Staying Fit

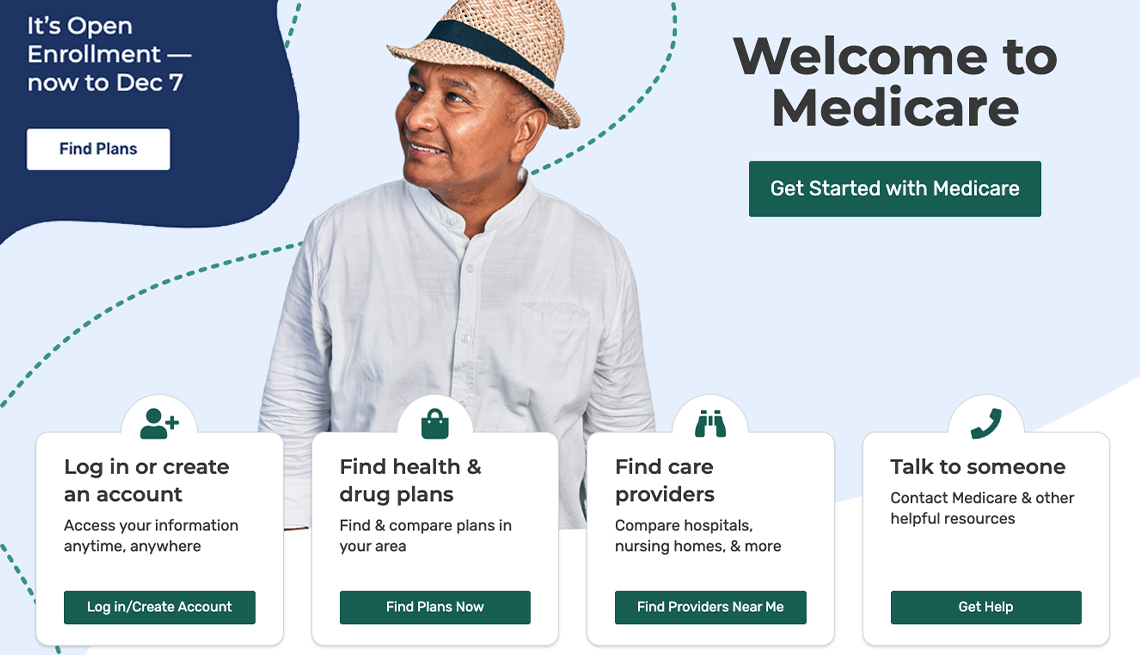

As you are deciding how you will pay for your prescription drugs when you enroll in Medicare, one of your major tasks is to make sure the medicines you take regularly are covered under the plan you select. For most of its history, Medicare did not have a prescription drug benefit. Congress added coverage for medicines that took effect in 2006.

As with most Medicare benefits, choosing a Part D prescription drug plan can be complicated, as the program has many twists and turns. Here are some questions and answers that can help you navigate the process:

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

What does Part D cover?

Part D pays for outpatient prescription drugs — in other words, medicine you take yourself. (If you receive chemotherapy, dialysis or other medicines that are injected or given intravenously at a doctor’s office or outpatient facility, Medicare Part B kicks in.) However, Part D does cover some self-injected medicines, such as insulin for diabetes.

What doesn’t Part D cover?

Part D does not pay for over-the-counter medications, such as cough syrup or antacids. It also doesn’t cover some prescription drugs, such as drugs used to help grow hair, medicines to help you gain or lose weight, or prescription vitamins.

Does Part D cover brand-name and generic drugs?

Yes. But most plans charge higher cost-sharing for brand-name drugs. In addition, each individual Part D plan has its own list of the drugs it covers and charges cost-sharing that varies by drug and sometimes even by where you fill your prescription.

What does Part D cost?

That’s complicated. How much you pay for prescriptions under Part D depends on the individual plan and how many medicines you take. Here’s a breakdown of the costs.

First, there will be a monthly premium. The Centers for Medicare and Medicaid Services (CMS) announced that the average monthly Part D premium for 2024 is $55.50, but the premiums can vary widely by plan and where you live. (If you are enrolled in a Medicare Advantage plan that includes Part D coverage, part of the premium goes toward prescription drugs.)

If your Part D plan charges an annual deductible, that means you have to pay full price for your medicines until you’ve met that threshold. The federal government sets the standard deductible every year; for 2024, a plan can’t impose an annual deductible higher than $545. But just like with premiums, deductible amounts vary by plan; some don’t impose any deductible.

Finally, many Medicare beneficiaries with high drug bills are subject to a coverage gap. In 2024, once you incur $5,030 in drug costs, you’ll pay 25 percent of your brand-name and generic prescription drug costs. Once your out-of-pocket costs reach $8,000, Part D’s catastrophic coverage kicks in and you won't have any more out-of-pocket drug costs for the rest of the year.

More on Medicare

Big Changes Coming to Medicare Part D Plans

Inflation Reduction Act limits out-of-pocket drug costs, caps insulin copays, makes vaccines freeNew Medicare $35 Insulin Benefit Will Cut Costs for Millions

Beneficiaries have all of 2023 to switch plans for a lower price on that diabetes treatment

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices