AARP Hearing Center

The client’s tax preparation bill should have been around $200. Instead, Freeport, New York, tax preparer Damaris Beltre charged her $2,200 in fees for a fraudulent return. The problem with the scheme: Beltre’s client was an undercover federal agent.

The sting appeared as part of a 42-count federal indictment unveiled by U.S. attorneys on March 12, 2025. The charges ranged from aiding and assisting in preparing false tax returns to aggravated identity theft for Beltre’s role in “allegedly preparing hundreds of false individual tax returns,” according to the Internal Revenue Service (IRS). The IRS said Beltre frequently took a percentage of clients’ refunds and filed returns “claiming refunds on behalf of former clients without their knowledge.”

The case is a warning to taxpayers. As the tax deadline approaches, scammers are eager to steal your money and personal information, whether posing as tax preparers or claiming to work for the IRS. In a March survey from LifeLock, 28 percent of participants said they’d been involved in a tax-related scam attempt at some point in their lives. Of those, 42 percent said the scams involved an IRS impersonator.

Criminals may also file tax returns in others’ names; during the 2025 tax season through the end of April, the IRS suspected potential identity fraud in more than 2.4 million tax returns with refunds totaling $23 billion and suspended their processing pending identity verification, according to the Treasury Inspector General for Tax Administration. And we’re all potential targets for these scams.

Types of tax scams

In February 2025, the IRS issued its “Dirty Dozen” list of tax scams. Topping the list:

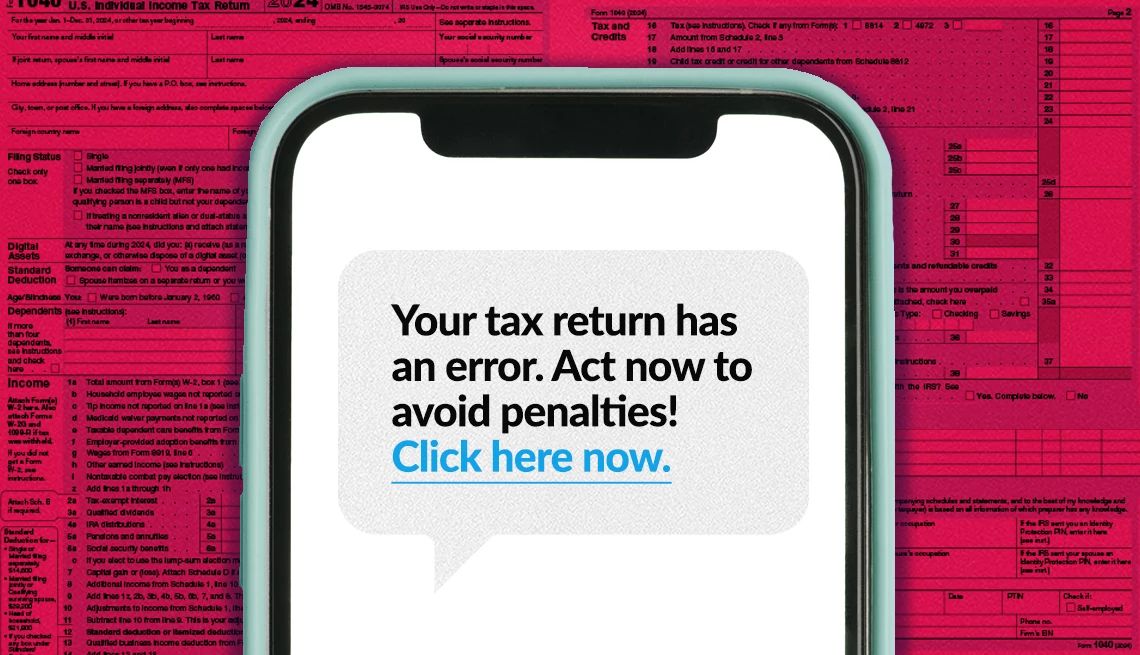

Impersonation scams. Phishing messages from criminals posing as entities such as the IRS, state tax agencies, tax preparers, and tax software companies. The emails, texts, and phone calls often lure victims with promises of big refunds or threats of criminal tax fraud charges.

Tax prep scams. Other scams cited in the IRS list include shady tax agents. Some may pledge to provide large refunds and then charge a fee based on the size of the refund. The IRS notes that a significant red flag is when the tax preparer is unwilling to sign the return. “These individuals often promise inflated refunds and may manipulate tax filings, leaving the taxpayer liable for penalties and interest,” says Chad D. Cummings, CEO of Cummings & Cummings Law. “Some fraudulent tax preparers offer services without signing returns or including their IRS Preparer Tax Identification Number (PTIN), which is required by federal law.” (For more, read this story on “10 Signs Your Tax Preparer is a Fraud”).

More From AARP

Get Free Help Filing Taxes

Our IRS-certified volunteers help older adults get the refunds and credits they've earned.

'Pig Butchering’ Scams Lure Victims Into Fake Investments

The terrible term describes a key tactic for criminals perpetrating investment and romance scams

What to Know About Cryptocurrency ATMs

Kiosks are everywhere, helping scammers steal cash from victims