AARP Hearing Center

Key takeaways

- Programs help when life throws you a curveball.

- Idea of federal pension was born after Civil War.

- Because health care is job based, retirees had been forgotten.

- Tens of millions participate. Trust funds need shoring up.

- Now is time to save them. In 1980s, bipartisanship worked.

After a long career as an office manager in St. Louis, Debbie Haupt retired at age 60 so she could provide full-time care for her ailing husband. “I had been planning to work at least until 68, maybe 70,” she says, “but Parkinson’s had other ideas.”

But the Haupts had a problem: They hadn’t built up much of a retirement fund. “My 401(k) was tiny,” she says, laughing. “If I had eaten nothing but dog food, it would have lasted less than three years.”

Fortunately, as an older American, Haupt could rely on another source of sustenance.

“Social Security has been my lifeline,” she says. “I paid into it all those years, and when I badly needed the help, it was there.”

Join Our Fight to Protect Social Security

You’ve worked hard and paid into Social Security with every paycheck. Here’s what you can do to help keep Social Security strong:

- Add your name and pledge to protect Social Security.

- Find out how AARP is fighting to keep Social Security strong.

- Get expert advice on Social Security benefits and answers to common questions.

- AARP is your fierce defender on the issues that matter to people 50-plus. Become a member or renew your membership today.

She began taking her benefit at 62, the earliest age of eligibility. Her husband was already drawing Social Security by then. When she reached 65, Haupt, now 71, qualified for another federal benefit benefit that marked its 60th anniversary July 30.

“Medicare is the best health insurance I ever had,” she says. “The deductibles I had when I was on private insurance — I could never pay that much now. But Medicare is a godsend.”

In rural Virginia, Suzanne Leedy, 80, has a similar story.

“My wife was a nurse, and I was in real estate,” she says. “So there was really no retirement fund for either of us, even though we worked for years. But Social Security has made all the difference for us. Our current situation is we can pay the bills and keep our house. Let’s hope it lasts.”

Somewhere, Franklin D. Roosevelt and Lyndon B. Johnson must be smiling, knowing the programs they fought hard to establish have made such an important contribution to the lives of Haupt, Leedy and tens of millions of other Americans.

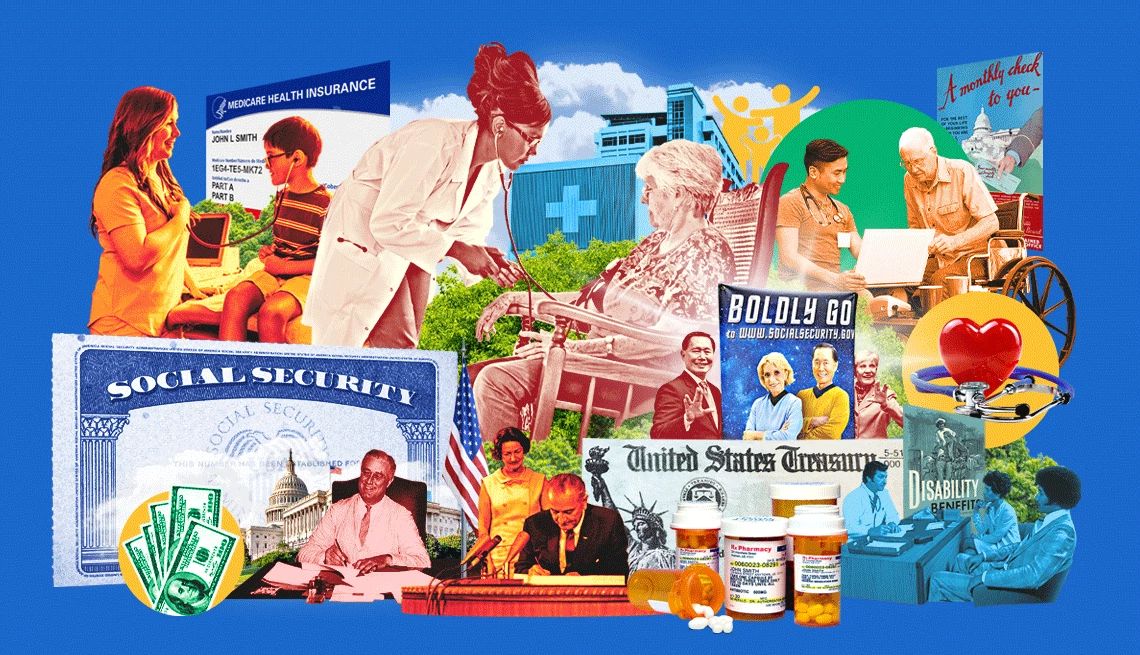

Ninety years ago, on Aug. 14, 1935, Roosevelt signed the Social Security Act. Sixty years ago, on July 30, 1965, Johnson — after months of arguing, arm-twisting and horse-trading in Congress — signed the law creating Medicare.

So it seems fitting to commemorate — indeed, to celebrate — two historic initiatives that have insured the American people against poverty and medical bankruptcy in the late innings of life.

— James Chappel, Duke University Aging Center

“Together, Social Security and Medicare transformed the meaning and experience of old age in the United States,” says James Chappel, a historian at Duke University’s Aging Center. “Thanks to Social Security and Medicare, these older people are far less impoverished and enjoy far better health than was imaginable a century ago.”

As Chappel points out in his 2024 book Golden Years, people 65 and older aren’t the only beneficiaries of these so-called old-age programs. Social Security and Medicare serve younger generations as well, sparing them from the financial challenges of supporting older family members and friends.

“I know my kids would help if they had to, but I don’t want to make them do it,” says Donna Dalrymple, 68, an AARP member in New Hampshire who is facing expensive treatments for blood cancer. “With Medicare [Part] D, I can afford to control this cancer. I don’t have to impose those costs on my family.”

In that sense, Social Security “enables us to have freedom,” says Janice Ferebee, 69, of Washington, D.C. “To be able to age with dignity and not have to rely on friends or family for support — Social Security has been very important just for that. It’s essential for me.”

Medicare, Social Security were years in the making

Providing support for older adults was a decades-long process in the United States. The first U.S. federal pension plan was created for Civil War veterans.

The obvious benefits to those men prompted various organizations to campaign for a broader program of financial support for people after their working years ended. Groups like the Fraternal Order of Eagles, which counted Franklin D. Roosevelt among its members, and the Townsend Plan with local affiliates in almost every congressional district mounted campaigns for a national pension system.

Beginning in 1929, the widespread pain and poverty of the Great Depression made the need even greater. When Roosevelt entered the White House in 1933, he directed his secretary of labor, Frances Perkins — the first woman to serve in a cabinet — to devise a plan.

More From AARP

AARP Wants to Stop Medicare Advantage Upcoding

Billing method allows private plans to boost their revenue

AARP to Congress: Protect Rx Negotiations

Pharmaceutical companies are trying to make it harder to lower prescription costs

Medicare Expands Drug Price Negotiations

Negotiations aim to ease costs for pricey Medicare drugs