AARP Hearing Center

When Medicare announced its 2026 monthly premiums for Medicare Part B, which covers doctors’ visits and other outpatient services, enrollees may have noticed that the increase is higher than in the past few years.

Beginning in January 2026, the standard Part B monthly premium is $202.90, up from $185 in 2025, representing a 9.7% jump. With a Social Security cost-of-living adjustment (COLA) of 2.8% for 2026 (or about $56 on average among Social Security recipients), many people will see a large portion of their Social Security COLA absorbed by the $17.90 monthly increase in their Medicare premium. Over the past five years, from 2020 to 2025, the Medicare Part B premium increased an average of about 5% a year.

This blog post takes a closer look at who pays a Part B premium, how the premium amount is determined, and what we might expect for future increases.

Who pays a Part B premium

The Part B premium applies to everyone with Medicare, except for people who enroll only in Part A (which covers inpatient hospital, skilled nursing facility, hospice, and home health services). The people who enroll only in Part A do so typically because they or their spouse are working and have employment-based insurance coverage; when that coverage ends, they also enroll in Part B. (For nearly all Medicare enrollees, there is no premium for Part A.)

The Part B premium applies to both people enrolled in traditional Medicare and those enrolled in one of the private plans that contract with Medicare, known as Medicare Advantage (MA) plans.

While most Medicare enrollees pay the Part B premium themselves, Medicaid pays this premium (with the cost shared between states and the federal government) on behalf of about 19% of Part B enrollees who have lower incomes and limited savings. These individuals are either enrolled in a Medicare Savings Program only or are enrolled for full Medicaid benefits.

How Medicare determines the Part B premium amount

The Centers for Medicare & Medicaid Services (CMS) annually determines the Part B premium for the upcoming year based on rules set by law. CMS’s calculation begins with an estimate of how much the Medicare program’s average per enrollee Part B costs will be that year for enrollees age 65 and older. The standard premium is 25% of this amount.

In 2026, the standard premium will apply to 92% of Part B enrollees—about 73% will pay it themselves and about 19% will have it paid on their behalf by their state Medicaid program (as described above).

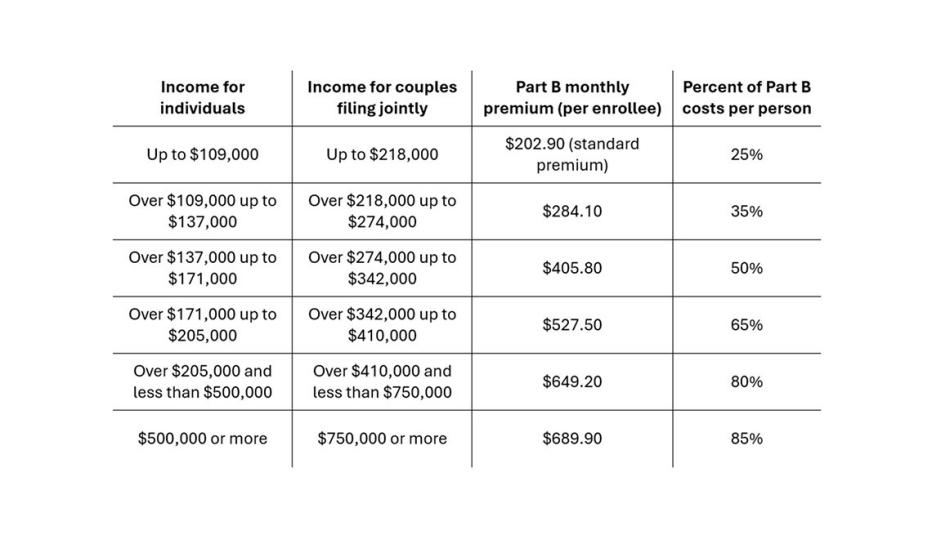

The other 8% of Part B enrollees will pay a higher premium because their incomes are above certain thresholds. In 2026, individuals with incomes above $109,000 (and couples with incomes above $218,000) will pay an Income-Related Monthly Adjustment Amount (IRMAA) on top of the standard premium, with the IRMAA varying by income (see table).

Federal law includes a “hold harmless” provision that ensures most Medicare enrollees who receive Social Security benefits and have their Part B premium deducted from their Social Security check will not see the amount of their monthly Social Security check decrease from one year to the next because of a Part B premium increase. Instead, their premium is adjusted for that year to the dollar amount that keeps their Social Security check from being less than the previous year. Hold harmless protection does not apply, however, to people who pay Medicare’s higher income-related premiums, or to states paying Medicare premiums on behalf of eligible individuals. In 2026, the hold harmless provision is expected to affect less than 5% of Medicare enrollees; these are individuals with low monthly Social Security benefits for whom the dollar amount of their COLA is less than the Part B premium increase of $17.90.

The Part B premium’s role in financing Medicare

Medicare uses different methods to finance Parts A and B. To finance Part B, Medicare uses premiums from Medicare enrollees plus general government revenue. The Part B premium amounts are set before the year begins, as described above, with general government revenue used as needed so that together these income sources finance Part B services each year. In 2024, 26% of Part B income came from premiums, 72% from general revenue, and just over 1% from interest and other sources. Medicare Part D, which provides optional coverage for outpatient prescription drugs, is similarly financed with a combination of premiums for Part D coverage and general government revenue.

In contrast, Medicare Part A is financed mainly by Medicare payroll taxes on the wages of workers (paid by employers and employees) and on earnings of self-employed individuals. These funds are credited to the Part A (also called Hospital Insurance) trust fund from which resources are drawn to cover expenditures for Part A benefits. Because of the way Part A is financed, there’s a risk of it running short of the funds needed to fully pay for Part A benefits; Part B and Part D do not face this risk.

Key factors driving increase for 2026

Part B premiums are based on a share of total projected Part B program costs in both traditional Medicare and Medicare Advantage for a given year. According to CMS, expected spending growth from both an increase in the use of health services and higher Medicare payment rates is driving the rise in the 2026 Part B premium. The spending estimate includes Medicare’s payments to Medicare Advantage plans for their coverage of Part B services. Medicare pays each plan a certain amount per person to cover Part A and Part B benefits, which those plans use in turn to pay hospitals, physicians, and other providers. CMS estimates the portion of its per-person payments to Medicare Advantage plans that account for Part B benefits and includes this spending when determining the Part B premiums.

Looking ahead

For the next five years, 2027 through 2031, the Medicare trustees estimate Part B premiums will grow somewhat more slowly than in 2026, averaging 6.4% a year. Still, as estimated, Medicare’s Part B premiums—like health care costs overall—will continue to grow faster than Social Security COLAs, which the Social Security trustees project will average 2.4 percent a year from 2027 through 2031. Rising premiums and other health care expenses are a significant challenge for many Medicare enrollees. One in four Medicare enrollees spent at least 21% of their income on premiums and other health care costs in 2022, and 1 in 10 spent 39% or more.

With Medicare premiums expected to continue to grow faster than many enrollees’ incomes, more people are likely to find Medicare premiums to be a financial challenge. Policymakers could consider a variety of options to improve affordability of this vital insurance coverage, including those that address rising program costs as well those that directly assist Medicare enrollees.

To help constrain growth in program costs, one approach would be policy mechanisms to constrain Medicare Advantage spending per person, which exceeds what Medicare would spend if the same individuals were in traditional Medicare. Another approach would be to update Medicare payment for outpatient services so that payment is similar regardless of setting (such as physician office or hospital outpatient department), a policy referred to “site-neutral” payment. Other policy options could help more people with limited incomes get financial assistance with Medicare premiums, such as by enrolling in Medicare Savings Programs.