Staying Fit

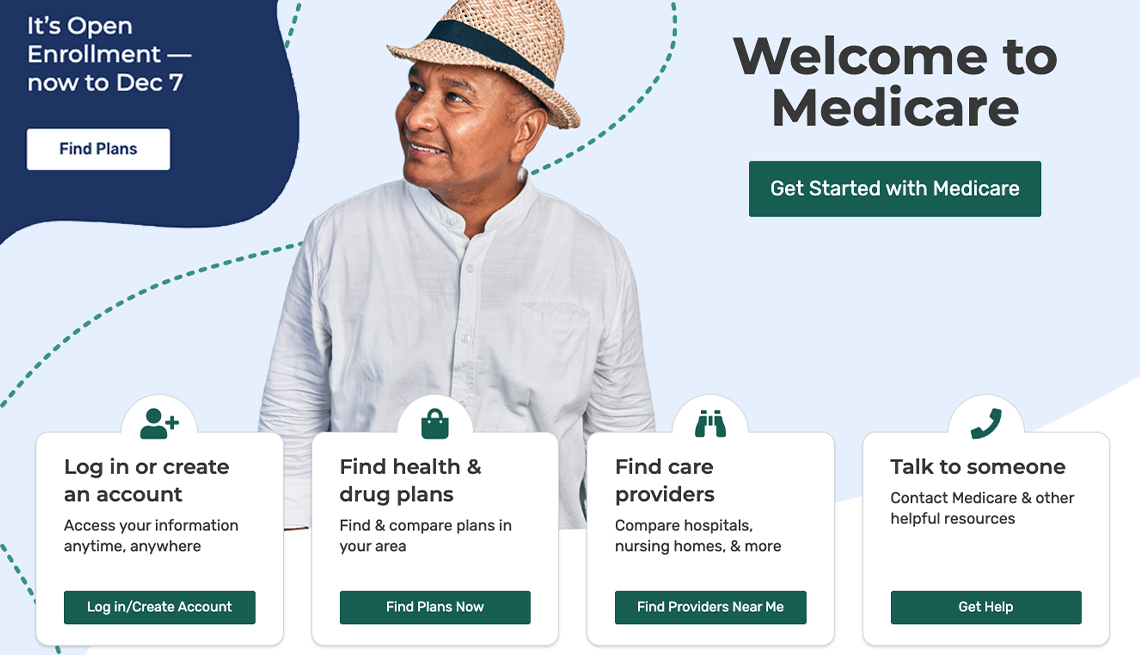

Medicare covers most of your health care expenses after you turn 65, but it isn’t free. You’ll still have out-of-pocket costs for Medicare Part A, Part B and Part D prescription drug coverage.

Fortunately, several programs provide financial assistance to people with limited resources or who have certain medical conditions. They can help pay Medicare premiums, deductibles, copayments and prescription drug costs.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Reducing your costs for parts A and B and even D

State-run Medicare Savings Programs can help people with low incomes pay Part A and Part B premiums and out-of-pocket costs as well as help with their drug costs.

To be eligible, your income — and sometimes your savings — must be below certain limits, which vary by state. These limits are often higher than those required to qualify for Medicaid, the jointly run federal-state program for low-income Americans. Some states won’t count savings into the eligibility equation.

Medicare Savings Programs come in four types, each with different details and eligibility requirements; income limits are slightly higher in Alaska and Hawaii.

The Qualified Medicare Beneficiary Program helps pay for Part A and Part B premiums, deductibles, coinsurance and copayments and automatically qualifies you the Part D Extra Help program. You’ll pay no more than $11.20 in 2024 for each drug your plan covers.

2024 monthly income and asset limits:

- Individual — $1,275 in income, less than $9,430 in assets.

- Married couples — $1,724 in income, less than $14,130 in assets.

The Specified Low-Income Medicare Beneficiary Program pays Part B premiums and provides Extra Help with Part D costs. You’ll pay no more than $11.20 in 2024 for each drug your plan covers.

2024 monthly income and asset limits:

- Individual — $1,526 in income, less than $9,430 in assets.

- Married couples — $2,064 in income, less than $14,130 in assets.

The Qualifying Individual Program pays Part B premiums and provides Extra Help with Part D costs. You’ll pay no more than $11.20 in 2024 for each drug your plan covers. States approve applications on a first-come, first-served basis.

2024 monthly income and asset limits:

- Individual — $1,715 in income, less than $9,430 in assets.

- Married couples — $2,320 in income, less than $14,130 in assets.

More From AARP

How Much Does Medicare Cost?

Monthly premiums, other out-of-pocket expenses can add up

When 9 Biggest Medicare Changes Under New Rx Law Go Into Effect

A year-by-year implementation timeline of the Inflation Reduction Act’s health provisionsUnderstanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices