AARP Hearing Center

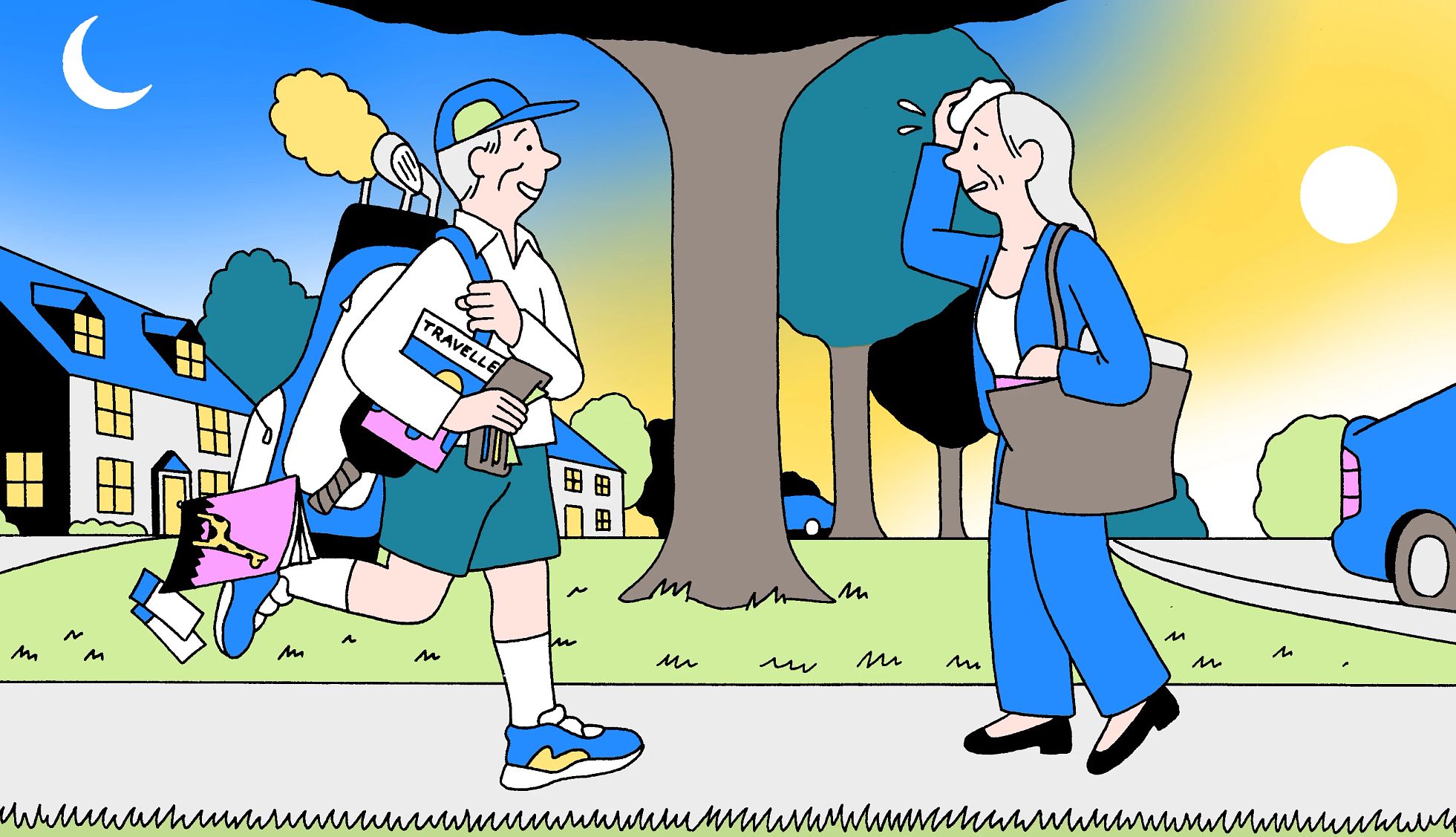

It’s a common dream of togetherness for older spouses: Nearly two-thirds of still-working couples expect to retire at the same time or within a year of each other, according to an April 2024 report from Ameriprise Financial.

But those expectations rarely meet reality. The Ameriprise survey found that only 11 percent of retired couples leave their careers simultaneously, and 62 percent retire more than a year apart.

“Social norms are changing, spouses are becoming more independent than in the past, and sometimes life gets in the way of our plans,” says Sue Mintz, a certified retirement transition coach in Dallas. “The old goal of retiring together just doesn’t work for a lot of people anymore.”

Whether it happens by choice or circumstances beyond your control, such as a layoff or health issue, retiring at different times comes with challenges — and opportunities. Couples need to reimagine longstanding roles and routines, adjust to the loss of one income, and find new purpose and ways of being together.

If you and your spouse are navigating this sometimes-rocky terrain, retirement advisers and couples who’ve been through it recommend these steps to smooth the way.

1. Expect an adjustment period

On the first day of her retirement in 2017, Pat Link gave her husband’s closet a top-to-bottom makeover — jeans and casual clothes in one place, work clothes in another, dress shirts arranged by color. When Gregg Link got home from work, he told his wife the new system would be a big help when he packed for business trips. What he thought to himself was was: This woman really needs something to do.

The Links laugh at the memory now, but they say it reflects the challenges they faced as a couple after Pat, now 73, left her job as a process improvement manager at a health services company.

“It was a bumpy road in the beginning because I was struggling to find my purpose,” she says. “Also, more of your personalities, preferences and differences start to surface once you retire because you have more time to explore them.”

In the absence of regular workday hours, Pat’s night owl tendencies bubbled up, while Gregg, 65, is a morning person. She began socializing more with friends and throwing herself into volunteer work, including founding a community nonprofit focused on beautification projects in Farmers Branch, Texas, where the couple live. They began going to bed and getting up at different times, relying on a shared calendar to keep track of each other’s schedules.

“We give each other grace to be separate, to be on different paths at different times in our lives — to not do everything together,” Pat says.

Gregg, a senior director of product management for a tile manufacturer, plans to retire in the next few years. He says it’s important for the working spouse to support their partner as they’re finding their way. “There needs to be a lot of conversation and communication about what your lives are going to look like,” he says.

Mintz agrees that talking about your expectations is key.

“Roles and routines are going to change. Having a shared vision of what that’s going to look like helps defuse tension,” she says. “The retired spouse may be looking for the working spouse to come home earlier, or the working spouse expects the partner to do more cooking and laundry. All of that should be discussed and negotiated to avoid conflicts.”

More From AARP

Are You Emotionally Ready for Retirement?

Just as it's important to create a plan for our finances, we should create a plan for our emotional fulfillment. Here's what the experts recommend

5 Social Security Claiming Options for Married Couples

Age, health, finances key to building benefit strategy7 Keys to Pretirement Planning With Your Partner

Check out seven questions you and your partner should consider to reach your goals.