AARP Hearing Center

What began with a $1 payment to her credit card company turned into a loss of $1,000 and months of hassle for Ana Warner.

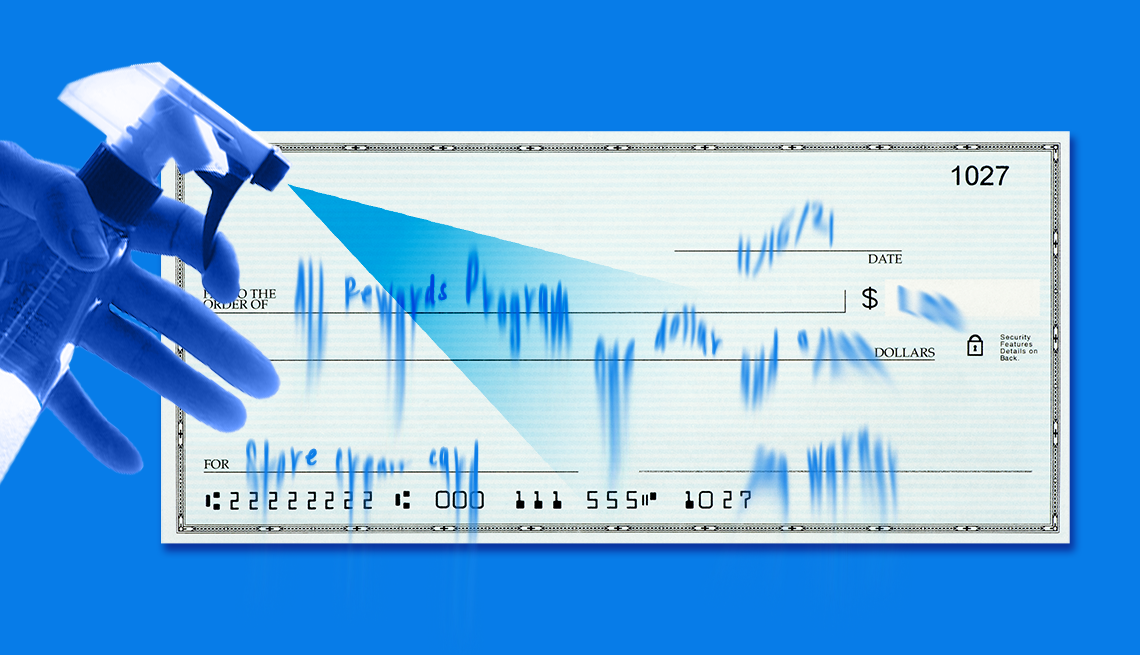

The retired teacher and Illinois resident mailed a check made out for “$1.00” to “ALL Rewards” for a Loft store charge using the company’s ALL Rewards credit card. Somewhere en route from her former apartment complex’s mailbox in Missouri to the credit card company in San Antonio, the check was stolen. The interceptor added a few more zeros to the amount, changed the recipient to “Autumn Dicks” and deposited the check at a Wells Fargo bank in San Francisco.

Still a few days away from receiving her next Social Security check, Warner lost $1,000 from her checking account, which was overdrawn. “I was cleaned out,” she says. Though the vast majority of mail sent through the U.S. Postal Service (USPS) — which handled an average of 340 million pieces of mail and packages per day in 2024 — arrives without incident, mail theft and mail carrier robberies continue to be a problem around the U.S. In June, six defendants were charged in New York with stealing checks from mail boxes, fraudulently cashing millions of dollars worth of checks and selling additional checks on third-party sites for other criminals to cash.

Check theft and assults on postal workers have drawn intense scrutiny from law enforcement. and particularly the U.S. Postal Inspection Service (USPIS). In January, The FBI and the USPIS issued an alert warning that between 2021 and 2023 check fraud due to mail theft had more than doubled. A Government Accountability Office report found that crimes against letter carriers have increased almost every year since 2017. The uptick isn’t fueled by lone thieves and random porch pirates, explains Brendan T. Donahue, former assistant inspector in charge at the USPIS Criminal Investigations Service Center. The most pernicious perpetrators work for “organized criminal groups that are extremely tech savvy and adept at countering law enforcement techniques,” he says.

More From AARP

7 Scams Reported on AARP’s Fraud Watch Network Helpline

From requests for genetic testing to fake arrest warrants, here's how crooks are deceiving consumersBanking Returns to the Post Office

They last cashed checks in 1967

How International Fraud Rings Operate

From phone and email scams to imposter fraud, see how they operate