When It Comes to Social Security, 70 is the New 65!

Suze Orman explains why delaying benefits may be right for you

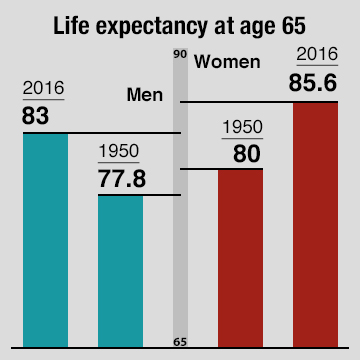

En español | If you’re reading this story, you’re likely at least 50 years young. Yes, young — and I don’t mean it in the cutesy way that people sometimes talk about aging. I mean it in that living well into your 80s and beyond is no longer some rare event. You may have a lot of good years ahead of you.

So if you have even the slightest concern about your financial security in retirement, I want you to think of age 70 as the new 65, especially where Social Security is concerned.

The right way to think about Social Security

You should hardly ever start taking Social Security at age 62, which is when you can first elect to receive your retirement benefit. That’s especially true if you’re single or the higher earner in your marriage. If you start taking it at 62, your monthly payout will be 25 to 30 percent less than what you would get by waiting until your full retirement age (66 or 67, depending on the year you were born). Plus, if you take Social Security early and you die before your spouse, his or her survivors benefit will be lower, too.

A better plan is if you wait until 70. Every year you wait between your normal retirement age and 70, Social Security will add a guaranteed 8 percent to your eventual monthly payout.

I want to make sure you didn’t glide by what I just said: 8 percent. Guaranteed. Right now you’re lucky to find a bank account that pays 2 percent annually. The deal you get from Social Security if you wait is one of the best risk-free ways to boost your later-life income.

Now I know many of you are howling: “But, Suze, I worked so hard. I want to get what’s mine. What if I end up dying young, before I collect my Social Security?”

But let me ask you to consider the consequences of not dying young. If you retire in your early 60s, will your savings be able to support you for another 30 years?

It’s not the first 10 or 15 years of retirement that concern me — it’s how you’ll fare if your retirement stretches another 10 or 15 years beyond that.

And that’s where delaying Social Security can be the most precious tool in your retirement planning kit. Delaying your Social Security start date until age 70 entitles you to a monthly payout that’s more than 75 percent higher than your age-62 benefit. That’s a whole lot more money to support a much older you.

How to make delaying work for you

To delay receiving Social Security until you’re 70, you could start living off your 401(k) or IRA savings in your 60s. But please be careful. The longer you wait to use this retirement money, the more years it has to grow and the fewer years it will be needed to support you. If you tap your retirement savings in your 60s, your goal should be to keep the withdrawals as low as possible.

That brings us to the next element of 70 as the new 65: working longer. A new study estimates that every three to six months you extend your work — and delay taking Social Security — is the equivalent of having saved one more percentage point in your retirement accounts over 30 years.

I want to be clear here: Saving more is also great. But delaying when you stop working and when you start living off your savings can really shore up your retirement security.

If you’re in a job you enjoy, now is the time to think through what skills you might need to add, or polish, to make you a valued employee through your 60s.

Or if you can’t imagine staying in your current job, or working at your current workaholic pace, start thinking about how to move to a less demanding position that brings in enough money in your 60s to cover your living costs — or at least most of them.

Even if you must start tapping other retirement assets in your 60s, I’m not budging on Social Security. If you’re in good health, I really want you to try to delay taking Social Security at least until your full retirement age, and ideally all the way to 70.

I’ll bet that if you’re serious about wanting a less stressful retirement, you could find some part-time work in your 60s that would be on par with your monthly benefit if you took Social Security early. For instance, if your age-62 benefit is $1,200, your goal might be to find a job that pays that much a month. That’s not necessarily a full-time grind, right? Consider being an Uber or Lyft driver, or dog walking. Or maybe working part time at your old job, if that’s a possibility. A little more work in your 60s can go a long way.