AARP Hearing Center

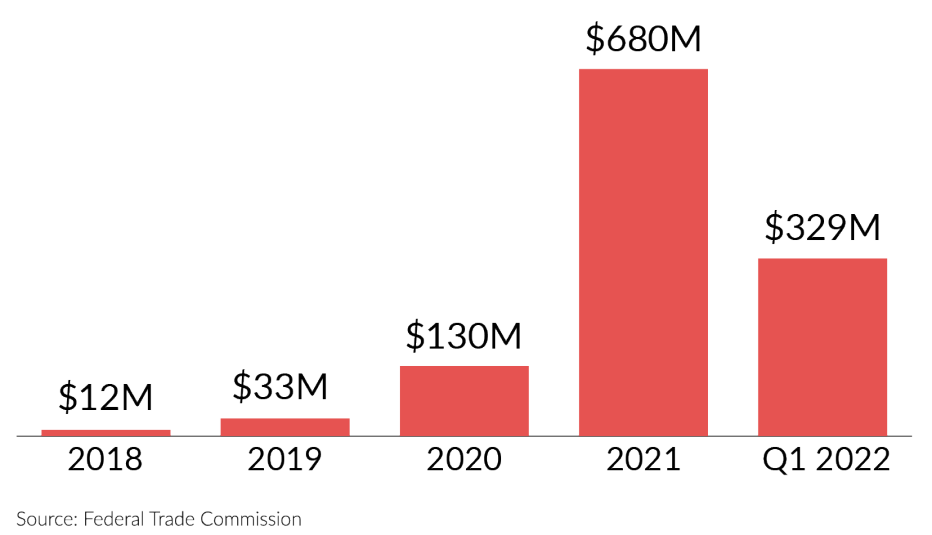

U.S. consumers reported losing more than $1 billion to fraud involving cryptocurrencies from the start of 2021 through March 31, 2022, according to new data from the Federal Trade Commission (FTC).

The cumulative losses from more than 46,000 complaints filed with the watchdog agency account for nearly $1 of every $4 lost to fraud over those 15 months, putting crypto atop the list of scam artists’ favorite ways to get paid.

The skyrocketing costs of crypto fraud, with annual losses increasing more than 20 times over in the last three years, suggest criminals are cashing in on virtual money’s growing mainstream prominence, the FTC says, with Bitcoin ATMs cropping up at supermarkets and commercials for crypto trading platforms taking center stage in Super Bowl advertising.

Reported Losses to Cryptocurrency Fraud

Consumer losses from crypto-linked investment fraud, romance scams and other cons jumped from $33 million in 2019 to $680 million last year, with another $329 million tallied in the first quarter of 2022, the FTC reports. The median loss in crypto scams is $2,600, compared to $1,000 across all fraud types.

LIMITED TIME OFFER Memorial Day Sale! Join AARP for just $11 per year with a 5-year membership Join now and get a FREE gift. Expires 6/4

While people ages 20 to 49 were three times as likely as older adults to report losing crypto to a con artist, the amounts lost rise steeply with age, according to the FTC — from a median of $1,600 for someone in their 20s to more than $8,000 for victims age 60 and older.

Social media and crypto are a particularly “combustible combination,” the agency says, with nearly half of people who lost money in a crypto con reporting that it started with an ad, post or message on a social network, most commonly Instagram or Facebook.