AARP Hearing Center

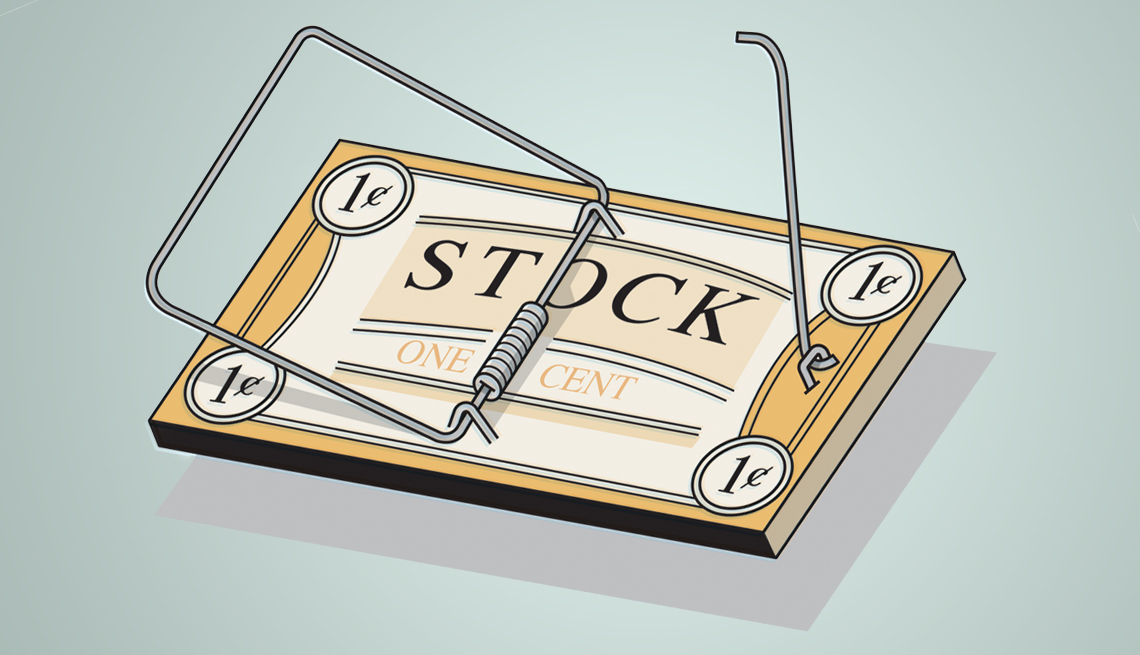

Remember penny stock scams? The investment brokers who ripped off thousands of hapless investors in the 1990s by selling them worthless stocks are still around. And experts say they are more cunning now than ever.

Though regulators barred scores of penny stockbrokers from the securities industry and dozens were imprisoned, fraudulent stock sellers are still at work — and they frequently target seniors because of their accumulated wealth. “It's the Willy Sutton principle. Why did he rob banks? ‘That's where the money is,’ “ says Lori J. Schock, director of investor education and advocacy at the Securities and Exchange Commission (SEC). About 30 percent of microcap fraud victims are older than 65, notes Terrence Bohan, vice president of investigations at industry regulator FINRA. (A microcap company has very little capitalization, or value.)

The objective of shady sellers is the same as always — to get you to buy stakes in these companies by convincing you their value is about to soar. But the stocks often have virtually no value, and there is no active trading market for some of the shares. Sometimes there's a real company behind the stocks, though it is small and of uncertain future; other times, the company is just a shell created solely to sell bogus shares.