AARP Hearing Center

When Virginia Barber and Tom Ring first met three decades ago, they were colleagues sharing office space at Palmer College of Chiropractic in Davenport, Iowa, where they were both on faculty. But their bond deepened into love after Ring’s marriage ended.

Barber and Ring, now 65 and 77, have weathered more than most. Barber, a two-time cancer survivor with a complicated medical history, and Ring, who’s faced prostate and bladder cancer, know better than to take anything for granted. That’s why, after 30 years together, they’re again sitting down with their lawyer to update their estate plans — not because something happened, but because they know something eventually will.

“We’re not married, and that’s intentional,” Barber says. “It protects us financially if one of us ends up needing long-term care. But it also means everything has to be in writing, because love isn’t recognized on a hospital intake form.”

Their decades-long relationship is part love story, part cautionary tale, and entirely rooted in pragmatism. Whether navigating bitter divorces, family tensions or the realities of aging, they’ve learned that the greatest gift partners can give each other besides romance is legal protection.

Why planning is essential

Unlike married couples, unmarried partners are not legally recognized as next of kin. Without written directives, no matter how long you have been together or how committed you are, your partner’s rights and ability to make decisions are usually not legally recognized during critical times, potentially touching off legal complications, family disputes and your wishes not being honored. This issue affects a substantial portion of the U.S. population. A 2022 report estimates that about 20 million people live with an unmarried partner.

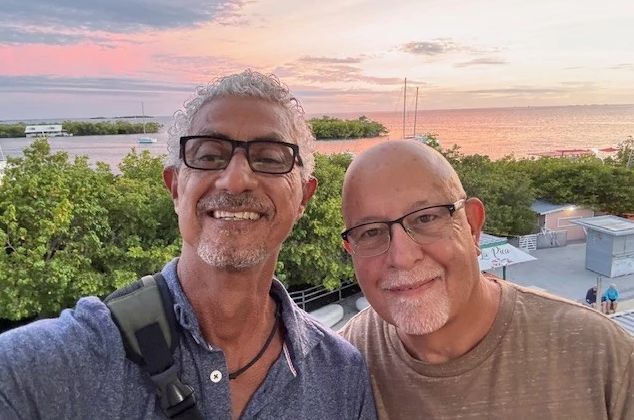

When Mark Forgetta, 73, and Angel Caro, 66, met nearly 48 years ago, same-sex marriage was not yet recognized, so their only option was an unmarried partnership. Recognizing their commitment and desire to care for each other long-term, they proactively worked with an attorney to establish the necessary legal documents.

“As an unmarried couple years ago, it was critical to have legal documents in place. We have since had a commitment ceremony, but we always wanted to ensure our family, the hospital and everyone knew who our spokesperson was and what our care preferences were through advance directives,” says Forgetta.

If your unmarried partner becomes your caregiver, it’s very important to have legal documents in place to ensure that they can help you without barriers and make decisions that align with your wishes while also protecting their own rights.

“People don’t want to think about mortality, but the reality is, one accident can leave a lifelong partner with nothing,” says Gordon Morris, president of Unmarried Equality, a Los Angeles-based nonprofit that advocates for equality for unmarried people.

More From AARP

Hidden Costs in Assisted Living

Explore how to avoid surprise fees in care facilities

Navigating Family Tensions Over Care Costs

Their Dad left her money in a trust, but they worry they will have no inheritance left

Family Caregiving Doesn't End When the Recipient Dies

These steps can lessen the workload and make the process easier