AARP Hearing Center

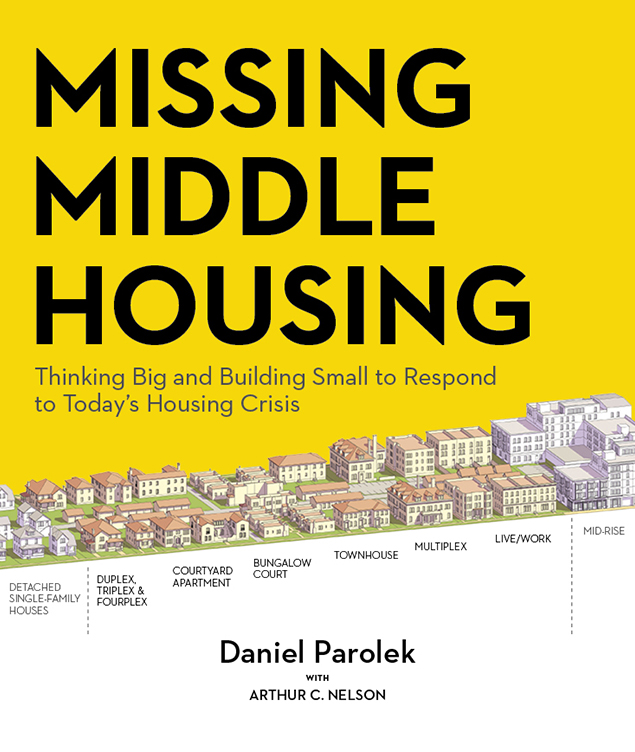

From Missing Middle Housing: Thinking Big and Building Small to Respond to Today’s Housing Crisis, by Daniel Parolek (Island Press, 2020)

A frequent contributor to AARP Livable Communities, Daniel Parolek is an architect and urban designer. The term he coined for the type of housing that once flourished in such communities — Missing Middle Housing — describes the kind of small to mid-sized residences that have become hard to find but can greatly expand the availability of housing that's affordable for a variety of middle income households. The following article is adapted from Parolek's introduction to his book as well as a chapter written with Karen Parolek, his wife and business partner.

Missing Middle Housing is a range of multiunit or clustered housing types, compatible in scale with single-family homes, that help meet the growing demand for walkable urban living, respond to shifting household demographics, and meet the need for more housing choices at different price points.

The majority of these types accommodate four to eight units in a building or on the lot, in the case of a cottage court. At the upper end of the spectrum they can have up to 19 units per building.

We label these housing types “missing” because, even though they have played an instrumental role in providing housing choices and affordable options historically in towns and cities across the country, we are building very few of these housing types today and have built very few in the past 30 to 40 years

Four Homes in One

"The one-story units delivered by a fourplex are often more desirable to older renters and buyers who want a one-story unit without stairs as they age and their mobility decreases. The value of this type is that is reads like a house from the street.”

— Daniel Parolek

The word middle as used in the term Missing Middle Housing has two meanings.

First, and most importantly, it represents the middle scale of buildings between single-family homes and large apartment or condo buildings.

The second definition of middle relates to the affordability or attainability level.

These housing types — which range in style from small multiunit apartment buildings to town houses to duplex, triplex or fourplex houses — have historically delivered attainable choices to middle-income families and continue to play a role in providing homes to the “middle income” market.

Missing Middle Housing is affordable by design, which means it can achieve affordable price points for rental or for-sale units without subsidies. It achieves this by increasing supply and filling the gap for neighborhood living; using simple, lower-cost construction methods; reducing reliance on automobile ownership; and using land more efficiently with shared and smaller units; and providing more income opportunities for residents. All of these factors result in an end product that is much more attainable for households, typically those making 60 percent or more of the area median income, or middle-income household.

Reducing Transportation Costs

Building parking is expensive, especially with the high cost of land in high-demand markets. The cost of building parking is passed on to the buyer or renter, thus increasing the cost of housing. Missing Middle Housing is inextricably tied to walkable places, so the need for a car and parking is reduced or outright eliminated. In the United States, the average annual cost of owning a car is nearly $10,000.

Smaller Spaces and Shared Land Costs

Missing Middle Housing delivers multiple units on the samesize lot as a single-family home, therefore allowing distribution of land costs across multiple units, making them inherently more affordable. Because the units are often smaller than conventional single-family housing, they are less expensive to build.

That said, the economic benefits of Missing Middle Housing are only possible in areas where land is not already zoned for large, multiunit buildings, which will drive land prices up to the point that Missing Middle Housing will not be economically viable regardless of how many units can be integrated into a Missing Middle type.

Income, Equity and Empowerment

Since federal home loans can be used for buildings with up to four units, a homeowner can qualify to purchase a Missing Middle Housing building that could contain their own unit, plus up to three additional units, which can provide additional rental income to help subsidize their housing cost.

(Historically, Missing Middle types provided lower-income households an opportunity to attain higher-quality living, to build equity, and to move up the social ladder.)

"Missing Middle Housing is a proven, affordable-by-design housing solution that meets the growing demand for walkable neighborhood living and the need for housing choices at a broad range of price points. It provides a 'missing middle' option between subsidized housing at one end and market-rate mid-to-high-rise housing at the other, but does so at a small, neighborhood scale or within house form." — Daniel Parolek

Small, incremental Missing Middle infill is also an excellent business opportunity for a small local business, which could lead to a groundswell of incremental Missing Middle Housing development, contributing large numbers of affordable, locally-owned housing units. It’s the development version of a successful fundraising strategy: making big change through lots of small contributions. It also puts the power to make that change in the hands of the many rather than only a few. Finally, it empowers locals to build equity and benefit from improvements to a neighborhood and broader community.

Land Trusts and Lasting Impact

Creative approaches can be used to limit the impact of the cost of land on the short- and long-term affordability of a unit. One approach is a community land trust, which is a nonprofit organization that’s formed to hold title to land in order to preserve its long-term availability for affordable housing and other community uses.

(A land trust typically receives public or private donations of land or uses government subsidies to purchase land and develop housing.)

The resulting houses or units are sold to moderate-to-lower-income families, but the land trust retains ownership of the underlying land and provides long-term ground leases to homebuyers. The community land trust typically limits the price homeowners can sell the homes for and also retains a long-term option to repurchase the homes at a formula-driven price when homeowners later decide to move.

Unlike home-buyer subsidy programs, which are efficient at building wealth in individual homeowners but are very inefficient at creating and preserving affordable-housing supply, a community land trust is a place-based alternative that creates a permanent affordable housing stock for generations to come through a one-time subsidy at the outset.

***

Missing Middle Housing is a proven, affordable-by-design housing solution that meets the growing demand for walkable neighborhood living and the need for housing choices at a broad range of price points. It provides a “missing middle” option between subsidized housing at one end and market-rate mid-to-high-rise housing at the other, but does so at a small, neighborhood scale or within house form.

The Missing Middle types can also be utilized creatively in subsidized projects to deliver neighborhood-focused affordable-housing options. Missing Middle should be a tool in every city’s affordable-housing toolbox.

Learn More

- Book Excerpt: Barriers to Missing Middle Housing

- Slideshow: Missing Middle Housing Types

- Web Page: AARP Livable Communities: Missing Middle Housing

Page published July 2020