Staying Fit

While saving for retirement can be a difficult path for anyone, Black Americans face unique challenges and often a bumpy road.

Not only are Black Americans less likely than whites to have a workplace retirement plan, but lower rates of homeownership and less generational wealth in the Black community can make it more difficult for Black families to save.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

The impact of those financial realities are far-reaching: Black Americans generally have less than half the retirement savings of white Americans, according to a 2022 study by the TIAA Institute.

Yet despite the increased challenges, there is no single retirement experience in the Black community. Some families leverage 401(k) savings while others cobble together income from multiple jobs. Many plan to augment their retirement savings with part-time work or other streams of income.

The road to retirement has its fair share of obstacles for everyone. Here, three Black families from different ends of the economic spectrum meet real-world challenges with practical solutions and plenty of resilience and hope.

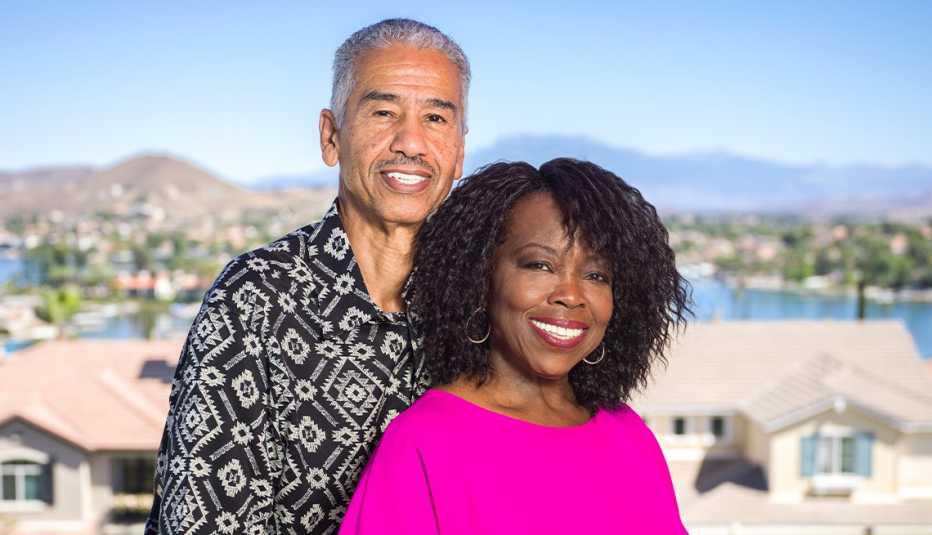

Andre and Sheila Cuffy: Making the best of a late start

Some people start putting aside money in a retirement plan in their 20s and 30s, but Andre and Sheila Cuffy of Fort Wayne, Indiana, didn’t have that luxury.

While growing up in Trinidad, Andre always dreamt of having a big family, and when he met Sheila he got his wish: The two raised nine loving children.

But the day-to-day costs of feeding, clothing and providing for nine children meant there was little left at the end of the month to put away for retirement. Sheila wanted to be home during the days to care for the children when they were young, so she worked part-time midnight shifts as a medical lab technician. However, that flexibility came at a cost: The part-time work provided no retirement benefits.

Andre, 62, worked in construction. However, during the winters, work would dry up so “we had to save for the four or five months when you know you’re going to be out of work,” he says. That meant there was not much money coming from his checks that could be set aside for retirement either. Then he got hurt on the job and had to go on disability, which made money even tighter.

Today, the couple do what they can to catch up. After going back to school to get her master’s and Ph.D., Sheila, now 67, has been working full time as an assistant professor of communication at Galen College of Nursing based in Louisville, Kentucky, for the last three years. This time she has a retirement plan that she contributes to generously. “We increase my 401(k) amount every year,” she says. “When I receive my merit increase, I increase my 401(k) percentage.”

Having raised the family they always wanted, the Cuffys are OK with living frugally if they have to. “It’s the sacrifices you have to make for your family,” Sheila says.

But she sometimes feels a sense of anxiety. “The thing that gives you that stress is looking at the amount that everyone says that you need to have,” she says. “If you listen to all of that, it scares you because you’re like, I’m not going to be able to reach that.”

Also, retirement is not their only major financial goal. The couple still want to put aside money for college for their youngest child, 16-year-old Nyasia. “All the other kids are past that stage, but she isn’t. So that also makes it difficult, you know?” Sheila says.

The idea of retirement sounds nice, but the Cuffys know that for them it’s just not practical in the near future. “At 67, you stop to think, Well, when do I want to retire?” Sheila says. “And then I started adding up the fact that Nyasia won’t be 25 for the next nine years. So it’s like, OK, do I have to work until then so that I can keep her insured?”

More From AARP

6 Things I Wish Someone Had Told Me Before I Retired

Recent retiree shares lessons learned about money, time

5 Ways Sole Proprietors Can Build Retirement Savings

Explore IRAs, 401(k)s that cater to the self-employed

Are IRAs, 401(k)s Safe From Financial Failures?

Patchwork of regulators protect nest egg investments