Staying Fit

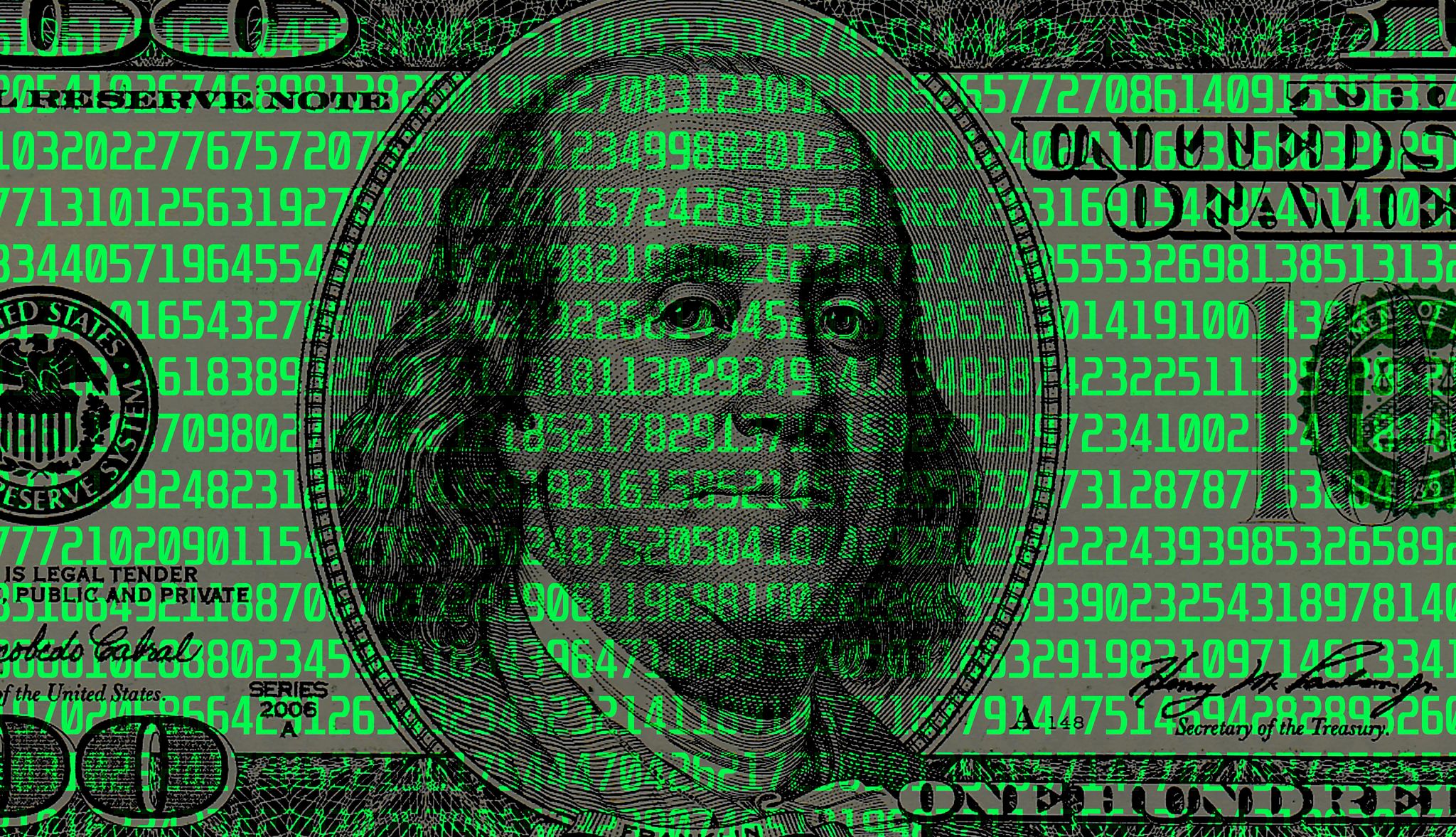

Scammers stole more than $3.4 billion from older Americans last year, according to an FBI report released Tuesday that shows a rise in losses through increasingly sophisticated criminal tactics.

Losses from scams reported by Americans over age 60 were up 11 percent last year over the year before, according to the FBI’s Elder Fraud Report. Investigators are warning of a rise in brazen schemes to drain bank accounts that involve sending couriers in person to collect cash or gold from victims.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

“It can be a devastating impact to older Americans who lack the ability to go out and make money,” said Deputy Assistant Director James Barnacle of the FBI’s Criminal Investigative Division. “People lose all their money. Some people become destitute.”

Last year, the FBI received more than 100,000 complaints from victims of scams who were over age 60, with nearly 6,000 people losing more than $100,000. It follows a sharp rise in reported losses by older Americans in the two years after the 2020 coronavirus pandemic, when people were more likely to be home and easier for scammers to reach over the phone.

Barnacle said investigators are seeing organized, transnational criminal enterprises targeting older Americans through a variety of schemes, like romance scams and investment frauds. The most commonly reported fraud among older adults last year was tech support scams, in which criminals pose over the phone as technical or customer service representatives. In one such scam that authorities say is rising in popularity, criminals impersonate technology, banking and government officials to convince victims that foreign hackers have infiltrated their bank accounts and to instruct them that to protect their money they should move it to a new account — one secretly controlled by the scammers.

More From AARP

New Tech Tools Protect Consumers From Identity Fraud

Emerging fraud-fighting technologies make it easier to separate impostors from actual customers

Identity Fraud Cost Americans $43 Billion in 2023

Victims are losing more money to these crimesWhat to Do After You’ve Experienced a Scam

Take these key steps to protect your bank accounts and personal information, and find the support you need13 Ways to Protect Yourself From Fraud

Learn how to lower your risk and keep criminals at bay

Recommended for You