AARP Hearing Center

Indianapolis financial adviser Leslie Thompson saw the signs of dementia in her client even before a doctor's diagnosis confirmed it last year.

The woman, in her early 80s, suddenly started bouncing checks and asking for cash withdrawals from her account a couple of times a week. Thompson set up a bill-paying system to help the client, the second in two years to begin suffering from dementia.

Get retirement savings tips in the AARP Money Newsletter

Regulators and financial firms are starting to tackle the issue of serving clients with diminished mental capacity — something not covered under federal regulations and addressed by only a few states. Alzheimer's disease, the most common form of dementia, now affects 5.1 million Americans 65 and older — a number that's expected to nearly triple by mid-century, according to the Alzheimer's Association. Already, financial advisers typically serve at least seven clients with Alzheimer's or other dementia, according to a 2012 study by Cerulli Associates. Current regulations require advisers to protect a customer's privacy and promptly execute orders, even if they're imprudent. Advisers worry that by following the rules, they could later be sued by, say, the customer's family, claiming the client didn't have the capacity to make financial decisions.

Poor money skills may be first sign

Daniel Marson, a neuropsychologist and director of the Alzheimer's Disease Center at the University of Alabama in Birmingham, says warning signs include memory lapses about money, failure to pay bills or paying them more than once, and new difficulty comprehending money concepts.

"The most important warning sign is a change in the person's risk preferences and choices regarding how to invest money," Marson says. "They are interested in get-rich-quick schemes that they wouldn't have paid attention to 10 or 15 years earlier."

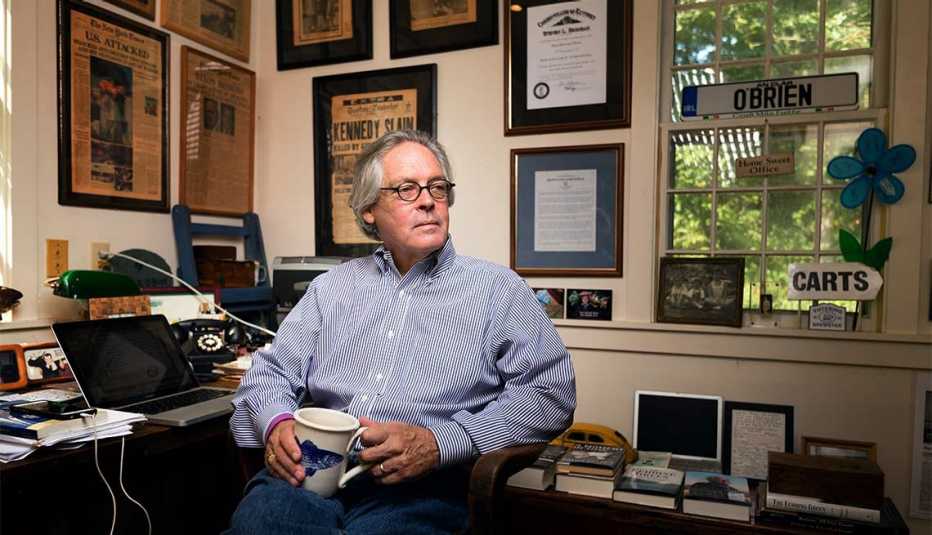

Financial advisers often are among the first to recognize a client's illness, because money handling is often the first skill to fade. "That's the way it was with me," says Greg O'Brien, a 65-year-old political consultant and publisher from Brewster, Mass. He was diagnosed with Alzheimer's six years ago and is in the early stages of the disease.

O'Brien, author of On Pluto: Inside the Mind of Alzheimer's, says people with the disease tend to spend money they don't have. "You want to take away the credit cards," he says. O'Brien's wife did just that. He now uses a debit card, which allows his family to monitor his spending online.

It hasn't always worked. O'Brien recalls a Christmas a few years back when he forgot he already bought presents for the family. With only two days left until the holiday, he searched the house, found a hidden credit card and went on a shopping spree. He spent $800 within 45 minutes on such things as shot glasses, gloves decorated with funny faces and kid-sized clothing for his adult children.

After realizing what happened, O'Brien's family returned the gifts and made him fork over the credit card. Even using a debit card, though, O'Brien sometimes makes multiple purchases of things he likes, such as six jars of pickles at once.

"See the trend here? Imagine if I were still buying cars," he says.

More on money

Target-Date Retirement Funds Miss the Mark in 2022

Even all-weather funds see rainy days sometimes