Staying Fit

If you are one of the nearly 66 million Americans who get health care through Medicare, you have until Thursday, Dec. 7 to review your options and make sure you have the medical coverage you need at the most affordable price. For most enrollees, the six-week open enrollment period between Oct. 15 and Dec. 7 is the prime opportunity to take stock of your coverage and, if necessary, make changes.

Here are six tips to help navigate this all-important annual open enrollment period.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

1. Don’t ignore open enrollment

Too many people let open enrollment come and go without checking to make sure their current coverage will take care of their medical needs and that they are getting the best deal financially. According to KFF, the nonprofit organization that closely tracks Medicare, in 2020 just 3 in 10 Medicare beneficiaries surveyed reported that they had compared their current coverage with other plans offered in their area.

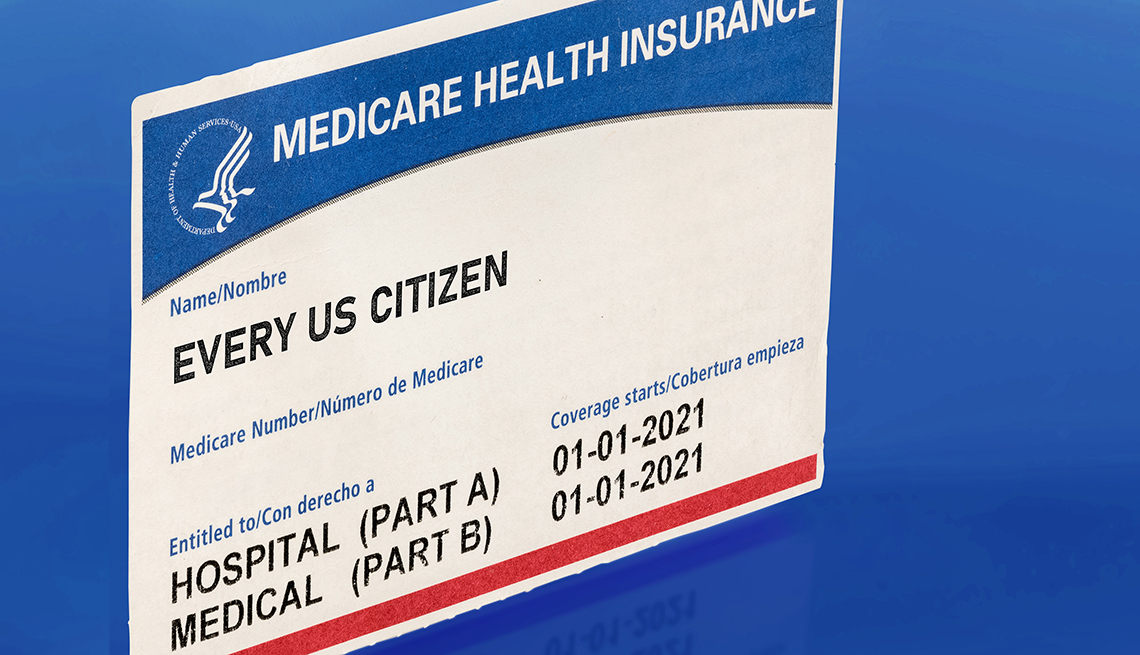

2. Know what you can and can’t change

If you are on original Medicare, it’s easy to switch to a Medicare Advantage (MA) plan if you choose to do so. And if you already have an MA plan and want to switch to a different MA plan, that’s also not a problem. MA plans are the private insurance alternative to original Medicare.

But if you already have an MA plan and want to switch to original Medicare, you likely will have difficulty getting an affordable supplemental — or Medigap — plan to take care of some of your out-of-pocket costs.

Why? Once you have gotten beyond your seven-month initial enrollment period, which straddles your 65th birthday, Medigap insurers in most states are allowed to charge you high premiums or even refuse to offer you a policy, especially if you have any preexisting conditions. So, check with your state insurance department to see what its Medigap rules are or reach out to your local State Health Insurance Assistance Program (SHIP) for help.

More on Medicare

Medicare Part B Premium to Increase in 2024

Deductibles also going upWill Original Medicare Survive the Medicare Advantage Boom?

New enrollees increasingly opting for the private insurance alternative to the federally-run programMost Medicare Advantage Premiums Won’t Increase in 2024

About half of all Medicare beneficiaries will be enrolled in MA plans next year