AARP Hearing Center

The Internal Revenue Service (IRS) issued about 160 million stimulus checks to eligible Americans for the first round of economic impact payments (EIP) that began in April. Millions more payments, dubbed EIP 2, started going out in late December for the second round of stimulus. Nevertheless, some people never got their first-round stimulus checks, while others didn't receive the full amount to which they were entitled. The same will be true for the second round of stimulus payments.

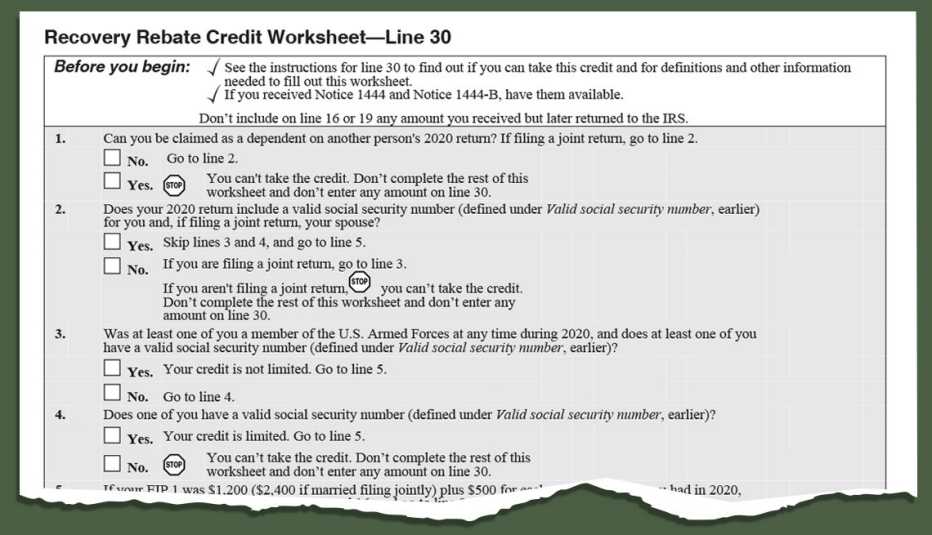

If you didn't receive money from the first or second round of stimulus payments — or you didn't get the full amount you should have — don't give up. You'll need to file the standard 1040 federal tax return form, or the 1040-SR tax return for people 65 or older, to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund.

Why you may be missing stimulus money

The first round of stimulus checks, mandated by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, was signed into law in March 2020. The CARES Act gave a maximum $1,200 per person and $500 per eligible dependent child under 17. Payments were limited by 2019 or 2018 income as reported on federal income tax forms. Individuals who had more than $75,000 in adjusted gross income had their stimulus check reduced by $5 for every $100 of income, and the same was true for married couples filing jointly with income above $150,000. Individuals who earned more than $99,000 and couples who earned more than $198,000 jointly did not receive checks.

The second round of stimulus checks gives a maximum $600 per eligible person and dependent child. Married couples who filed jointly in 2019 receive $1,200 total ($600 apiece). Families get an additional $600 for each eligible dependent child under 17. The income limits are the same for the second round of stimulus payments as they were for the first, though the phaseout amounts are lower since the maximum payment is $600 vs. $1,200 during the first round. Individuals who earned more than $87,000 and couples who earned more than $174,000 jointly won't receive second-round checks. The deadline for the IRS to issue second-round payments is Jan. 15.