AARP Hearing Center

Get the latest news, expert claiming advice, and answers to the most frequently asked questions about Social Security benefits

Tools & Resources

Frequently Asked Questions

Find clear answers on how Social Security works and how your benefits are calculated. Get expert advice on maximizing your monthly check, filing a disability claim and pursuing your rights as a divorced spouse or survivor.

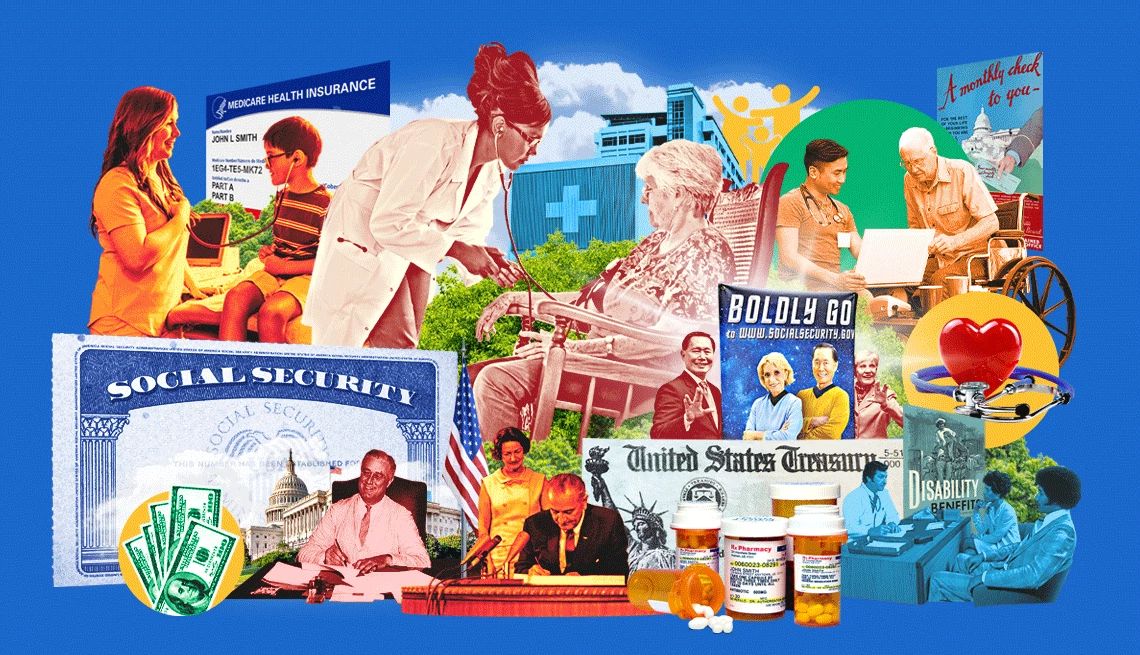

Your retirement benefit is based on your lifetime earnings in work in which you paid Social Security taxes. Higher income translates to a bigger benefit (up to a point — more on that below). The amount you are entitled to collect is modified by other factors, most crucially the age at which you claim benefits.

Yes. You don't have to hand in your notice when you start getting retirement benefits.

But continuing to draw income from work might reduce the amount of your benefit if you claim Social Security before you reach full retirement age (FRA), the age when you qualify to collect 100 percent of the benefit calculated from your earnings history.

If your total income is more than $25,000 for an individual or $32,000 for a married couple filing jointly, you must pay federal income taxes on your Social Security benefits. Below those thresholds, your benefits are not taxed. That applies to spousal benefits, survivor benefits and Social Security Disability Insurance (SSDI) as well as to retirement benefits.

When a Social Security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. About 3.8 million widows and widowers, including some who were divorced from late beneficiaries, were receiving survivor benefits as of August 2024.

Need more help? Ask an Expert

Social Security News

Join AARP’s Fight to Protect Social Security

Sign up to be an AARP activist and tell lawmakers to protect and save the program

How AARP Is Fighting For You

NEW SSA LEADERSHIP WILL IMPACT GENERATIONS TO COME

Your voice matters as the Senate selects a new commissioner

AARP URGES FIXES IN SOCIAL SECURITY CUSTOMER SERVICE

Website crashes, lenghthy wait times are unacceptable

TELL CONGRESS IT NEEDS TO PROTECT YOUR EARNED BENEFITS

Tell your representative that Social Security must be saved

AARP IN YOUR STATE

Find AARP offices in your State and News, Events and Programs affecting retirement, health care and more.

.jpg?crop=true&anchor=0,0&q=80&color=ffffffff&u=5jvmea&w=1140&h=655)