AARP Hearing Center

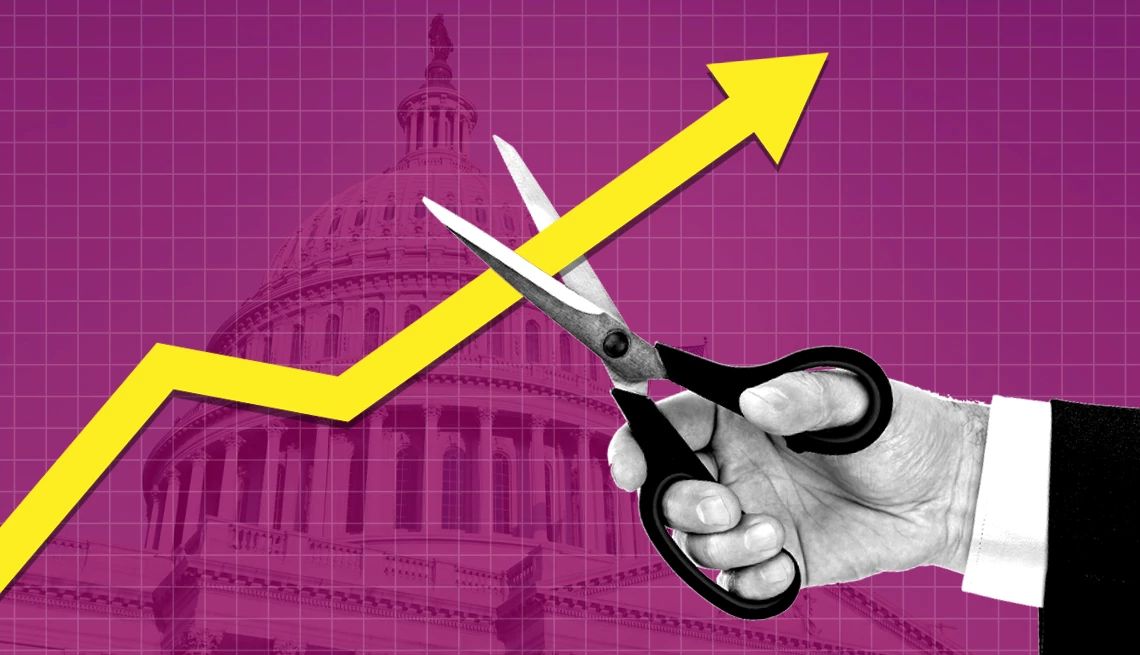

After holding interest rates steady for most of the year despite pressure from President Donald Trump to cut them, the Federal Reserve is lowering its benchmark rate.

The central bank’s Federal Open Market Committee agreed at its Sept. 17 meeting to reduce the federal funds rate by a quarter percentage point to a target range of 4 to 4.25 percent. The last time the target federal funds rate was this low was December 2022.

Since returning to office in January, Trump has been calling for aggressive rate cuts. But Fed policymakers had kept the federal funds rate unchanged at a target range of 4.25 to 4.5 percent because of concerns about inflation and the impact of tariffs on consumer prices.

Although inflation remains above the Fed’s target of 2 percent, policymakers appear to have lowered rates in response to recent employment data showing the labor market is cooling, says Sebastián Leguizamón, director of the Center of Applied Economics at Western Kentucky University.

The rate cut might be welcome news for some retirees, but not all older adults will benefit from it. “The effect is mixed and very portfolio-specific,” Leguizamón says. “So rather than cheering or booing, it’s better to think in terms of trade-offs that depend on debt levels and how a retiree’s assets are allocated.”

Here’s what to know about how retirees win and lose when interest rates fall.

Winners

Borrowers

The federal funds rate is the interest rate that financial institutions charge each other when they lend reserves overnight. Changes to this rate can have a trickle-down effect on consumers by affecting some of the interest rates they pay.

“The winners are borrowers,” says Anqi Chen, associate director of savings and household finance at the Center for Retirement Research at Boston College. But not all debt will be impacted the same way by the Fed’s rate cut.

More From AARP

Your Secret Tax Weapon for Saving for Retirement

A health savings account can provide a source of tax-free cash

99 Great Ways to Save 2025 Edition

Stretch your dollars — and cut costs on groceries, travel, entertainment and more

What to Stop Buying Now If You’re Retired

It may be time to reconsider all the stuff you’ve been spending money on for years.