Staying Fit

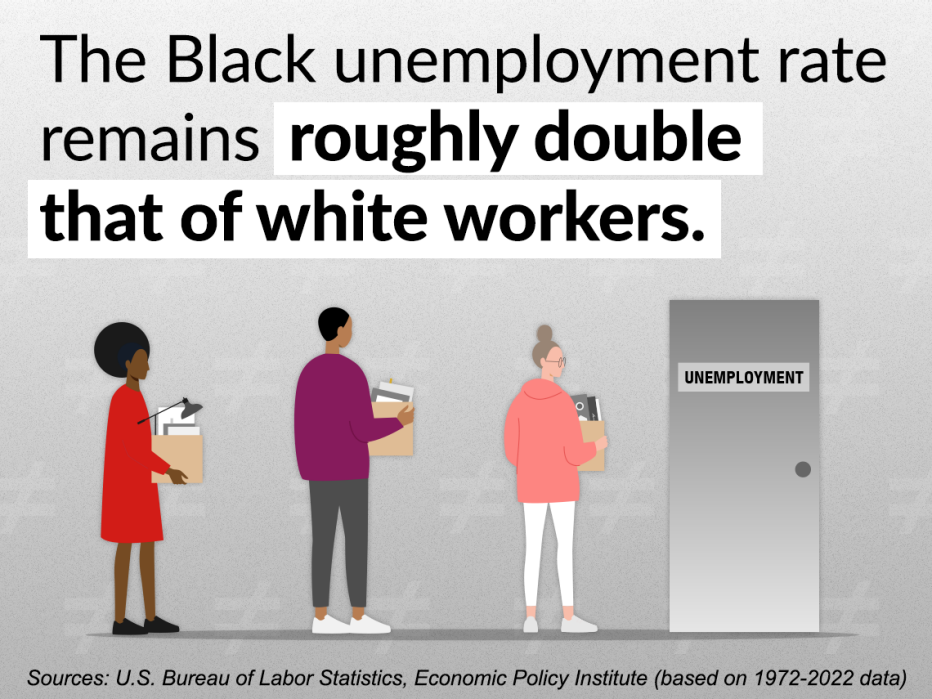

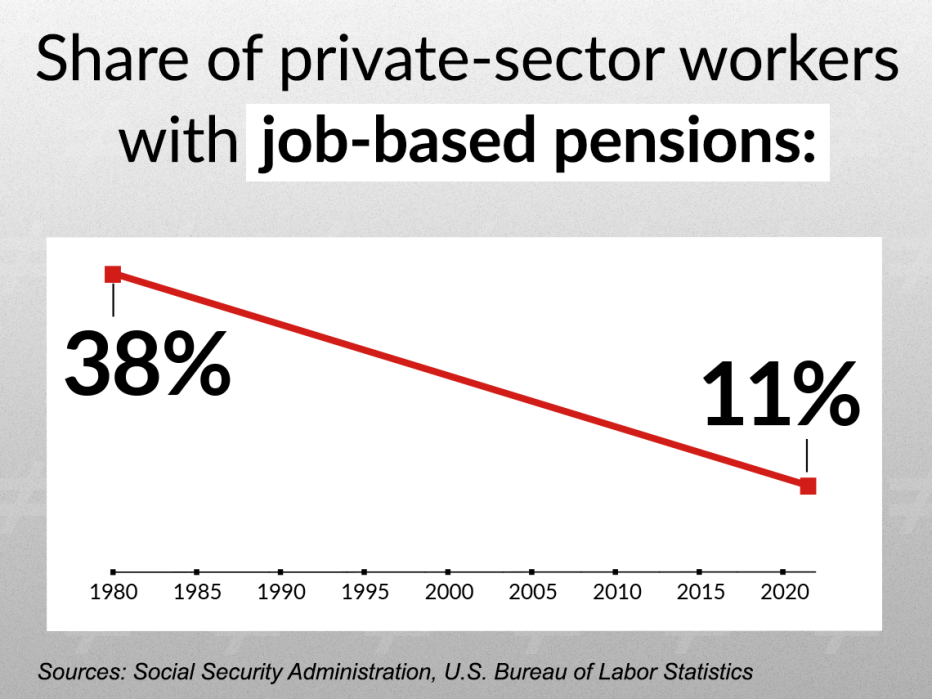

Building a financially secure retirement is an uphill climb for many Americans, but it’s especially steep if you are Black.

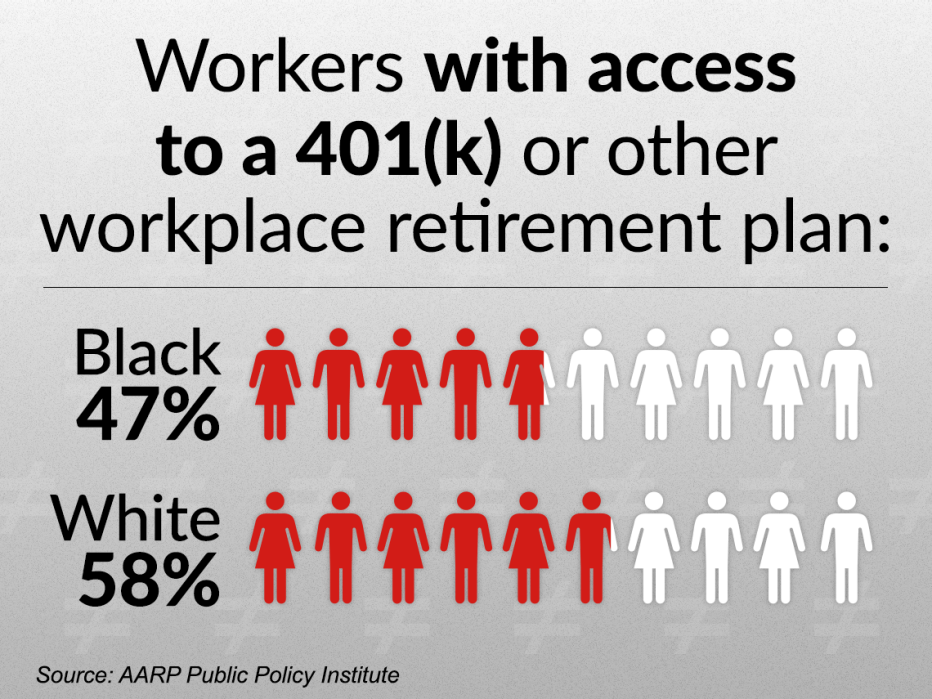

The numbers paint a stark picture. Black workers ages 51 to 64 are the least likely among all racial and ethnic groups to have a retirement account, according to a July 2023 report from the U.S. Government Accountability Office. When they do have one, their median balance is far below that of similarly aged white adults across all income levels.

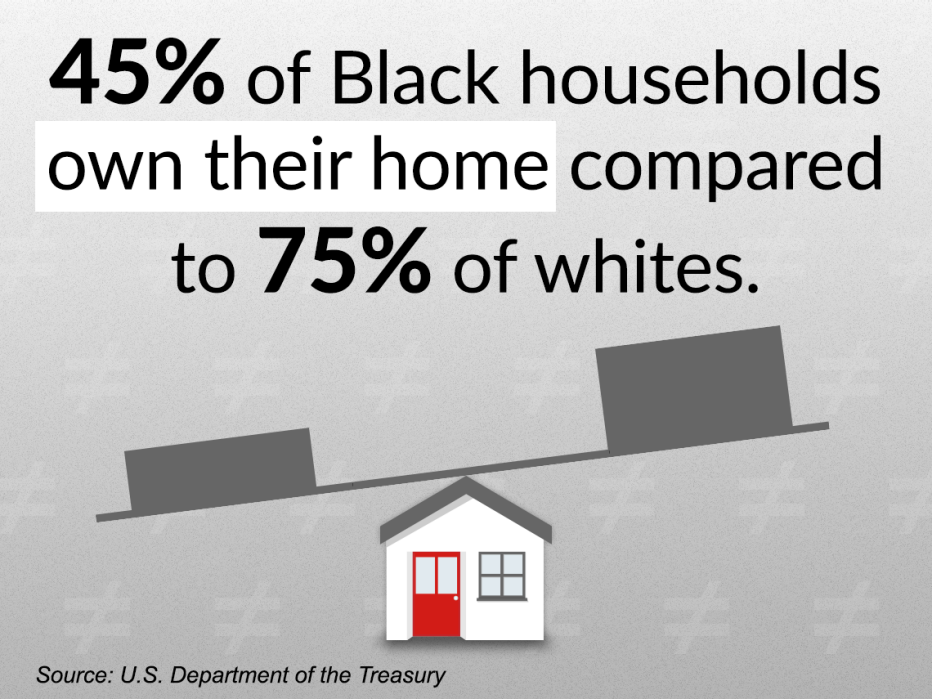

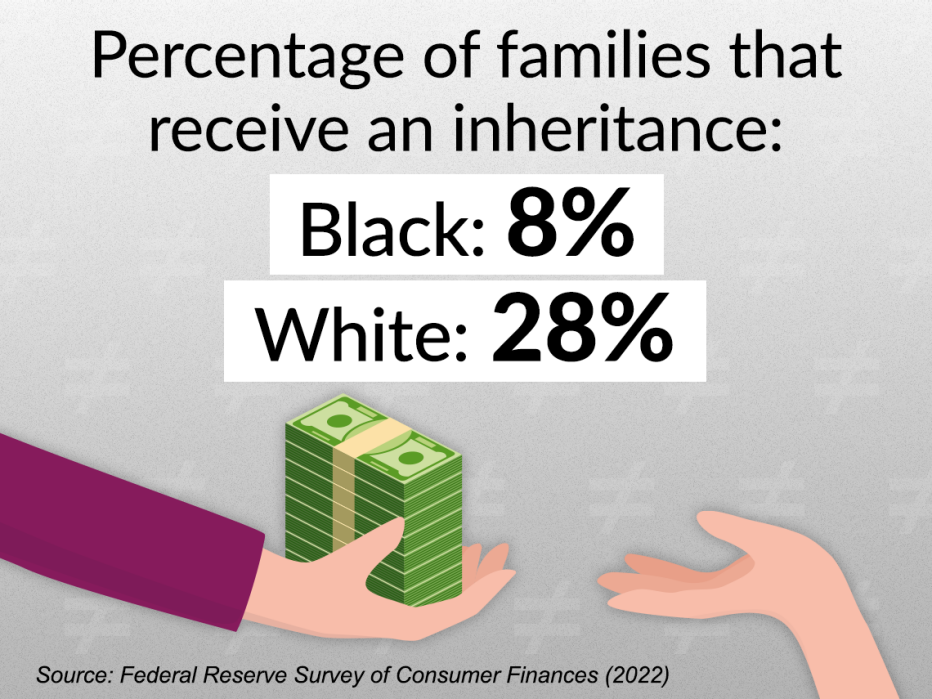

The savings gap is just the tip of a very large iceberg. Median overall net worth of white households was more than six times that of African American households — $285,000 to $44,900 — in 2022, according to Federal Reserve data. These disparities are the product of many others, spanning American economic life — legacies of the inequities that echo and accrue through Black Americans’ working lives.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Retirement equity “doesn’t mean everyone will have an equal balance. People have different financial lives, different goals and different obligations,” says Karen Andres, director of the Retirement Savings Initiative at the Aspen Institute Financial Security Program. “But the disparities that we can see in retirement savings balances are so large that it would seem that our retirement savings system is not giving everyone what they need.”

Those racial disparities have large, lingering effects on financial security in later life, when people have fewer avenues to compensate for inadequate retirement savings. Black Americans age 65 and up rely far more heavily than their white counterparts on Social Security for retirement income, and they are more than twice as likely to live in poverty.

Here are seven facts that help illustrate why Black workers often face difficulties in saving money for retirement.

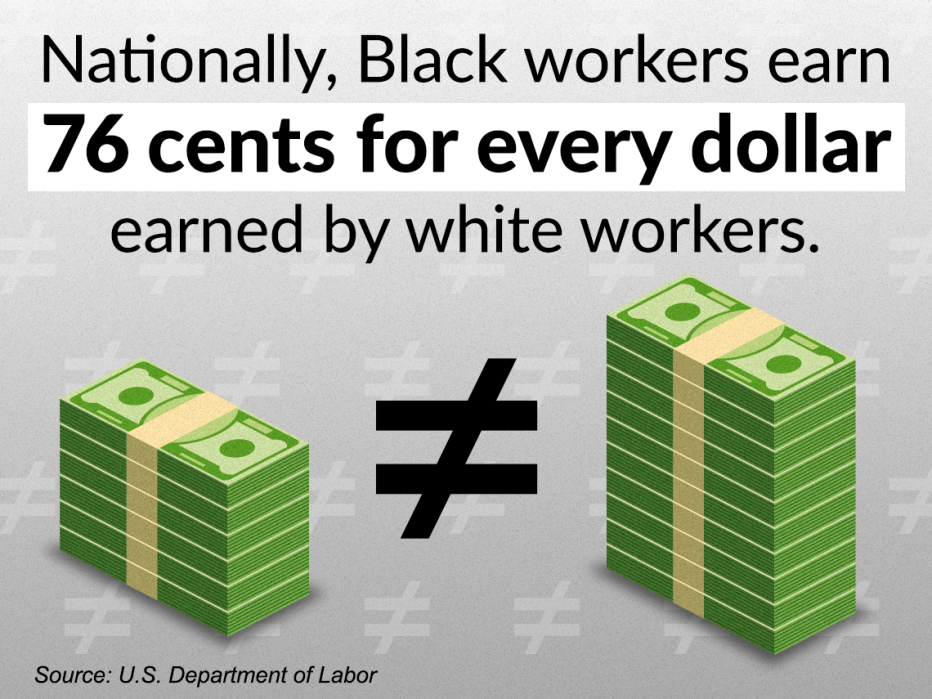

1. Black workers are paid less

Black families are also significantly more likely to have very low earnings. The Federal Reserve’s 2021 Survey of Household Economics and Decision-Making found that 43 percent have annual income under $25,000, compared to 20 percent of white families.

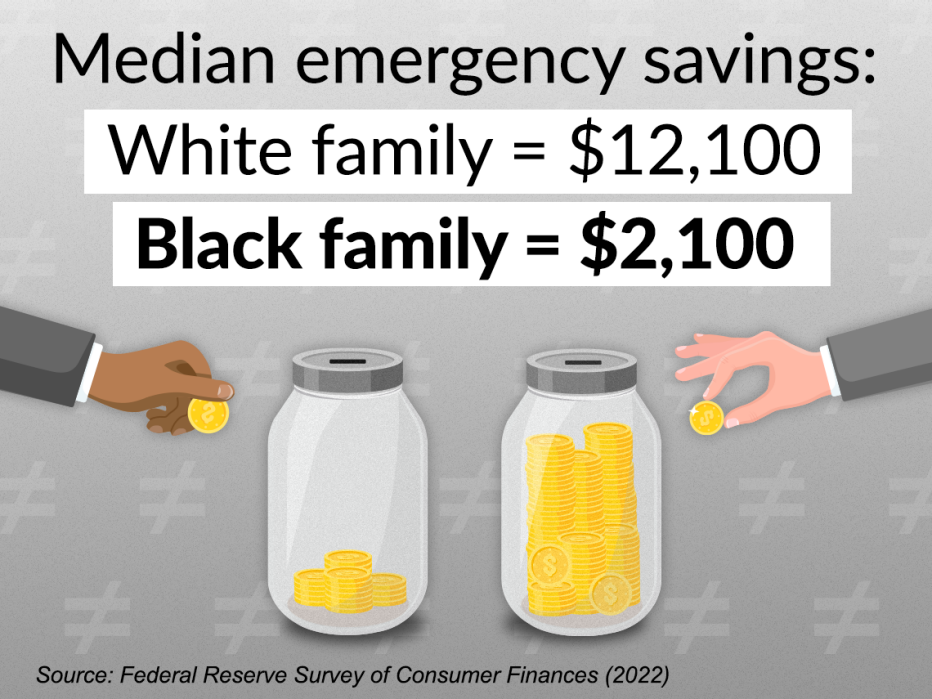

Retirement inequality is “rooted in wage inequality,” the Aspen Institute’s Leadership Forum on Retirement Savings said in a 2021 report. “If you don’t have income sufficient to cover day-to-day bills and accumulate the short-term savings needed to handle emergencies, how will you be able to save for the long term while keeping intact whatever you do manage to set aside?”

Lower income doesn’t just dampen savings. It also reduces future Social Security payments, because these benefits are based on a worker’s earnings history.

More From AARP

5 Warning Signs That You’ll Never Retire

What to do if you fear you can’t afford to stop workingIs a Robo-Adviser Right for My Retirement Savings?

Pros and cons of using automated managers for IRAs5 Ways Sole Proprietors Can Build Retirement Savings

Explore IRAs, 401(k)s that cater to the self-employed