AARP Hearing Center

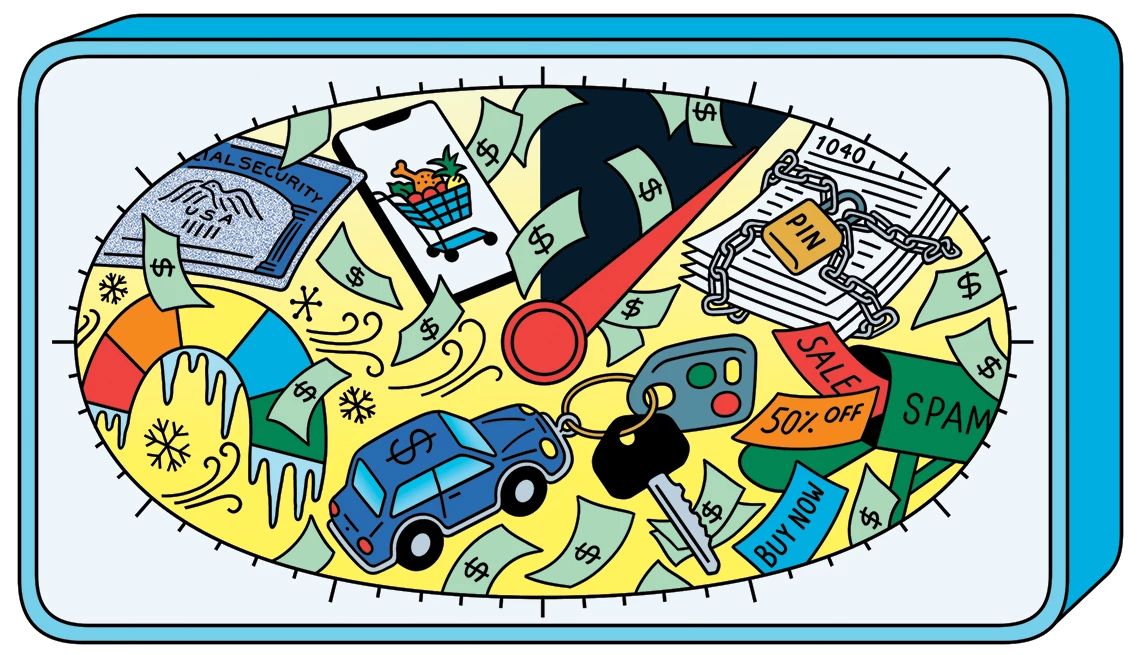

Have 60 minutes to kill? You could spend it watching TV or playing games on your smartphone. Or you could spend it saving money, by ticking some easy but important financial tasks off your to-do list.

Get one — or more — of these 10 smart money moves accomplished on your next lunch hour.

1. Check your credit report

Unfortunately, credit report errors are widespread. A recent survey from Consumer Reports and WorkMoney, a nonprofit group that aims to help people find savings, showed nearly half of respondents (44 percent) who checked their credit reports found at least one error.

A credit report error, such as the wrong name on a bank account, an incorrect payment date or a bill you paid that's been marked as outstanding, could be dragging down your credit score. Checking your credit report regularly can also help you spot when a bad actor uses your personal information to open a fraudulent account.

“Look for unfamiliar accounts, incorrect personal details or unauthorized inquiries,” recommends Bruce McClary, a spokesman for the National Foundation for Credit Counseling, an association of nonprofit credit counseling agencies.

You can request a free copy of your credit report once a week from each of the three major credit bureaus — Equifax, Experian and TransUnion — at AnnualCreditReport.com. You can also obtain reports by calling 877-322-8228 or downloading and filling out a request form and mailing it to the address listed at the top.

2. Put your credit on ice

Freezing your credit can help protect you from scammers and hackers. This simple move prevents the credit bureaus from releasing your financial information to third parties, making it harder for identity thieves to open new accounts in your name.

“Freezing your credit is an easy and effective way to reduce the risk of identity theft, which is especially important to keep in mind as we grow older,” says McClary. “As Americans grow older, they become increasingly attractive targets for criminals who count on their potential victims to be less tech-savvy and more likely to trust what they say.”

You can request a freeze for free online or by phone in just a few minutes — but you’ll have to do a separate freeze with each of the three credit bureaus. Once you do so, the credit agency must restrict access to your credit within one business day. Temporarily thawing a security freeze so that you can open a legitimate account is simple, too — and if you submit the request online or by phone, the company has to lift the freeze within one hour.

3. Sign up for an IRS identity protection PIN

People ages 65 to 74 are at greater risk of large financial losses from tax scams, a 2025 survey by McAfee found. An identity protection PIN, or IP PIN, can help protect your taxpayer data from cybercriminals.

To obtain a PIN, register for an account with the IRS. Once you verify your identity, you’ll receive a six-digit number to use when filing your taxes annually. You’ll get a new IP PIN each year. “This will provide taxpayers with the peace of mind that come tax time, no one else is claiming a refund in their name,” says Carl Breedlove, a lead tax research analyst at The Tax Institute at H&R Block.

More From AARP

I Think Tipping Has Gone Too Far. Am I a Total Cheapskate?

Nearly half of baby boomers say U.S. tipping culture has spiraled out of control

10 Products That May Get More Expensive Due to Tariffs

Watch out for higher prices for avocados, smartphones and more, economists warn

7 Home Maintenance Tasks That Can Pay for Themselves

Take these steps to catch problems early, cut your utility bills and prolong the life of your home's HVAC system