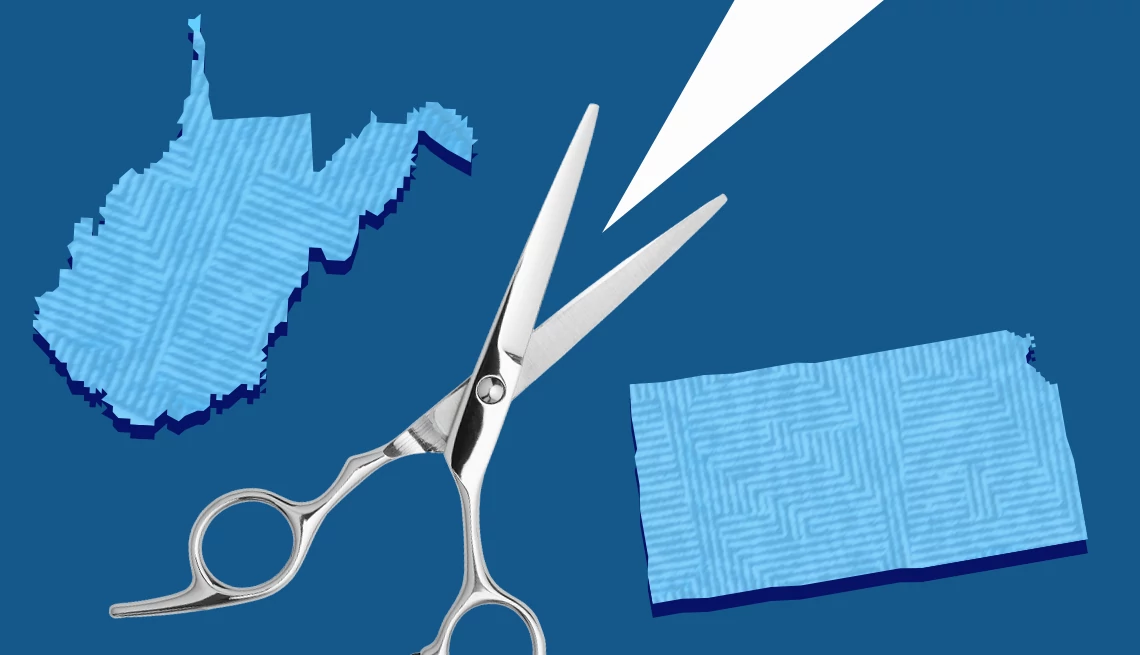

Kansas joins West Virginia in moving this year to end the tax on Social Security payments. West Virginia lawmakers enacted legislation in March that phases out the levy on benefits for all state residents over the next two years.

9 states still tax benefits

Social Security benefits may be subject to federal income taxes, regardless of where you live, depending on your overall income. That tax revenue goes into the trust funds that pay for Social Security and Medicare benefits. A dwindling number of states also tax Social Security income to varying degrees, with that money going into their general funds.

With Kansas’ repeal, only nine states will tax benefits received in 2024: Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont and West Virginia (which will eliminate the tax in 2026). State taxation of benefits also ends this year for Missouri and Nebraska residents under measures adopted in 2023 in those states.

Ending state taxation of Social Security income has been a legislative priority for AARP offices in states where the practice continued.

“We are pleased that legislative leadership and Gov. Kelly worked together to develop and pass a tax plan that prioritizes the elimination of the Social Security income tax,” said AARP Kansas State Director Glenda DuBoise. “Our members played a vital role in this process. Their advocacy, leading up to the special legislative session, helped carry the bill over the finish line.”

Kansas AARP members sent nearly 1,300 phone and online messages to legislators and the governor’s office calling for an end to the benefit tax, the state office said.

More From AARP

Tax Breaks You Shouldn’t Overlook

Every deduction counts in tax season7 Ways to Reduce Taxes on Social Security Benefits

Moves that lower taxable income can also limit the IRS bite on your benefits

These States Don’t Tax Retirement Distributions

Every penny from your nest egg counts when you’re retiredRecommended for You